WE ARE ON TOP OF IT

The markets have been going down and up with extraordinary volatility.

Here is the bottom line for our clients: we are capitalizing on volatility by putting money to work at discounted prices, or to upgrade our current holdings, always in alignment with our stringent investment criteria (see link at end of blog). We did both of these last Friday, when we did our biggest rebalance since the onset of Covid.

This is all part of the process, and why withstanding volatility generates higher returns over time.

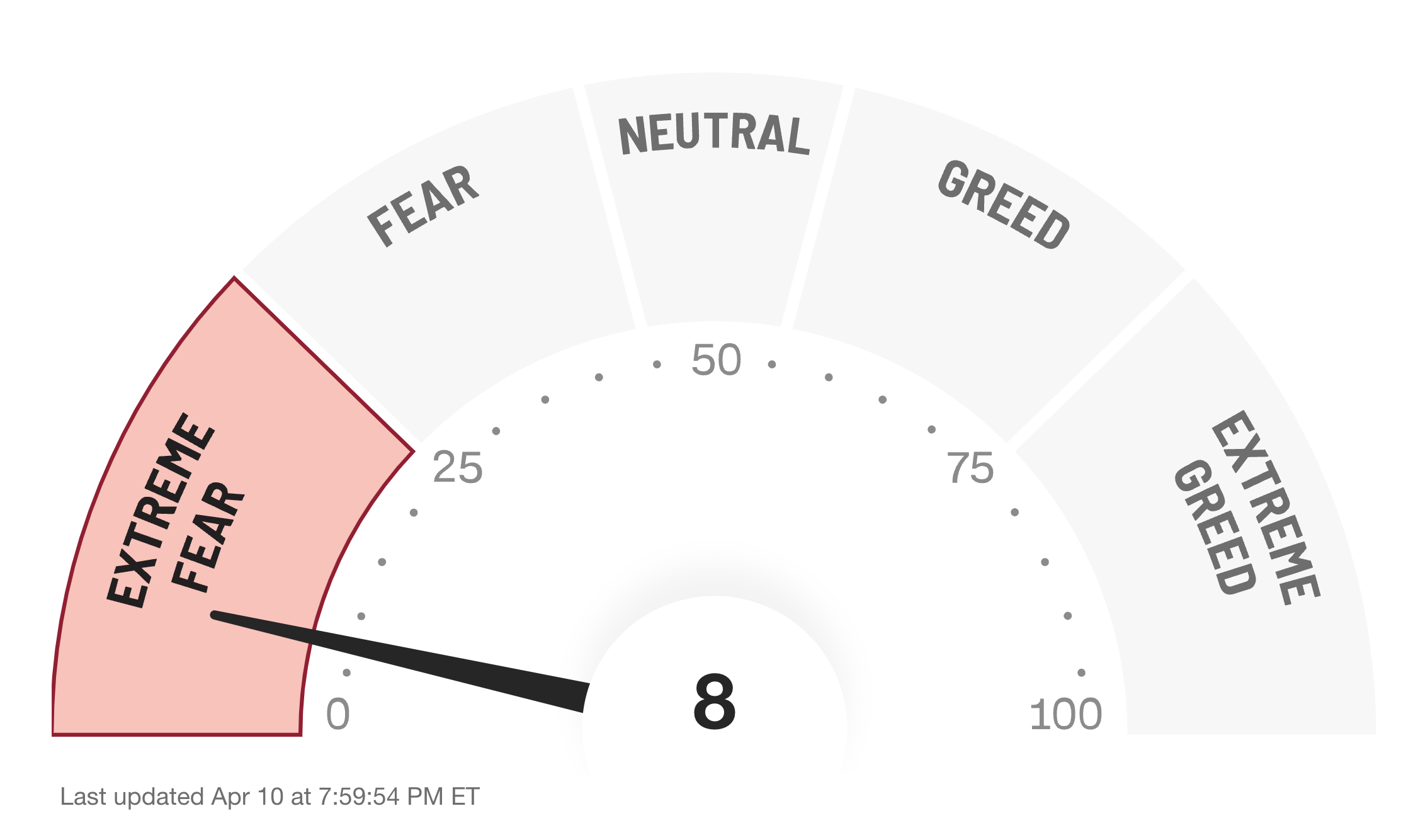

As a disciple of the world’s greatest value investor, Warren Buffett, I often refer to his famous maxims. One of them is especially relevant at this time: “A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful."

Right now, investors in general are extremely fearful, as illustrated by CNN’s Fear and Greed Index. Here is what Buffett means: now isn’t the time to join in on that fear – which would drive us to sell unwisely or perhaps to freeze and do nothing – but to look intensely for the bargains that are created by the markets dropping, and buy prudently.

