A BIG MISTAKE

“I don’t think it’s right.”

Tariffs “can be an act of war. Trade should not be a weapon.”

So said Warren Buffett, the world’s greatest value investor, at the annual shareholder meeting of his company, Berkshire Hathaway, on May 5th.

“Just the attitudes it’s brought out. In the United States, I mean, we should be looking to trade with the rest of the world, and we should do what we do best, and they should do what they do best," Buffett said.

He warned that protectionist policies could harm the United States in the long run, especially given America’s status as the world's leading industrial power.

“It’s a big mistake, in my view, when you have seven-and-a-half billion people that don’t like you very well, and you got 300 million that are crowing in some way about how well they’ve done. I don’t think it’s right, and I don’t think it’s wise.”

As disciples of Buffett’s investing philosophy, we agree with him on these matters. And we salute the clarity of his words, in perhaps the final major address he will make – given that he took the opportunity of the annual meeting to announce his retirement, at age 94, as Chairman and CEO of Berkshire Hathaway, effective end of 2025.

WHAT WE LEARNED

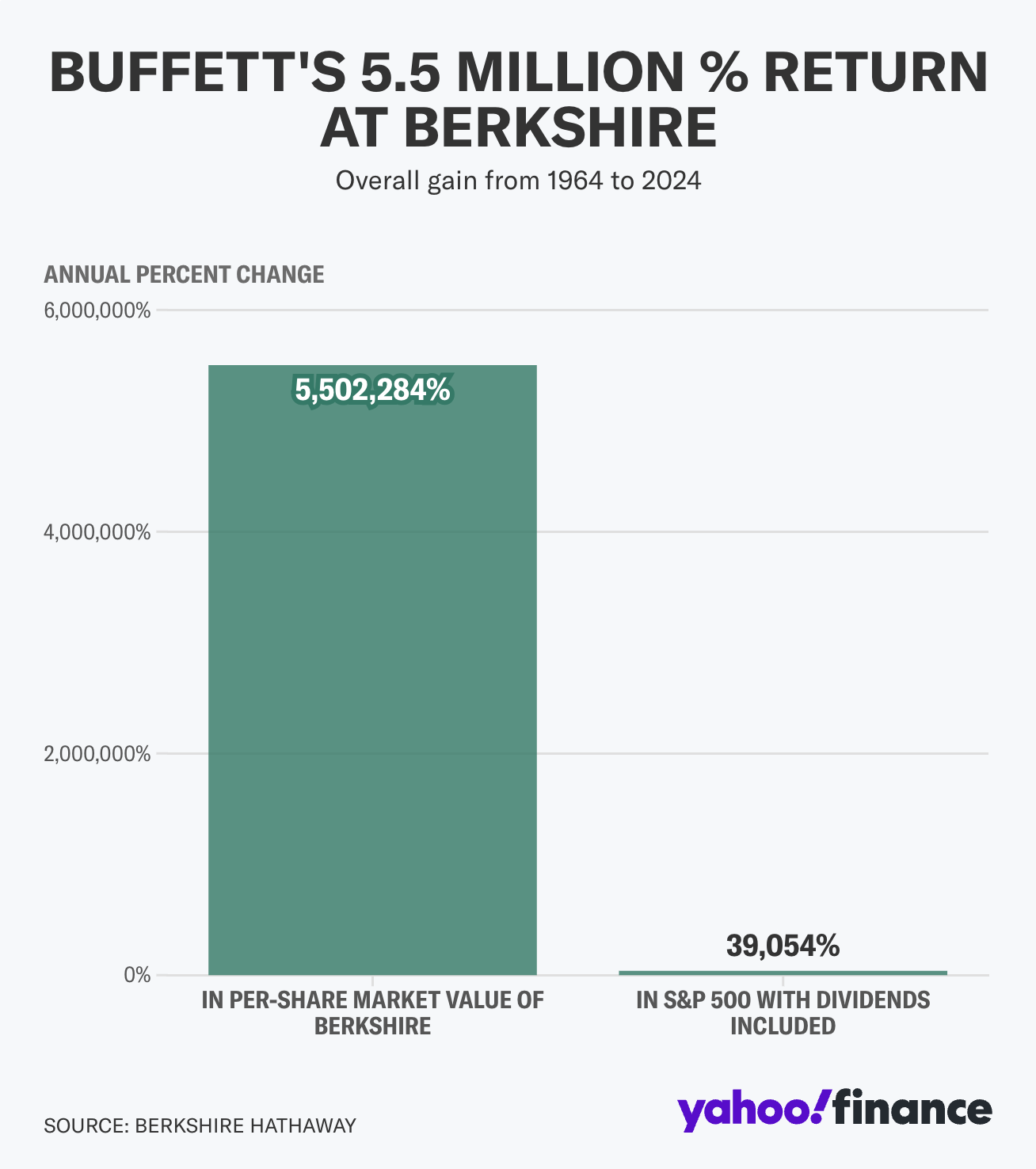

What have we learned from Mr. Buffett in decades of following him? That our investing strategy, aligned with his, has proven itself again and again. Our core belief, that wealth management doesn't need to be complicated, is inspired by Mr. Buffett – the man with whom, had you invested $100 when he joined Berkshire in 1965, your money would have grown to $550 million by today.

That’s right: from 1965 to 2024, Berkshire Hathaway stock has returned 5,502,284%. In that same time period, the S&P 500, with dividends included, has provided a return of 39,054%. Berkshire Hathaway's compound annual gain over that period was 19.9%. The S&P 500's return was 10.4%.

Buffett’s personal wealth, by the way? $160 billion, for #6 on the list of the world’s richest people.

