EARNINGS SEASON

Summer can be a quiet time for the markets and economy. Not this year. A steady stream of headlines – many trade-related – continue to attract the attention of investors.

Q2 earnings season is well underway. At the time of writing, the results have been solid, with companies exceeding estimates at a higher clip than the long-term average, and with the projected earnings growth rate trending higher.

We remain alert to elevated equity market valuations, with the S&P 500 index, which we consider to be the authoritative indicator of the markets overall, near record highs. We are carefully monitoring trade negotiations and corporate guidance for signs of how tariffs, geopolitics, and a range of factors may affect the market outlook.

WAIT FOR IT

The United States has now levied tariffs on goods coming from many countries, including Canada. Substantial negative effects have not yet been felt in the US economy. Why?

Because they have been largely delayed by the fact that many firms imported considerable excess supply in anticipation of tariffs. They frontloaded, in other words, and the economic numbers will eventually catch up.

Some export-reliant companies have already cited rising tariff-related costs for downward pressure on profits. While the outlook for corporate profitability remains positive, any further indication that US trade policy is undermining business performance or consumer demand could create volatility, which regular readers of Marche Monthly will recognize as good news, given our constant state of readiness to buy good companies at prices we believe to be lower than their intrinsic value.

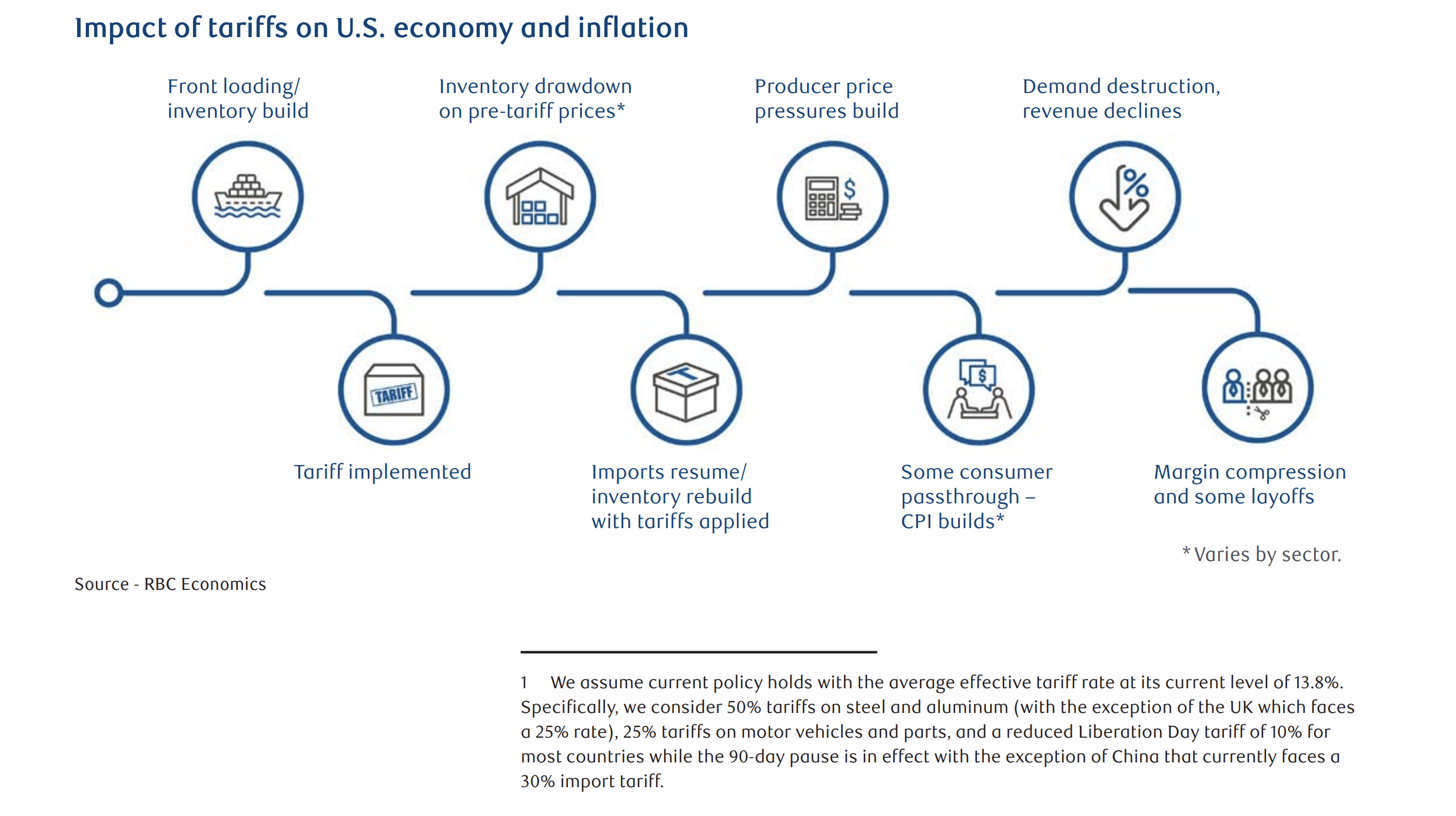

From the graph below, we can see that it takes time for the effects of tariffs to be felt. The eventual result is that higher costs to the consumer leads to a reduction in demand, a decline in corporate revenues, and layoffs.

Higher costs will eventually be a drag on the economy, something for which the US Federal Reserve is preparing, as they are expected to begin cutting interest rates this September and will likely reduce them six or seven times between then and the end of 2026 (click here for the interest rate outlook from RBC Economics).