THE IMPORTANCE OF PLANNING

Our approach also continues the trend in which our performance has been above the market over the past five years, including by double digits in 2024. All of our clients are still running healthy surpluses in their financial plans – those plans being built to withstand this volatility.

In short, the current volatility has no impact on our clients’ financial plans, because proper planning means we never have to sell a stock when the market is down. All of our clients’ liabilities and cash flow needs for at least the next five years are immunized through guaranteed investments and income.

LOOKING FORWARD

What is happening with tariffs – up and down, on again, off again – is unsustainable. Eventually, the picture will become clear, and the market will continue to march upward, as it always does over the long-term.

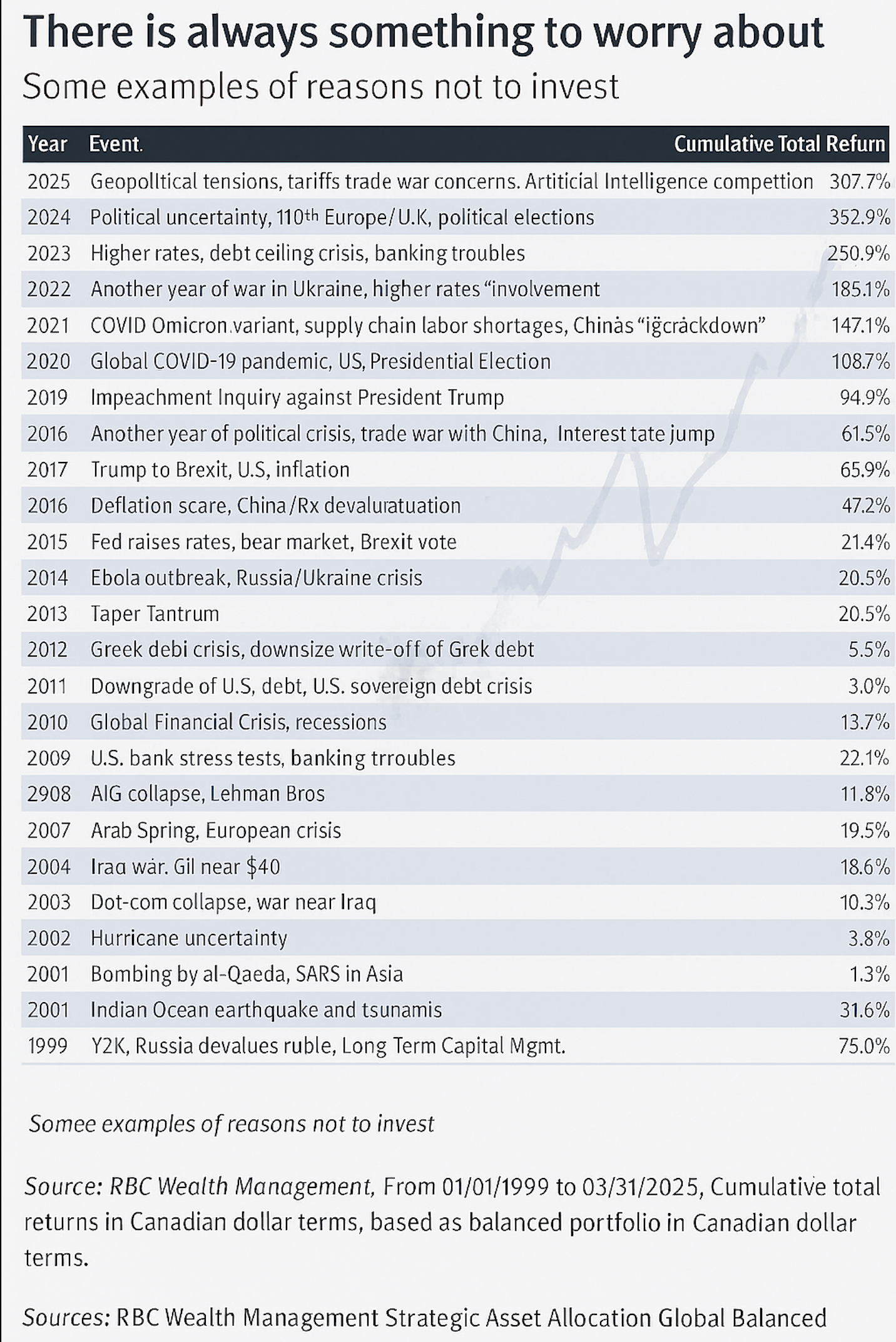

THERE IS ALWAYS SOMETHING TO WORRY ABOUT

Every single year, there is something to worry about. Y2K, 9/11, the dot-com bubble, the 2008 financial crisis, Covid-19, wars, inflation and the current trade war are just some examples. And so it always seems like there are reasons not to invest.

