Opening notes

Despite the continual drumbeat of pandemic news and a year filled with so much isolation and strangeness, 2020 is almost in the rearview mirror. As I write these opening notes, rumours are now circulating that another provincial lockdown is around the corner to get 2021 off to a "great" start. These certainly are trying times for all of us. We hope that everyone is able to enjoy the Christmas and holiday season as best you can despite these challenges. With my  home office staff reduced to a minimum this year (me, my son and my dog), I thought that I would share a picture of my faithful office colleague (the dog, not the son). If there is one thing we can learn from our pets, it is the ability to be completely content despite being cooped up at home every day.

home office staff reduced to a minimum this year (me, my son and my dog), I thought that I would share a picture of my faithful office colleague (the dog, not the son). If there is one thing we can learn from our pets, it is the ability to be completely content despite being cooped up at home every day.

I have included some good reading for you in this edition of the newsletter figuring that all of us will have lots of time to fill. The year-ahead reports are always a good read and give you a good synopsis of where RBC sees things heading in the new year. We have also included a good report on dividend investing, an area that has struggled somewhat this past year as growth stocks dominated returns. Rounding out the reading list are a couple of timely tax articles and a copy of the 2021 RRIF/LIF payment chart. We have delivered many of our desk calendars and the rest will be sent out shortly. Again, from myself, Craig and Michelle, we wish everyone a Merry Christmas and Happy New Year! Thank you for your support this past year.

Global Insight - 2021 Outlook

The pandemic has marked the start of a new economic era—one where old rules are swept away. World governments are racking up massive borrowing, money is being printed to buy government debt at an unprecedented pace, and governments’ role as capital allocator has grown markedly.

The pandemic has marked the start of a new economic era—one where old rules are swept away. World governments are racking up massive borrowing, money is being printed to buy government debt at an unprecedented pace, and governments’ role as capital allocator has grown markedly.

As 2021 approaches, the promise of vaccines means we could leave behind a world of social distancing and lockdowns. But what are we heading toward? Follow this link to read the report (press the back button to return to the newsletter): Global Insight - 2021 Outlook

Dividend Investing - Be Patient & Cast a Wider Net

The highly uneven economic fallout from the pandemic has been a notable headwind weighing on the performance of some dividend-paying sectors that investors have traditionally relied upon to navigate periods of market turmoil. As the COVID-19 health crisis subsides, the economic recovery gathers momentum, and worries about dividend sustainability fade, we believe the outlook for dividend equity strategies will continue to improve in the year ahead. Follow this link to read the article (press the back button to return to the newsletter): Dividend Investing - Be Patient & Cast a Wider Net

The highly uneven economic fallout from the pandemic has been a notable headwind weighing on the performance of some dividend-paying sectors that investors have traditionally relied upon to navigate periods of market turmoil. As the COVID-19 health crisis subsides, the economic recovery gathers momentum, and worries about dividend sustainability fade, we believe the outlook for dividend equity strategies will continue to improve in the year ahead. Follow this link to read the article (press the back button to return to the newsletter): Dividend Investing - Be Patient & Cast a Wider Net

Deducting Home Office Expenses for 2020

Millions of Canadians unexpectedly had to start working from home due to the COVID-19 pandemic. In response, the government announced plans in their Fall Economic Statement to simplify the process for deducting home office expenses. On December 15, 2020, the Canada Revenue Agency (CRA) released the details on a simplified method for claiming these expenses for 2020. This simplified method has made the home office expense deduction available to more individuals. This article discusses the circumstances in which home office expenses incurred by salaried and commissioned employees are deductible, as well as whether allowances and reimbursements provided by an employer are taxable. Follow this link to read the report (press back button to return to the newsletter): Deducting Home Office Expenses for 2020

