Dear Friends,

Happy New Year. I hope your Christmas and holidays were wonderful.

I would be remiss if I didn’t kick off this inaugural 2025 newsletter with a huge congratulations to my high school alma mater Notre Dame College School for winning the 68th Welland Tribune Basketball Tournament! It was another exciting weekend for what is the oldest high school basketball tournament in Ontario.

I am proud to say that I played in two Tribune Finals. Over 30 years later I also had the special privilege of coaching my sons Matt and Noah in two more Tribune Finals. Nothing is more exciting than Championship Saturday night in Dillon Hall!

Finally, a special congratulations to Notre Dame Coach Andy Lucchetta and his son Aidan who was named the Tournament MVP.

|

Tribune Finals January 11, 2025 - Dillon Hall, Notre Dame

|

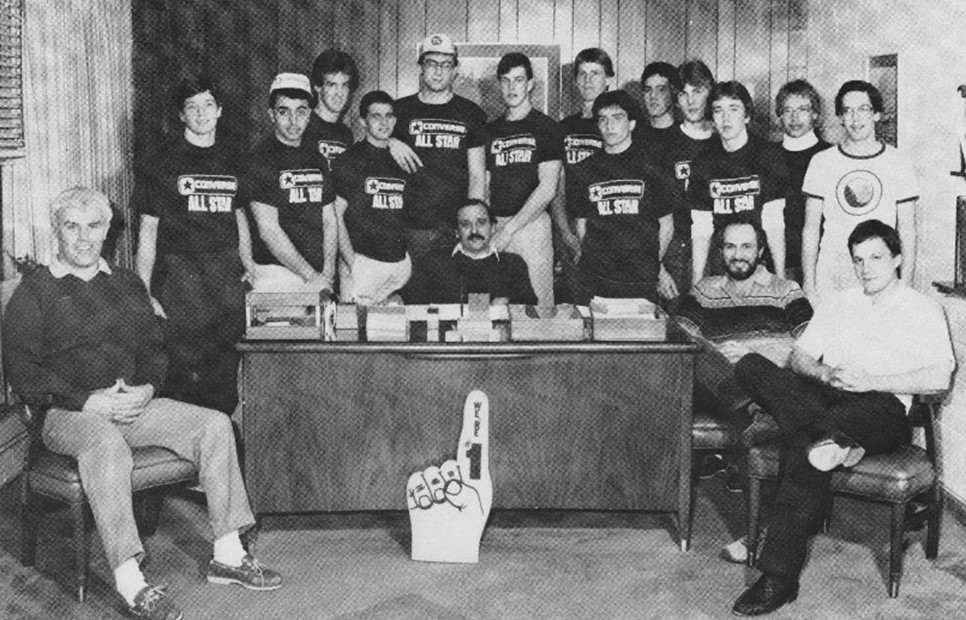

Notre Dame Sr. Basketball Team - 1984

The stock markets closed out a strong year on a quieter note as investors began to recalibrate their expectations for future interest rate cuts by the U.S. Federal Reserve. This shift in expectations led to a rise in government bond yields that continued in recent weeks. Below, we provide updates on recent developments in Canada and the United States.

The Federal Reserve cut interest rates at its mid-December meeting, as widely expected, despite inflation showing signs of being sticky. However, Fed Chair Jerome Powell struck a different tone on future rate cuts, stating that it will likely be appropriate “to slow the pace of further adjustments,” while acknowledging that the risks of economic weakness and inflation are relatively balanced. Policymakers’ projections revealed that they now expect to cut rates by only 0.5% in 2025—half of what was previously anticipated—and raised their inflation forecast for the year.

Closer to home, the Bank of Canada (BoC) also signalled the potential for a more restrained approach to interest rate cuts going forward. Markets currently expect 0.50% to 0.75% worth of rate reductions this year. However, it would not be terribly surprising if the BoC feels compelled to go further to avoid the risk of undershooting its 2% inflation target. The Canadian economy has been relatively lacklustre, with expectations this may continue near-term, which has contributed to lower Canadian bond yields than in the U.S. The Canadian dollar has suffered as a result because global funds tend to flow towards higher-yielding currencies, thereby strengthening their value relative to lower-yielding ones.

Meanwhile, Canadian Prime Minister Justin Trudeau announced his resignation. This was somewhat expected following months of poor polling, recent exits of key officials within the Cabinet, and mounting calls for his departure. Nevertheless, his exit introduces significant political uncertainty at a time when the country is dealing with the threat of tariffs from the incoming U.S. administration. Trudeau will remain in office until his successor is selected, with Parliament suspended until late March. Although the Canadian government retains the power to impose counter-tariffs on the U.S. without legislative approval, the leadership void could complicate negotiations. This uncertainty is also weighing on the Canadian dollar.

Recent developments in Canada may not inspire a lot of confidence in investors. But it is worth noting that the Canadian equity market may not depend as much on political or economic developments at home as it once did. After all, Canadian equities were up nearly 20% last year despite the fractures that already existed domestically. Instead, other factors, such as falling interest rates and declining inflation, have arguably been more important. In addition, U.S. growth has benefited many of the Canadian businesses that have become increasingly tied to activity south of the border over the years. Therefore, in our view, it’s important not to get too swayed by developments at home.

Overall, we expect some continued pessimism about Canada and its near-term economic prospects. But interest rates may continue to move lower, which may drive some anticipation of better economic and earnings growth later this year. Meanwhile, sentiment is nearly the opposite when it comes to the U.S. The consensus view is for continued economic expansion, the emergence of regulatory and tax tailwinds, and for limited additional rate cuts. Investors should remain mindful that these expectations – positive for the U.S. and less so for Canada – are already reflected in current market valuations. It’s the potential for a change in the outlook, for better or worse, that will likely drive market movements. That is what we will be watching for in the months to come.

Should you have any questions, feel free to reach out.

Have a great week!

Best Regards,

Frank