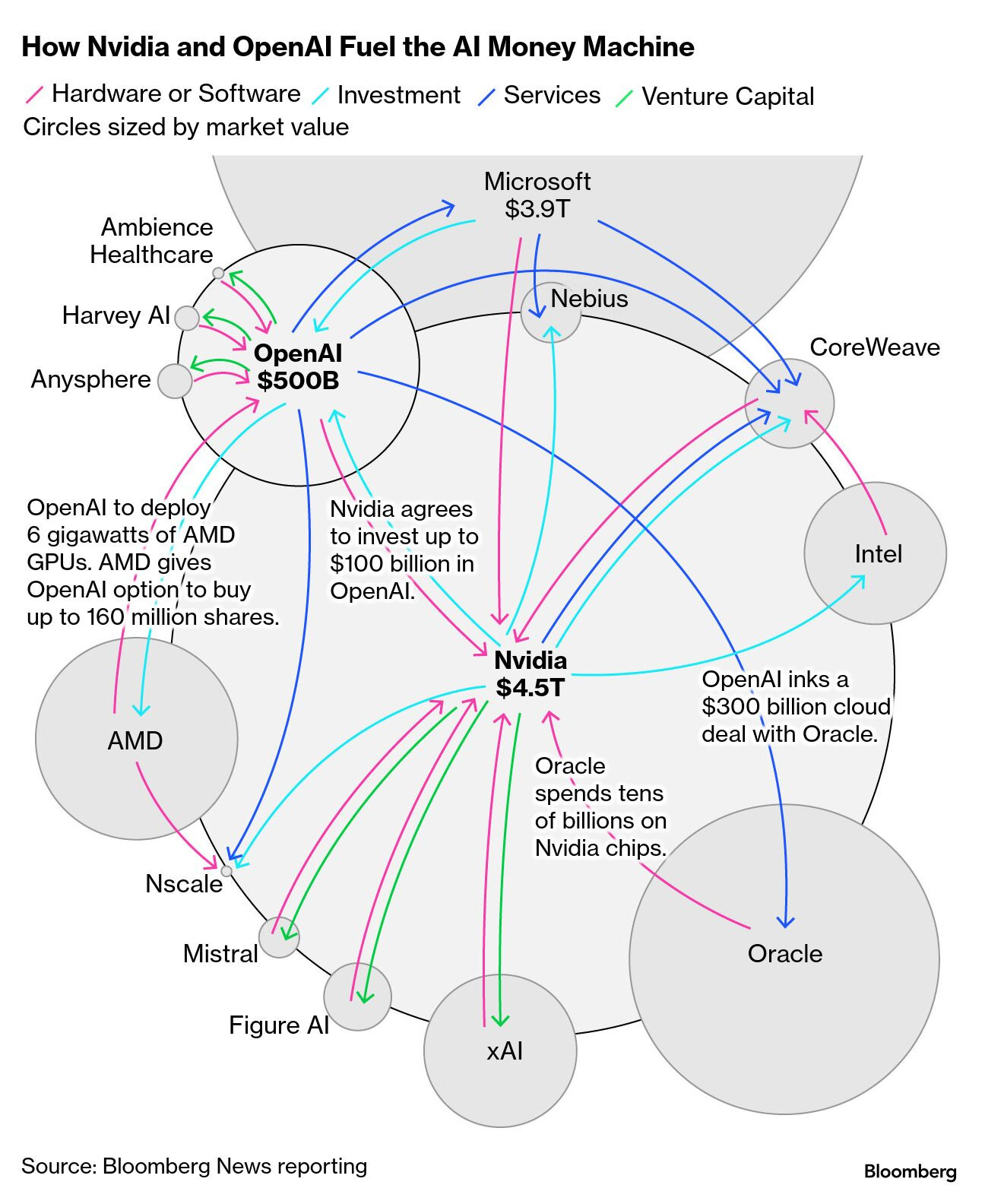

Now it’s an AI bubble? Just like liberation day and the tariff bristol board, Bloomberg published a bubble chart that’s sparked a flurry of AI Bubble headlines.

Here’s the gist in English.

- September 2025, Open AI signed a $300 billion deal with Oracle

- Oracle’s stock rallies +50%

- Oracle uses this bump in valuation to fund a huge purchase of Nvidia’s hardware

- This new demand sent Nvidia’s stock to new all-time highs

- Nvidia commits $100 Billion back into its partnership with Open AI

That’s a lot of money moving in circles. And it likely wouldn’t be an issue if all this AI investment was generating a return...

So far, 95% of investments in gen AI have produced zero returns.

Hey Chat GPT – could you summarize the above points in the form of clip art?

Damn – now I get all the hype.

Humour aside - I try to avoid the term bubble. By definition, a bubble will burst and we’ve yet to see that. It’s like calling a recession, you can only confirm it with hindsight.