Mr. Buffett also inspired our unbreakable rule to only provide investment solutions that we understand fundamentally. As part of this approach, we focus on owning companies which:

-Have a track record of creating shareholder value

-Have management that treats shareholders as partners

-Are trading below intrinsic value

-Have a simple, easy-to-understand business model

We tend to manage concentrated portfolios composed of quality businesses we want to own for many years. We believe this approach will maximize long-term performance, improve after tax returns and keep costs to a minimum.

Warren may be retiring, but we will continue to follow his strategy. As no doubt will Berkshire Hathaway, soon to be led by Canadian accountant and energy executive Greg Abel, a longtime BH leader whom Buffett groomed for the top job and who has, since 2018, led all non-insurance businesses at the company.

QUITE AN APRIL

A key component of Mr. Buffett’s strategy is to stick with fundamentals and avoid distraction – reminders that serve us especially well in volatile times like these. For all the market gyrations in April, global stock markets finished the month close to where they started.

That is an impressive feat, considering the markets fell nearly 10% during the first week of April, as the United States unveiled its initial tariff plans. Uncertainty remains elevated, but the past month should serve as a reminder that while periods of heightened volatility can be unsettling, it is best to resist the urge to react to the noise and avoid straying too far from the targets set out in our clients’ customized wealth plans.

A NEW PM

Canada has elected a minority Liberal government. There is an expectation that Mr. Carney will shift towards the centre and be more focused on economic than social policy. Beyond tariffs, the objectives at a high level are expected to include lower immigration, the reduction of interprovincial trade barriers, and increased spending in areas like infrastructure, housing, resources and defence.

Given its minority position, the Liberals are expected to negotiate with other parties to get policy pushed through.

