Monthly Report: Nov 2025

A few topics our newsletter touches on this month:

- Our Thoughts:

- By the numbers: October

- Interesting Links: Global Insight Monthly, 10 Minute Take podcast

- *new recurring feature* Arts in Ottawa corner: OCan Film Festival

Monthly Snaps for Nov: (clockwise from top left) Peter and Sarah hosted a table at the Youth Service Bureau Rise & Thrive event (pictured with Yasser Ghazi from RBC Commercial as well as Denis Meza-McNally and Tony Salvati from RBC Group Advantage; Peter delivering a financial literacy workshop for kids gr. 4-6 at WEJ in Kanata; a picture of Mark, Sarah and Peter (+ the marquee) at great evening with clients and partners supporting the Ottawa Canadian Film Festival (OCAN 25).

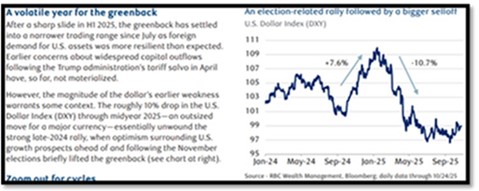

Our Thoughts: What’s up (or down) with the US$?

There is so much going on every day in news and markets – we thought we would take a moment to highlight one of the ongoing resources we link to regularly in our newsletter – RBC Portfolio Advisory Group’s Global Insight newsletters. These are released weekly, monthly and in a mid-year outlook edition. We highly recommend checking them out periodically, particularly when they hone in on an interesting topic. We link to the monthly edition on our website and in the “interesting links” section of this newsletter (below), but today we wanted to spotlight the weekly edition for Nov 6th, 2025 which focused on the US dollar and currency exchange fluctuations - a topic of keen interest to many of our clients and partners.

In summary, the report emphasizes that while valuations rarely provide guidance in the short term they can anchor long term outlooks. In their view, the combination of the U.S. dollar starting from a position of above average valuation combined with the elevated weight of U.S. assets in many portfolios reinforces the strategic merit for maintaining meaningful allocations to global ex-U.S. equities.

I have copied a snapshot below of the intro, but the overall edition zooms out to give context to currency cycles and the macro-economic backdrop at play.

For those interested more on Canadian economic variables, page 4 also gives a good (and relatively short) summary of the Carney budget – similar though a bit more technical as compared to the analysis we shared last week.

As always, should you have any questions, please feel free to reach out.

By the numbers (Oct):

The TSX was up 1% while the S&P 500 was up 2.3% in U.S. dollars (up 3% in $CAD). The Europe, Australia & Far East index (EAFE) was up 1.8%, while the Emerging Markets index rose 4.8%. The Canadian bond market was up 0.7%.

Interesting Listening/Reading:

- Disruptors - A dynamic 30 min RBC podcast co-hosted by John Stackhouse and Sonia Sennik about reimagining Canada’s economy in a time of unprecedented change.

To check out our Global Insight Monthly for Oct find the link here.

OCAN 25: No surprise this month we want to spotlight the films showcased at the Ottawa Canadian Film Festival this past weekend. We are proud to be sponsors for a 2nd year, and there were so many great short films screened. You can click here for the summary press release from the festival, including the winning film. Some of the films are already available on Youtube or other streaming services. If you navigate their site to the list of films you should be able to link onward to find out more information. “Renfrew County Killing” is an example of a local filmmaker that got a direct spotlight thanks to the festival.

Regards,

Mark, Peter, Sarah, Corinne & Nathalie

Gallivan Wealth Management of RBC Dominion Securities

RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © 2024 RBC Dominion Securities Inc. All rights reserved. This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The strategies and advice in this report are provided for general guidance. Readers should consult their own Investment Advisor when planning to implement a strategy. Interest rates, market conditions, special offers, tax rulings, and other investment factors are subject to change. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / ™ Trademark(s) of Royal Bank of Canada. Used under licence. © 2025 RBC Dominion Securities Inc. All rights reserved.