1. Fed Independence: Why It Matters for Investors

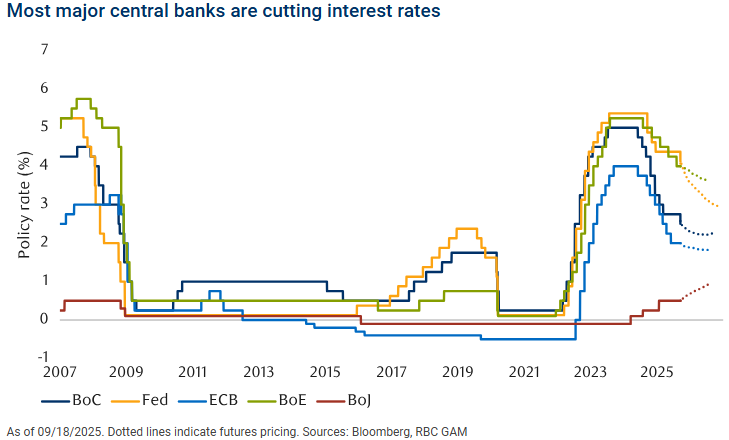

We’re paying attention to President Trump’s challenges to the Federal Reserve’s Independence. Lately, he’s called for Fed Chair Jerome Powell to more aggressively cut rates. Powell, so far, has held his ground, and delivered a measured cut last week.

In our view, central banks must operate at arm’s length from their government. This independence allows them to stay focused on their dual mandate: price stability and maximum employment. History offers a cautionary tale – when President Nixon pressured then-Fed Chair Arthur Burns to lower rates in the 1970’s, the result was stagflation: the damaging mix of high inflation and low growth.

The risk today is if markets view the Fed as an extension of the administration, long-term bond yields may rise, pressuring both stocks and bonds. On the other hand, markets often welcome rate cuts- provided they aren’t tied to a recession. Lower rates tend to support valuations, and the $7 trillion in cash on the sidelines may seek a new home in equities.

That said, markets usually do a good job pricing in known risks. It’s often the surprise events that move markets most. We remain optimistic that cooler heads will prevail, and stay focused on our long term strategy: holding a diversified portfolio of quality, cash-flowing businesses designed to deliver dividend and earnings growth through the market cycle.

2. Tax Loss Harvesting: The Silver Lining to Setbacks

There will be both winners and losers in a portfolio. In a taxable account, the “silver lining” of a losing position is the potential to use it for tax-loss harvesting. By realizing a loss, you can offset taxable gains elsewhere – improving after-tax returns.

This also helps combat a common behavioural bias: the urge to hold until a stock gets back to your cost base. Remember, the stock doesn’t know you own it – and you don’t need to make money back the same way you lost it. Strategically managing these outcomes is one of the quiet but powerful ways to add portfolio value.

3. Crypto’s Rise – and Why We’re Sitting It Out

Crypto has been on a remarkable run lately. But, from our perspective, it fails a core test: it’s not a productive investment. Stocks represent businesses generating cash, and bonds provide contractual income. Crypto, by contrast, is a speculation.

We are not trying to gamble to get wealthy, we’re trying to stay wealthy. Every dog has its day, but we remain disciplined: sticking to proven, productive investments that compound steadily over time.

Please feel free to reach out if you have any questions about your portfolio.

Sincerely,

Luke Charbonneau

Please note that we cannot accept trading instructions by email for regulatory reasons. Please call us to discuss any transactions in your account.