THE BUDGET

If there is some good news among the bad brought by the latest federal budget, issued in April, it is this: it has energized many Canadians to pay more attention to what they get to keep after taxes.

Here at Marche Wealth Management, we have always implemented strategies to minimize the impact of taxes on our clients’ family wealth, helping them preserve and grow it as efficiently as possible. This includes minimizing the impact of the capital gains tax, since the budget increased its inclusion rate from 50% to 66.67% for corporations and trusts, and for gains over $250,000 for individuals (we will discuss that in detail further below).

SOLUTIONS

Each of our clients has a completely customized wealth plan and investment strategy, based on their unique circumstances and goals. This strategy includes management of the tax efficiency of investments, whether they be held personally or, by our business-owner clients, corporately.

We have many tools at our disposal to minimize the impact of taxes - and even capitalize in some cases. We have reached out proactively to many clients whom we believe will be impacted by the budget, to get ahead of the changes. As well, a number of our clients have contacted us post-budget with a new resolve to not give the government any more of their money.

We have, for example, an investment strategy driven by the principles of Warren Buffett and Berkshire Hathaway, in that we tend to manage concentrated portfolios composed of quality businesses we want to own for many years. We believe this approach will maximize long-term performance, improve after-tax returns and keep costs to a minimum. On the personal and especially the corporate side, tax-exempt life insurance is an alternative asset class that we can use as a highly effective tool to get money out of a corporation mostly tax-free, while generating similar returns to stocks, without the volatility.

THE VALUE OF WORKING WITH US

Given the recent increases to the capital gains taxes, the value of having a customized portfolio and investment strategy is greater than ever. If you are a passive investor - someone essentially buying indexes or ETFs - you are greatly disadvantaged, because you are not getting our perennial, proven focus on maximizing after-tax returns (a focus that is now more important than ever), using a variety of strategies including tax-loss harvesting.

Not to mention that the tax code gets more and more complicated every year, and we have the broadest, deepest, team of elite experts in Canada - to make sense of it ongoing and provide you with the most effective tax minimization strategies available.

CAPITAL GAINS

Under the budget, the first $250,000 of capital gains will continue to be taxed under an inclusion rate of 50% for individuals, a percentage that will increase to 66.67% on every dollar of gains above $250K. But for corporations, 66.67% will kick in on the very first dollar of capital gains.

The new tax regime will come into force just weeks from now, on June 25th.

Particular attention is being paid to the impact on individuals who are considering selling their cottage. Cottages, assuming they are a secondary residence, do not benefit from the capital gains exemption given to the sale of a primary home. So, cottages that have been in the family for even one generation could have a capital gain well in excess of $250,000, resulting in a substantially higher tax bill for selling.

Along with encouraging our audience to pay more attention than ever to their after-tax returns, we want to point out that we don’t yet know the specific rules as to how the new capital gains regime will be enforced. Will spouses be able to split the gain, for example, meaning that it would take a combined $500,000 gain to trigger the 67% rate? At this time, this is unknown.

INCORPORATED PROFESSIONALS

Many incorporated business owners are also very displeased at their new, 67% rate. For one, we have long had the principle of tax integration in Canada, meaning that whether you make a gain personally or corporately, you will be taxed the same. This budget has discarded that principle, saying that if you make a gain corporately instead of personally, you will, in effect, be penalized.

Canadian doctors have been especially effective at publicizing the negative effect on them of the capital gains change. They have long been encouraged by government to operate their practices through medical corporations, thereby giving them access to more tax planning tools than they would have on the personal side. The increase in capital gains tax is set to affect them if they sell investments held inside their corporation, or if they sell commercial real estate should their office move locations or wind down, which is a common scenario when a physician retires.

It is important to note that other incorporated professionals - including lawyers, engineers, accountants, real estate agents and others - will be subject to these same new rules.

All of that said, I want to repeat: we have many tools at our disposal to minimize the impact of taxes on our individual and incorporated clients, helping them preserve and grow their wealth as efficiently as possible. These tools include alternative investments that can generate high, tax-exempt rates of return, and allow money in a corporation that would otherwise be taxable to pass to beneficiaries on a mostly tax-free basis.

NOT A CLIENT?

If you are a non-client reading this, and you are wondering if your advisor is doing everything they can to preserve and grow your wealth in light of the budget changes, we have been proactive for many years in optimizing our clients’ wealth plans for tax-efficiency. If your advisor has not, we are here to discuss the possibilities with you.

THE MARKETS

Our clients’ portfolios are still on track for above-average returns this year, despite a down month for the market. When interest rates go up more than anticipated, asset prices generally go down, and so the softening in the market has been driven by a change in interest rate expectations. Forecasts were expecting rates to drop by 1.5% this year, but now the market is pricing in a drop of just .35%, and there are some analysts of the view that rates will not decline at all.

his is a prime example of why we focus on owning quality businesses that we know will generate above-average long term returns, rather than trying to predict the markets or economy. We are confident that the businesses we own can thrive and prosper in any economy, and that eventually we will be rewarded.

TAX SEASON IS OVER - ALMOST

For most people, tax season is now in the rear view mirror. If you know someone who is still reviewing their taxes - or wondering if they can do better by structuring their affairs more efficiently - we are here to provide a complimentary analysis of their situation, with absolutely no cost or obligation.

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

WHO WE ARE

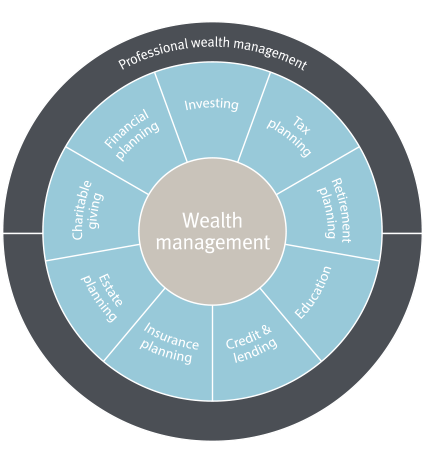

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

WHAT WE DO