Gallivan Wealth Management Report: June 2024

A few topics our newsletter touches on this month:- Our Thoughts: Canadian Banks and Bank of Canada’s next move

- By the numbers: May

- Other Things: Disruptors podcast, Global Insight Monthly, Kanata Race Day and Mark at RBC Canadian Open

Our Thoughts: Canadian Banks and Bank of Canada’s next move

Summer weather here in full force, but investor attention has turned to Canada over the past few weeks due to a slew of economic releases and earnings reports from Canadian banks. All eyes are on the Bank of Canada (BoC) and their upcoming June & July meetings.

Over the past week, Canadian banks reported their second-quarter results. Much of the focus has understandably been on the outsized stock price reactions. Typically, any moves in the big six Canadian banks related to earnings results are relatively tame and within a few percentage points of each other. But this time around, two banks (TD & BMO) saw declines in their stock prices, while the other four posted relatively strong earnings and saw their stocks rise accordingly, with RBC, CIBC and National bank hitting 52 week highs.

We have been more preoccupied with what the earnings and management commentary suggest about the state of the Canadian economy, its consumer, and overall credit conditions. Apart from BMO, most Canadian banks reported loan losses and provisions for future loan losses in line with expectations. There continues to be an uptick in credit card and auto loan delinquencies, and some banks flagged growing vulnerabilities among certain variable-rate mortgage holders. Overall, the Canadian consumer was characterized as reasonably healthy, with pockets of stress in certain areas. While this represents a headwind to the banking sector, it has been anticipated for some time and is reflected in the sector’s below-average valuation.

Despite the soft economic backdrop and tight credit conditions facing Canadian businesses and households, Canadian equities have performed reasonably well year-to-date. This is partly due to growing conviction that inflation in Canada is on track to return to the 2-3% target range, raising expectations that the Bank of Canada might soon lower interest rates. A first cut is expected in either June or July. Additionally, strong performance across a range of commodities – including energy, copper, gold, uranium, and nickel, to name a few – has boosted the Materials and Energy sectors, which together account for close to 30% of the Canadian equity market. Notwithstanding the gains made over the past year and a half, the valuation of the Canadian stock market sits just below its historical average. While sentiment may continue to improve with a further decline in inflation and the beginning of

rate cuts, we believe a turn higher in the economic and earnings cycle may be required to drive a more prolonged period of stock price gains. Given the lagged effects stemming from changes to interest rates, we see this as more of a possibility in 2025 and beyond. Meanwhile, many of our recommended stocks announced increases in their dividends, reinforcing the benefits of dividend growth investing and “getting paid while you wait”.

By the numbers (May): The TSX was up 2.8% and the S&P 500 was up 5.0% in U.S. dollars (3.8% in $CAD). The Europe, Australia & Far East index (EAFE) was up 2.2%, while the Emerging Markets index was down 0.8%. The Canadian bond market was up 1.8%.

Interesting Listening/Reading

- Disruptors - A dynamic 30 min RBC podcast co-hosted by John Stackhouse and Trinh Theresa Do about reimagining Canada’s economy in a time of unprecedented change.

- To check out our Global Insight Monthly for May find the link here.