History doesn’t repeat but it often rhymes. Looking back to the dotcom era, internet stocks had a similar rise and eventual crash.

What pops?

Rising interest rates.

For now, central banks are lowering interest rates. Both Canada and the US lowered interest rates this week.

This doesn’t rhyme with how the dotcom bubble burst.

2022 could offer a better smoke signal for investors. Many forget the “Metaverse moment”, when Facebook was down -75%. Mark Zuckerberg’s virtual world drew in billions of investment, and ballooning capex spending on universe that never was.

The key moment to watch is if a big AI firm announces additional AI capex to an adverse market reaction. This might be the inflection point where tides turn.

For now, this reporting season has rewarded companies increasing their spend on AI spending. Enjoy it.

Portfolio Update

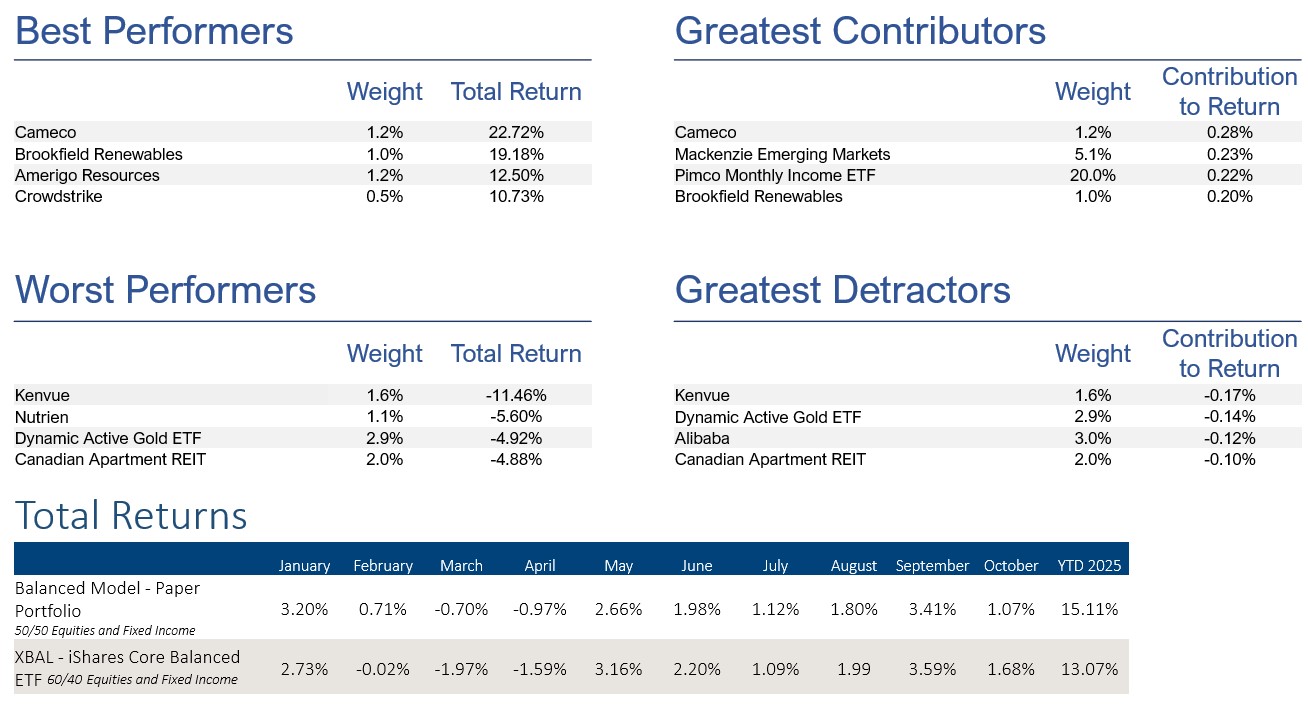

- Our Balanced Model was +1.07% in October

- The Paper Portfolio is up to $1,151,165, +15.1% ytd

Our performance in October was boosted by longtime holdings Cameco and Brookfield Renewable. Investing in the Nuclear theme has been a fortuitous decision, and we liked these companies as they jointly own Westinghouse – a world leader in designing and manufacturing Nuclear reactors.

This week, the US signed a partnership with them to build $80 billion in nuclear reactors.

Last month, we elected to take profits and rebalance our model back to 50%equity weighting. We highlighted this would likely result in underperforming our benchmark. This was the case in October, as the portfolio fell 0.64% short of XBAL.

We believe this to still be the prudent decision – our intent is to perform in line with market on the upside, and outperform on the downside.

This month, our only change will be adding exposure to healthcare via LMAX. We’ll be trimming our position in UMAX in ½ to fund the purchase.

Go Jays Go!

As always, If you have any questions or comments – let me know!

Much love to you and yours,

Lucas