We also note that the US administration has so far shown a reluctance to follow through on policies that have generated adverse market reactions, a fact that may offset negative impacts.

HERE FOR THE WHOLE FAMILY

Interest rates in this country may be steady at the moment – the overnight rate has been held at 2.75% by the Bank of Canada since March of this year – but young Canadians are still experiencing uncertainty and struggle with debt, many of them having given up on ever owning a home or even on having children.

One of the things of which we are most proud at Marche Wealth Management is the extension of our full suite of services to our clients’ children (and our clients’ parents, as well). With the support of RBC’s vast resources, we bring to bear an unrivalled team of experts – delivering Canada’s widest array of wealth management services – to multiple generations of our client families.

In short, the younger generations of our client families get access to the same advice and service as their parents. And simply put, the more generations of a family we can work with, the more value we can create. This may be by providing advice to younger generations on how to save for their first home via the FHSA (First Home Savings Account) or save money tax-free in a TFSA (Tax-Free Savings Account). Ensuring brighter futures for younger generations is further aided by the wills, estates and insurance services provided by esteemed members of our team including Insurance and Estate Planning Specialist Andrew Sipes, and Will and Estate Specialist Alleen Sakarian. At the end of this blog, you can see their names in a full list of our team members.

The access enjoyed by younger generations to all the services their parents enjoy gives them a big advantage – and in today’s world, they need it.

Would you like to discuss the ways in which we can support the younger – or older – generations in your family? Just let me know.

REAL ESTATE OR EQUITIES?