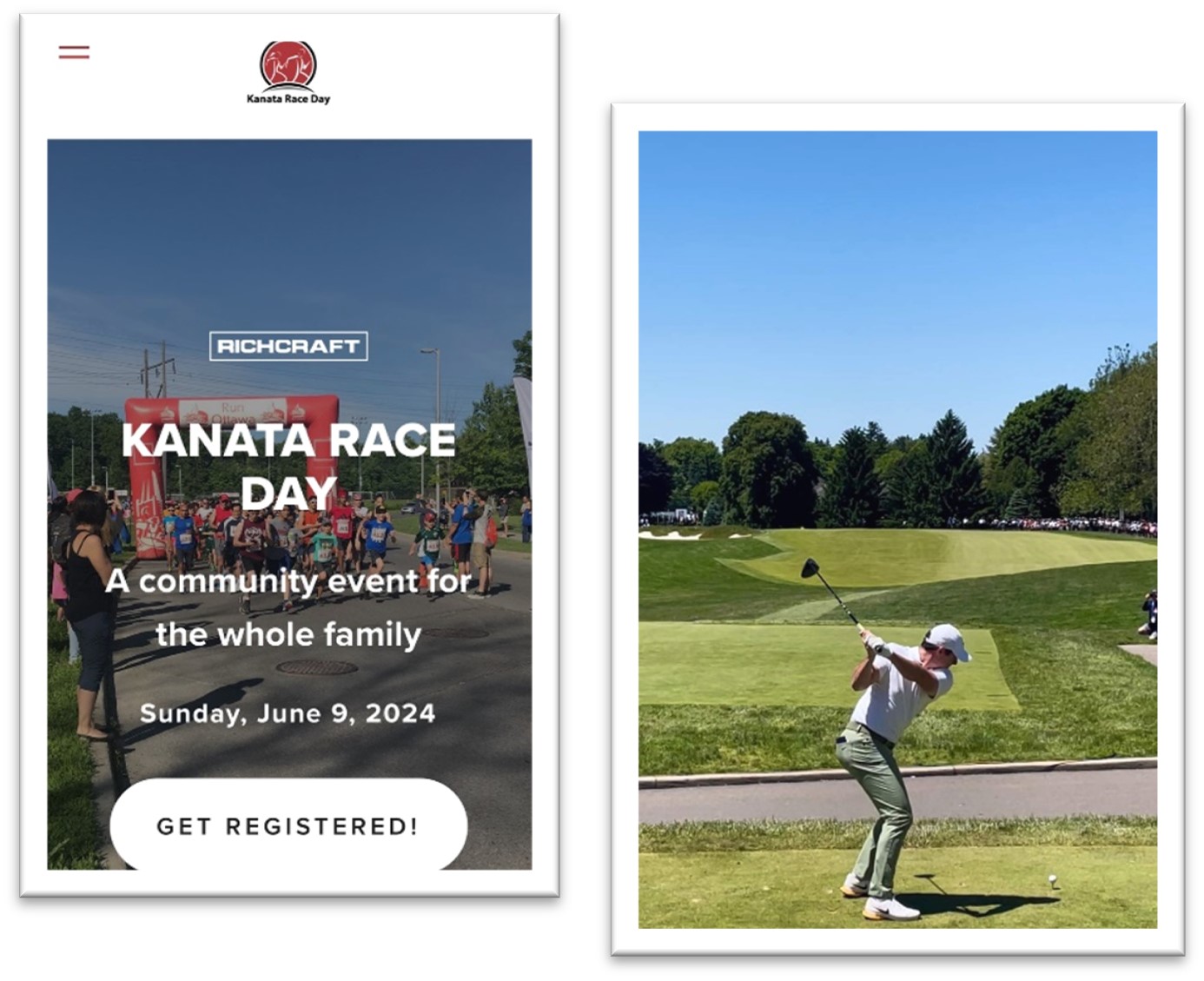

Not quite Augusta – picture on the right taken on Mark’s phone as he watched Rory McIlroy tee off at the RBC Canadian Open this past weekend in Ancaster, ON.

Kanata Race Day this Sunday June 9, 2024 – Organized with Kanata North Councillor Cathy Curry, the Gallivan Wealth Management Team has long supported this great community event, all proceeds going towards enhancements to recreational programs and its accessibilitiy.

Regards,

Mark, Peter, Sarah, Corinne and Nathalie

Gallivan Wealth Management

RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © 2024 RBC Dominion Securities Inc. All rights reserved. This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The strategies and advice in this report are provided for general guidance. Readers should consult their own Investment Advisor when planning to implement a strategy. Interest rates, market conditions, special offers, tax rulings, and other investment factors are subject to change. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © 2024 RBC Dominion Securities Inc. All rights reserved.