The Conversation Your Advisor Doesn't Want to Have

At Turner Wealth Management, we feel the need to help our clients understand what they are investing in. In recent years there has been a push towards a more open discussion regarding fees and performance, but is that a discussion your advisor has had with you? Our belief is that an investor who understands what they own, why they own it, and what the associated costs are with that product is a more empowered investor.

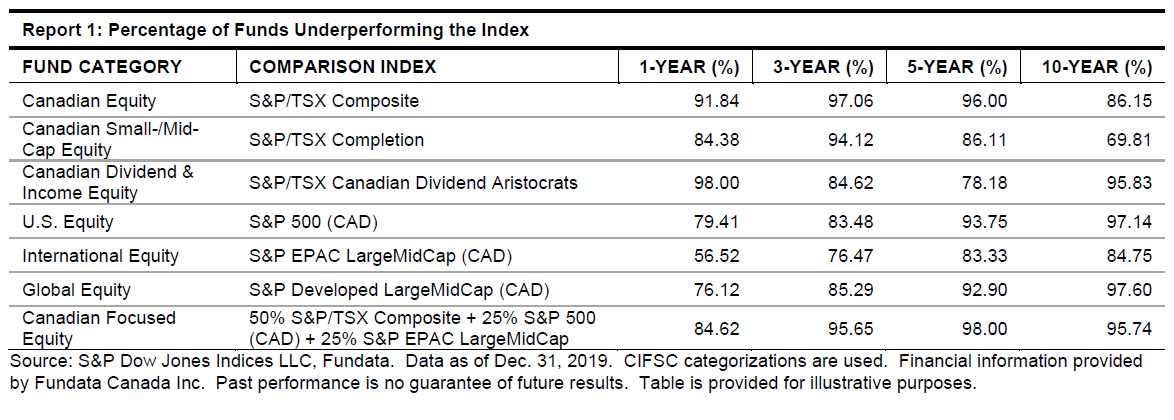

Actively Underperforming

Actively managed funds account for a large share of global savings. The reason for that is a perception that active managers are able to outperform their passive benchmarks. However, studies show that over a long period of time the vast majority of managers underperformed the broad market. Not only is it challenging for active managers to beat the market, it is challenging for investors to choose which ones will.

The Fee Difference

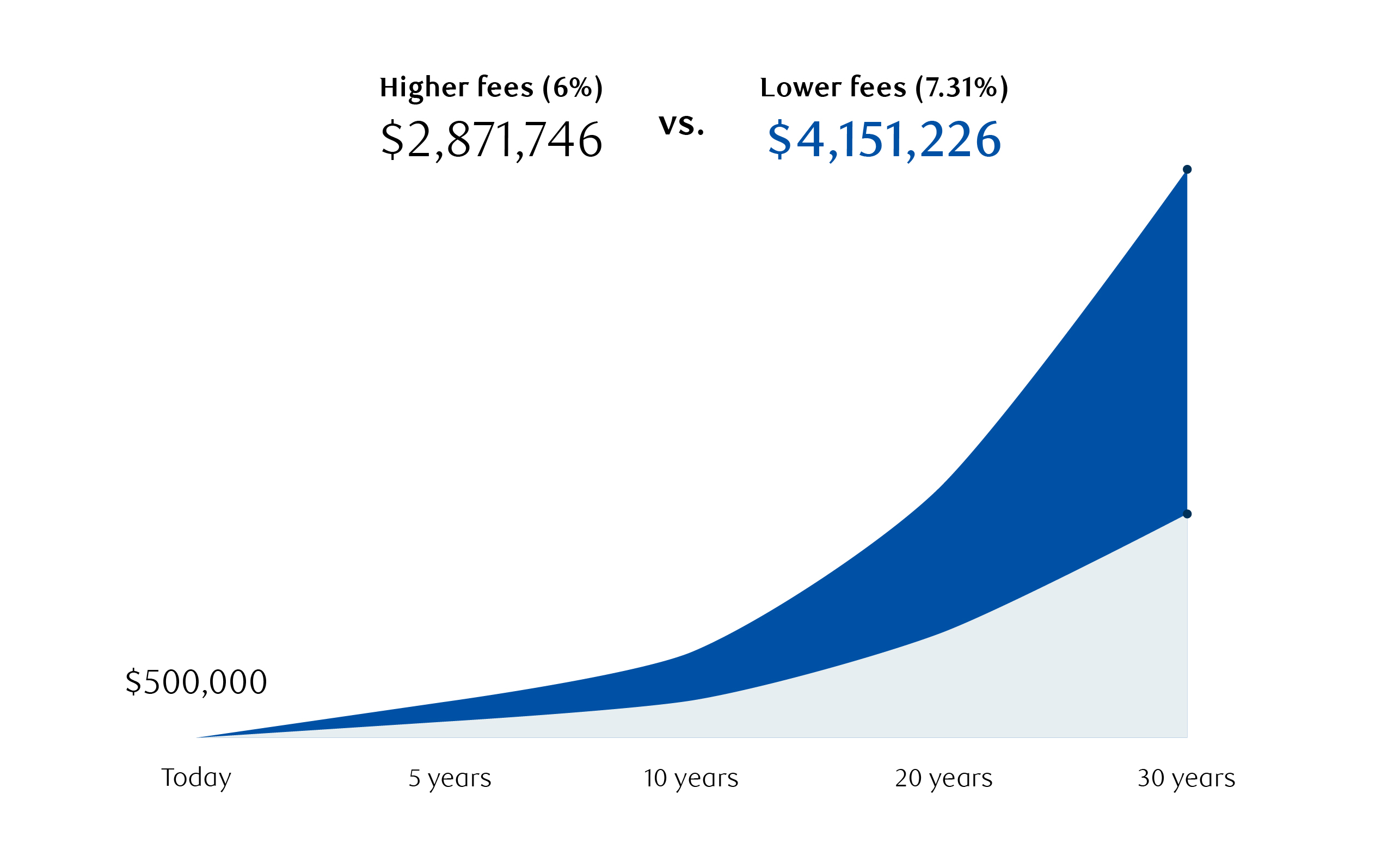

Active managers come with a cost. The average fee difference between an actively managed fund and a passive counterpart is 1.31%. It may not seem like a lot at first, but that difference can have a tremendous impact on your returns, especially over an extended period of time. The chart below shows the difference between the growth of a $500,000 portfolio over 30 years. One portfolio returning 6% and the other returning 7.31%. The difference between the two is simply the fees.

Impact on the Investor

High fees and underperformance are going to impact your returns. Your investments are tied to your financial goals, why not choose the best option to help you get there? At Turner Wealth Management, we believe in an active approach to passive management. We focus on strategically selecting passive investments that we believe will perform best. By reducing fees, we strive to help you achieve your goals faster. Contact us to discuss how we can help you.