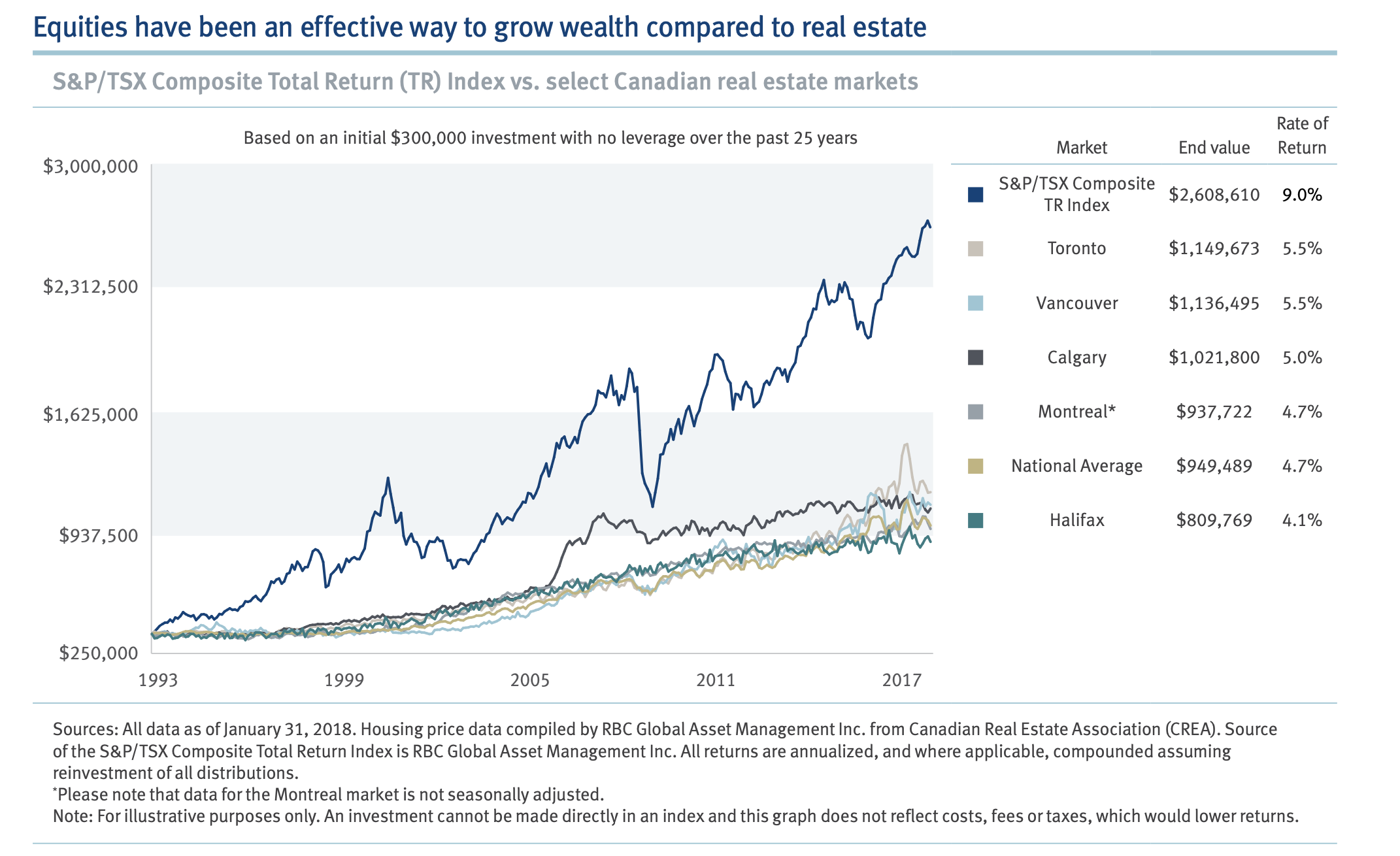

Many people believe that investing in real estate will give them superior returns to investing in equities.

Recent downward pressure on Canadian home prices reminds us of the inaccuracy of that perception. From the graph below, which looks at the period 1993-2017, we can see that an investment of $300,000 in the S&P/TSX Composite TR Index would have grown at an average annual rate of 9%. That was almost double the annual growth in national home prices (4.7%) over that period, and more than two-thirds higher than the annual growth (5.5%) in Toronto prices.

Equities outperform real estate, even taking into account what was perceived to be the years-long exceptional rise in Canadian home prices until the housing market started to turn some time in 2022.

As it happens, the Toronto market has just had its best July in four years, although we should recognize that those sales were brought about at least partly by lower home prices: the Toronto Regional Real Estate Board reports that the average selling price of a GTA home, at a little over $1-million, was down by 5.5% compared to July 2024.

All of this is a good reminder that equity investors do not have to worry about being landlords or fixing toilets. In fact, in recent months, we have had a number of clients return money – which they had previously withdrawn from their portfolios to buy real estate – to us for reinvestment in equities.

Despite the fact that equities outperform real estate, we take a particular interest in the housing market because it impacts many aspects of the Canadian economy and some equities we hold: the bank stocks in our portfolios, for example, because the banks have considerable exposure to the housing market, primarily through the mortgages they lend.

THANK YOU

We are always very happy to receive client referrals. Thank you for your continued trust and confidence. Do you know someone – or a business, or a charity – who is wondering whether their investment strategy is still the right one, or how they could be doing better? Those are exactly the reasons for many of the referrals we receive: people wondering if their advisor is getting them the best possible returns.

There is a very good chance we can do better for them. We would welcome an introduction from you, and would provide a completely confidential, complimentary and no-obligation review.

I hope you are enjoying summer!

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

Tyler Marche, MBA, CFP, FCSI

Your life, uncomplicated

tyler.marche@rbc.com

1-416-974-4810

www.tylermarche.com

WHO WE ARE

Tyler Marche, MBA, CFP, FCSI – Senior Portfolio Manager and Wealth Advisor

Tanvir Howlader, B.Comm, MBA, CIM®, FCSI – Associate Wealth Advisor

Tracy McClure, CPA, CA, CFP – Financial Planner

Karen Snowdon-Steacy, TEP – Senior Trust Advisor

Steve Mogdan, CPA, CA – Financial Planning Specialist

Andrew Sipes, CLU, CFP – Insurance and Estate Planning Specialist

Alleen Sakarian, LL.B., TEP – Will and Estate Specialist

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

WHAT WE DO