Good Morning,

Happy New Year ! Hoping that you enjoyed the holiday season.

2025 saw global stock market power through tariff uncertainty to all-time highs many cases.

Today we’ll examine whether the three-year winning streak can be extended.

What will take shape in 2026 ?

The U.S. equity market delivered its third straight year of double-digit and above-average gains. The S&P 500 rising 17.9 % including dividends in 2025, boosting the total return to 100.6 % since October 2022.

The S&P 500 and stock markets globally dropped meaningfully in the spring of 2025, punctuated by the Trump administration’s introduction of ultra-high “reciprocal” tariffs on dozens of countries.

The S&P 500 and stock markets globally dropped meaningfully in the spring of 2025, punctuated by the Trump administration’s introduction of ultra-high “reciprocal” tariffs on dozens of countries.

Then the S&P 500 surged nearly 39 % on a total-return basis from the April low through year end as tariffs lowered.

The market was also boosted by above-average GDP growth in Q2 and Q3 of last year. The economic backdrop improved due to an unanticipated surge in AI capital spending, three more Federal Reserve 25 basis-point interest rate cuts, passage of the taxpayer- and business-friendly One Big Beautiful Bill Act, and strong consumer spending among upper-income households.

These forces helped offset tariff headwinds, however, high prices for goods, services, and housing due to cumulative inflation continued to affect many households. This was also a drag on some retail and consumer stocks that underperformed the broader market.

The Tight Range

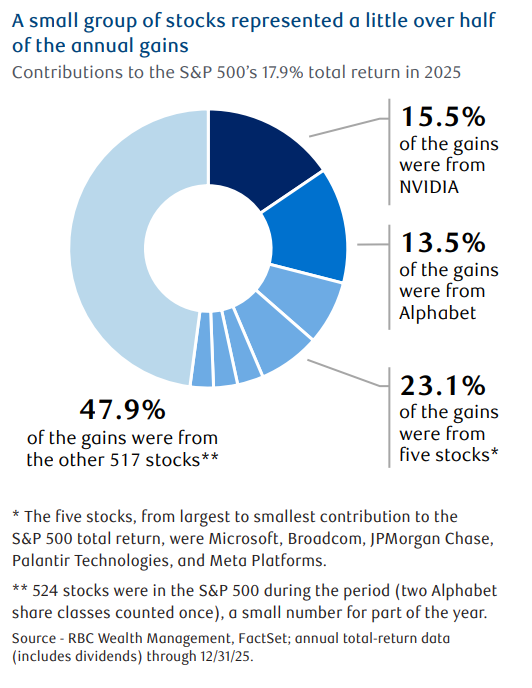

This bull market cycle has b een dominated by AI-oriented stocks. Seven stocks represented just over half of the S&P 500’s gains in 2025: NVIDIA, Alphabet, Microsoft, Broadcom, JPMorgan Chase, Palantir Technologies, and Meta Platforms. All of these stocks—even banking behemoth JPMorgan Chase—have at least some exposure to the AI theme.

een dominated by AI-oriented stocks. Seven stocks represented just over half of the S&P 500’s gains in 2025: NVIDIA, Alphabet, Microsoft, Broadcom, JPMorgan Chase, Palantir Technologies, and Meta Platforms. All of these stocks—even banking behemoth JPMorgan Chase—have at least some exposure to the AI theme.

While these 7 stocks represented 25 % of the S&P 500’s market capitalization last year, they accounted for 52 % of the index’s total return. This is the second year in a row that NVIDIA, Meta, Alphabet, Broadcom, and Microsoft were among the stocks that delivered the bulk of S&P 500 gains.

Based on assessments of company data, the seven large tech firms invested approx. $437 billion in capital in 2025. This unprecedented level is 61 % above what was spent in 2024 and almost 2.5 times more than in 2023—and even higher spending seems likely in 2026.

RBC Global Asset Management Inc.’s Chief Economist Eric Lascelles flagged AI as one of the key long-term investment themes for the second quarter of the 21st century. That said, currently there are open questions about the AI transformation related to the ongoing data center buildout and the technology’s uptake.

Information Technology sector net income (profits) grew 22 % in Q1 2025 and accelerated to 29 % in Q3 on a year-over-year basis, according to Bloomberg. The consensus forecast for Q4 (results will be reported in coming weeks) and the first half of 2026 calls for strong Tech sector earnings growth to persist, and earnings estimates have risen in the past couple months.

Please note - last year’s stock market rally and profit growth weren’t solely about AI and Tech stocks in general.

Excluding the Tech sector, the rest of the S&P 500 grew earnings by an average of 9.8 % from Q1 through Q3 2025—a pretty good clip considering there were tariff headwinds during that period.

If you have any questions or comments, please do not hesitate to let me know.

Wishing you a healthy and prosperous 2026 !