Following this recent equity market sell-off, more market volatility should be expected, and within equity portfolios a defensive tilt, with an emphasis on high-quality shares that can better withstand further economic deterioration.

The U.S. and global equity market selloff is still in the process of playing itself out. Pullbacks and corrections usually take weeks or months to fully resolve themselves, rather than just a few trading sessions.

This process should be familiar to those who have been invested in recent years, and especially to those who have been invested for decades.

Pullback shouldn’t be surprising following a 37.6 % surge in the S&P 500 from the October 2023 low through the peak in mid-July 2024. There are still open questions about the main factors associated with the selloff.

That is the state of the global economy ?

It’s clear that some areas of the U.S. economy are wobbly and others are weak. What is unclear is whether this will end up being a brief hiccup, a GDP growth scare, or a full-blown recession.

While a majority of leading economic indicators in our Recession Scorecard are now flashing red doesn’t mean that a recession is inevitable. RBC Global Asset Management, Inc.’s Chief Economist Eric Lascelles pegs the current risk of recession at 40 %, up from 35 % previously. But if the data deteriorate further and eventually push other leading indicators to red, the likelihood of recession could rise.

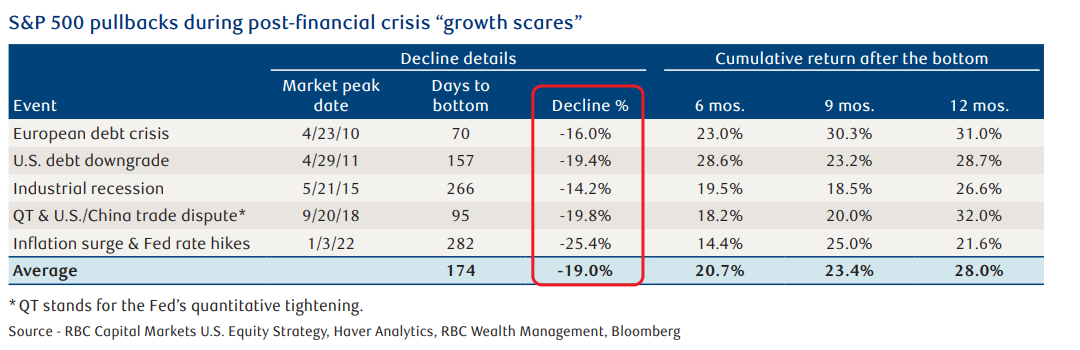

This stated in our market update following Monday’s sharp selloff, we’re mindful that GDP growth scares can cause deeper downturns than what the S&P 500 has experienced thus far with its 8.5 % selloff from the mid-July peak through the low on Monday, August 5.

Growth scares happen when market participants fear a recession for one reason or another, and begin to price this into stock indexes, but the economy ends up avoiding a recession.

The S&P 500 retreated 19 %, on average, in the five growth scares since the global financial crisis, yet the market powered back soon thereafter as economic and other risks faded. These ended up being classic buying opportunities.

Is The U.S. FED Behind The Curve ?

In periods of economic uncertainty, and following a major rate hike cycle like the one that has just occurred, it can be difficult for the Fed to properly time a new cycle of well-calibrated rate cuts.

There are historical examples when the Fed missed the mark. Sometimes rate cut cycles begin when the economy is in worse shape than is commonly thought or known.

Are Corporate Earnings Poised To Drop?

RBC Capital Markets, LLC’s Head of U.S. Equity Strategy Lori Calvasina correctly points out that the S&P 500 Q2 earnings season statistics have been relatively good overall and management team commentaries have been balanced, not negative.

Both the Magnificent 7 and non-Magnificent 7 categories have posted earnings growth in Q2, and the S&P 500 consensus forecasts of $242 per share this year and $277 per share next year have been stable over a period when they have historically eroded.

There are, however, pockets of weakness. Softer consumer trends have been revealed within a number of company reports.

Japanese Monetary Policy

The unwinding of the yen carry trade has largely run its course, and institutional investors seem like they’ve repositioned.

Following much criticism by market participants, economists, and others about the BoJ rate hike and the central bank’s hawkish comments on July 31 which prompted the volatility, a BoJ deputy governor reversed course by speaking in more dovish tones on Tuesday. This helped calm markets and prompted bounces in equity markets, and the yen weakened against the U.S. dollar.

This was likely confirmation that some hedge funds were concentrated in momentum trades and were over-leveraged. We’ve seen this movie before and are cognizant that other “volatility episodes” created by hedge fund positioning can occur.

Defense And High-Quality

There are enough lingering risk factors associated with this selloff to prompt a review of equity portfolio positioning. As RBC Wealth Management, Inc.’s Investment Strategist Jim Allworth wrote, planning for an eventual shift to defensive equity positioning beats a “hope for the best” approach.

This means holding no higher than a Market Weight position in U.S. and global equities in portfolios for the time being, and having a plan to shift the weighting downward if capital preservation becomes a priority.

Within equity portfolios, we would tilt exposure defensively, with an emphasis on high-quality dividend paying shares. This doesn’t rule out holding growth stocks, but would limit such holdings to quality growth—those companies with:

- Strong management teams

- Sizeable cash positions

- Realistic earnings growth prospects

- Reasonable price/earnings-to-growth ratios.

Core equity holdings should be confined to stocks that can better withstand further economic deterioration or a recession, with valuations supported by prospects for earnings growth.

As always, please let me know if you have any questions or comments.