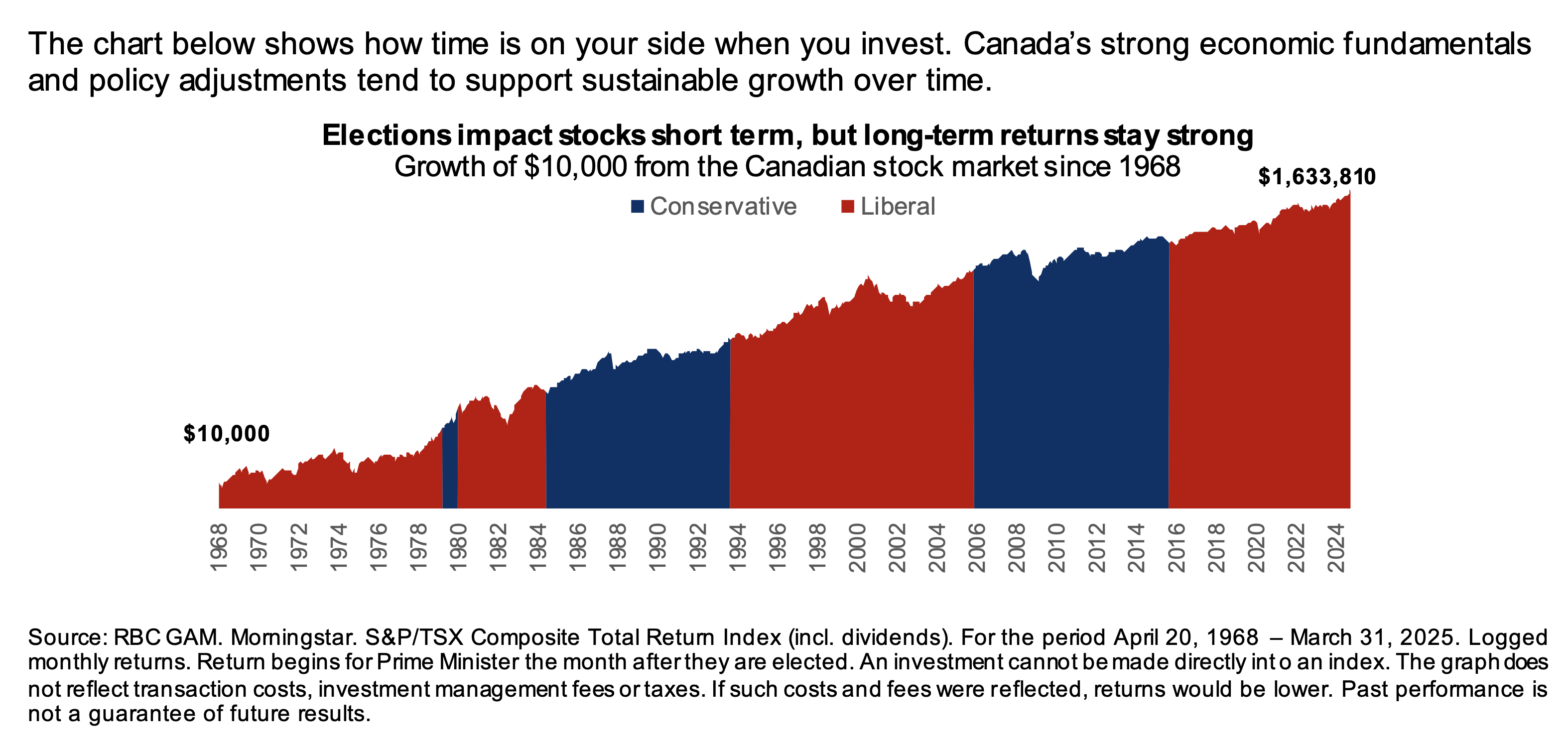

Elections often create short-term market volatility due to uncertainty. However, their long-term impact on financial markets is typically limited. Corporate earnings, interest rates, inflation, and economic growth have a far greater influence on long-term business profitability and investor sentiment.

To stay on track with your financial goals, it’s crucial to stick with your long-term investment strategy. Historical data, as in this graph, shows that the Canadian stock market has delivered steady growth, even amid changes in political leadership.

THE BOTTOM LINE

What ultimately matters, when it comes to wealth management, is how much money you get to keep after tax. While there is reason to hope that our new federal government will be more focused on economic issues, and Mr. Carney has proposed a very modest 1% reduction in the marginal tax rate in the lowest middle class tax bracket, it is still safe to say that taxes are not going to go down meaningfully any time soon.

