At Bois Wealth Management Advisory Group, we strongly believe in our “Dynamic Wealth Management” approach. Our Strategic and tactical allocation is Dynamic and is based on a multi facet investment process through an open architecture system. We are truly different. We pride ourselves in our ability to bring alternative strategies to our investment process including protective and defensive strategies.

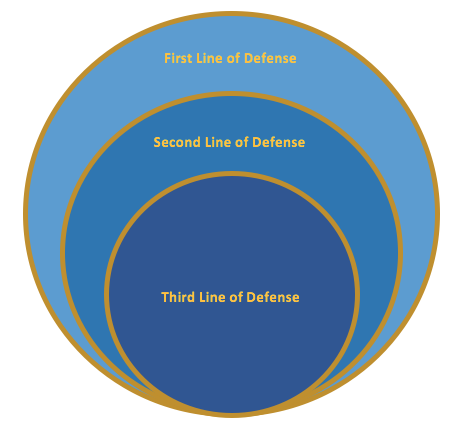

At the first stage, we would implement a tactical asset allocation call of up to 5% of the portfolio starting by reducing the most vulnerable positions in your portfolio.

When market risk persists or for ongoing protection, we would buy a series of Put options in order to reduce or eliminate the systematic risk of your portfolio while keeping the upside potential intact. This strategy also allows the portfolio to benefit from pre-existing income characteristics.

In order to preserve the ability to reach your objectives, some scenarios require a firmer response by implementing a reduction in your equity exposure towards the lower range of your strategic asset allocation target.