Despite this constant noise, we can see that cumulative returns in Canadian dollars have grown from approximately 14% in 1999 to nearly 393% in 2025.

And so, even when the world is especially unsettled, we continue to invest and capitalize on volatility.

WHAT WE HEAR

Here is what our clients tell us: that our planning process gives them peace of mind that they are not only withstanding the current volatility, but actually taking advantage of it and generating higher than average returns over time. Our clients know that we have planned ahead for situations like these, and are totally on top of it by being active in the markets.

DOES THIS SOUND LIKE SOMEONE YOU KNOW?

Amid the market upheaval, we are receiving a regular stream of new referrals because they have been wondering if they should be doing better – and have learned that we have a long-proven, clear and consistent plan.

Is there someone you care about who is wondering if they have the right wealth management plan? We would be pleased to hear from you or them, and provide them with a completely complimentary, confidential review of their current situation and what the future can look like.

DOLLAR NEWS

Amid the tariff war, investors around the world have become concerned about the outlook for growth. And so it is not a surprise that government bond yields moved lower (and prices higher) as investors have sought safe-haven assets. A bigger surprise may have been that the Canadian dollar rose following the announcement of tariffs.

Related, the US dollar has long been known as the world’s “reserve currency,” being the currency that investors around the globe wish to hold. Therefore, the US dollar has been the key beneficiary in “flight to safety” situations when investors sell equities amid uncertainty of the kind we are seeing now.

And yet, that has not been the case recently, which may mean that investors are reassessing the US from multiple perspectives. We believe the US dollar’s reserve status is facing gradual decline. US dollar holders around the world are increasingly diversifying into other currencies, driven by geopolitical tension, tariffs, and shifting trade patterns. Although no viable replacement for the US dollar yet exists, a passive shift is underway. It may be that reserve status is now more of a liability to the United States than a benefit, and that the transition to a multipolar currency world could weaken US influence while reshaping global economic stability.

We will continue to monitor the situation for our clients and advise them accordingly.

IS IT SPRING YET?

Although the calendar says otherwise, the winter seems to be sticking around. But another season – tax season – is definitely coming to an end. Our clients should have all the tax documentation they require from us. That said, if there is anything you or your accountants wish to discuss with us, please let us know.

TARIFF TALK

Tariffs have now gone global. This week, the United States unveiled a 10% baseline tariff on all imports, plus much higher individual duties to be applied on close to sixty countries.

In a somewhat positive surprise, Canada and Mexico were spared, as neither country will face additional levies. This removes, for now, some of the worst-case scenarios that investors were anticipating for both countries.

As a reminder, Canada is already facing a 25% tariff on goods, including autos and parts made in Canada not covered under the USMCA trade agreement signed in 2018, a reduced 10% duty on energy and potash not covered under USMCA, and a 25% tariff on steel and aluminum.

As of April 10, the United States has significantly increased tariffs on Chinese imports. Initially, a 125% tariff was imposed, but the White House later clarified that the effective rate had risen to 145%. In retaliation, China has imposed an 84% tariff on US goods. These mutual tariff increases have intensified trade tensions and are expected to have significant economic implications globally.

The market reaction to the tariff developments was predictable in some cases, and surprising in others. Technology and industrial sectors were particularly weak, as investors are increasingly questioning the resilience of the US economy and the growth expectations that have already been priced-in to the US stock market.

Here at home, the Canadian market fared a bit better, with bank stocks demonstrating some resilience, helping to offset some of the weakness from the energy sector. Overseas equity markets were also lower, although to a lesser degree.

WE ARE HERE

As always, we are here for you, along with your family, friends and colleagues. If you have any questions or concerns whatsoever, please reach out.

Click for our investing strategy.

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

Tyler Marche, MBA, CFP, FCSI

Your life, uncomplicated

tyler.marche@rbc.com

1-416-974-4810

www.tylermarche.com

WHO WE ARE

Tyler Marche, MBA, CFP, FCSI – Senior Portfolio Manager and Wealth Advisor

Tanvir Howlader, B.Comm, MBA, CIM®, FCSI – Associate Wealth Advisor

Tracy McClure, CPA, CA, CFP – Financial Planner

Karen Snowdon-Steacy, TEP – Senior Trust Advisor

Steve Mogdan, CPA, CA – Financial Planning Specialist

Andrew Sipes, CLU, CFP – Insurance and Estate Planning Specialist

Alleen Sakarian, LL.B., TEP – Will and Estate Specialist

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

WHAT WE DO