Here at Marche Wealth Management, we have many tools at our disposal to minimize the impact of taxes on our individual and incorporated clients, helping them preserve and grow their wealth as efficiently as possible. These tools include alternative investments that can generate high, tax-exempt rates of return, and allow money in a corporation that would otherwise be taxable to come out of the corporation on a tax-free basis. Please reach out at any time to discuss.

NOT A CLIENT?

If you are a non-client reading this, and you are wondering if your advisor is doing everything they can to preserve and grow your wealth in light of our high-tax environment, we have been proactive for many years in optimizing our clients’ wealth plans for tax-efficiency. If your advisor has not, we are here to discuss the possibilities with you, on a completely complimentary, confidential and no-obligation basis.

THE OVAL OFFICE

There is cautious optimism that Mr. Carney, in his Oval Office meeting with Donald Trump on May 6th, has set the stage for a better relationship with the American president than that had by Mr. Trudeau. As the new prime minister put it, “Today marked the end of the beginning of a process of the United States and Canada redefining that relationship of working together. The question is how we will co-operate in the future. How we can build an economic and security relationship built on mutual respect, built on common interests that delivers transformational benefits to our economies.”

This process could lay the groundwork for a new potential trade agreement between Canada, the United States and Mexico, possibly in the renegotiation of the USMCA (United States-Mexico-Canada Agreement) which is scheduled for next year.

DE-ESCALATION?

The US administration has recently been scaling back some of its trade demands. For example, many of the reciprocal tariffs announced on “Liberation Day” have been temporarily reduced, exceptions have been granted for key electronic components, and certain accommodations have been made for the automotive sector. The administration is also showing more willingness to negotiate than it did just a few weeks ago. In other words, it would appear there is a de-escalation of the aggressive approach to trade undertaken by the US earlier this year. This trend has moved us further away from a worst-case scenario that would have been marked by elevated tariffs across all sectors and countries for an extended period of time.

STILL CAUTIOUS

Despite some improved market sentiment, many questions remain unanswered. Most importantly, how much damage will the US approach on tariffs cause their economy? The United States’ first quarter GDP figures revealed a significant uptick in imports, suggesting consumers and businesses were stocking up on goods ahead of the arrival of tariffs. This indicates that tariff threats have already had an impact. Whether they continue to have an impact will depend on how long the tariffs remain in place and whether the levels of trade hostility from the past month continue to subside. Given the heightened level of uncertainty and overall market valuations, we continue to approach the management of our client portfolios with caution.

SPECIAL WEBINAR FOR WOMEN

We have the honour of working with multiple generations within our client families. As part of supporting the unique needs of female investors, we are proud to bring you the Women’s Age Lab Talks webinar series, presented by Women’s College Hospital in partnership with RBC Wealth Management.

This webinar series brings together experts to discuss key health, social, and economic issues affecting older women and caregivers. The series is hosted by Dr. Paula Rochon, Founding Director of Women’s Age Lab, and provides valuable insights and practical guidance for older adults and those who support them.

In the first episode, host Dr. Rochon is joined by special guest Leanne Kaufman, President and CEO RBC Royal Trust, and together they explore gendered ageism.

Learn about the unique ways in which gendered ageism can affect women’s health and wealth, and what can be done to combat this bias.

Register to watch this session by clicking here, and receive notification when future sessions are released.

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

Tyler Marche, MBA, CFP, FCSI

Your life, uncomplicated

tyler.marche@rbc.com

1-416-974-4810

www.tylermarche.com

WHO WE ARE

Tyler Marche, MBA, CFP, FCSI – Senior Portfolio Manager and Wealth Advisor

Tanvir Howlader, B.Comm, MBA, CIM®, FCSI – Associate Wealth Advisor

Tracy McClure, CPA, CA, CFP – Financial Planner

Karen Snowdon-Steacy, TEP – Senior Trust Advisor

Steve Mogdan, CPA, CA – Financial Planning Specialist

Andrew Sipes, CLU, CFP – Insurance and Estate Planning Specialist

Alleen Sakarian, LL.B., TEP – Will and Estate Specialist

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

WHAT WE DO