Millions of Canadians unexpectedly had to start working from home due to the COVID-19 pandemic. In response, the government announced plans in their Fall Economic Statement to simplify the process for deducting home office expenses. On December 15, 2020, the Canada Revenue Agency (CRA) released the details on a simplified method for claiming these expenses for 2020. This simplified method has made the home office expense deduction available to more individuals. This article discusses the circumstances in which home office expenses incurred by salaried and commissioned employees are deductible, as well as whether allowances and reimbursements provided by an employer are taxable. Follow this link to read the report (press back button to return to the newsletter): Deducting Home Office Expenses for 2020

Early 2021 Tax Tips

When the end of the year approaches, many individuals place a greater focus on tax planning to minimize their income tax liability. Beyond the end of the year, however, there are some areas of tax planning that often get overlooked. For example, there are tax planning strategies that may only be available early in the new year. With that in mind, this article summarizes some of the strategies that have deadlines in early 2021. Follow this link to read the report (press back button to return to the newsletter): Early 2021 Tax Tips

When the end of the year approaches, many individuals place a greater focus on tax planning to minimize their income tax liability. Beyond the end of the year, however, there are some areas of tax planning that often get overlooked. For example, there are tax planning strategies that may only be available early in the new year. With that in mind, this article summarizes some of the strategies that have deadlines in early 2021. Follow this link to read the report (press back button to return to the newsletter): Early 2021 Tax Tips

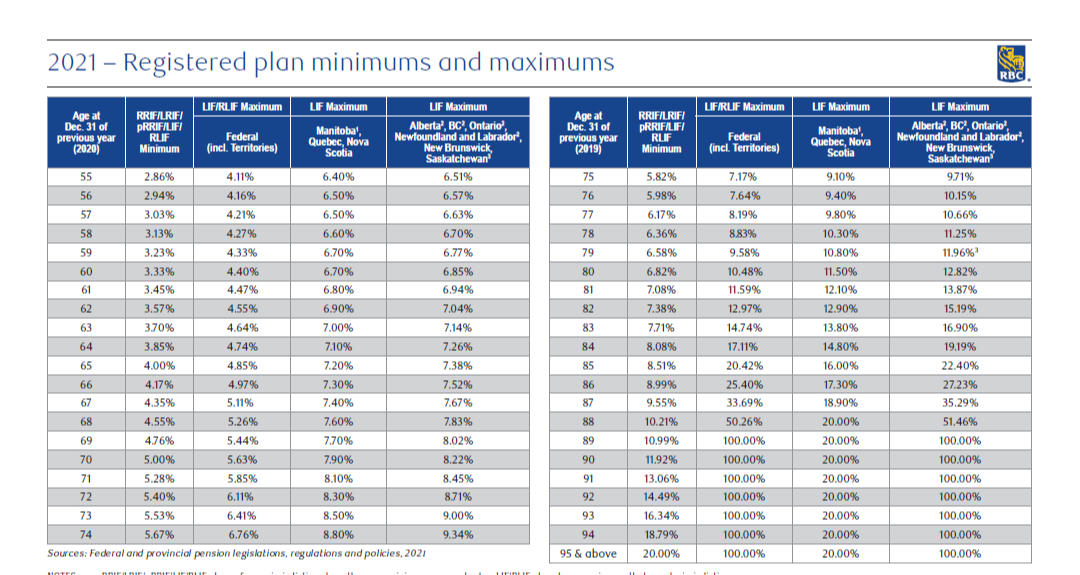

2021 Chart of RRIF & LIF minimums and maximums

Every year, depending on your age, new minimum percentages are established to determine how much you must withdraw from your Registered Retirement Income fund (RRIF) and/or Life Income fund (LIF) for the upcoming year based on your account's closing market value on December 31st. In addition for a LIF, a maximum is also set in much the same way. This chart is sometimes difficult to find, so we decided to attach it here for your reference. I have highlighted the two columns that apply to most Ontario account holders. Follow this link to review the chart (press the back button to return to the newsletter): 2021 RRIF/LIF Percentages

Every year, depending on your age, new minimum percentages are established to determine how much you must withdraw from your Registered Retirement Income fund (RRIF) and/or Life Income fund (LIF) for the upcoming year based on your account's closing market value on December 31st. In addition for a LIF, a maximum is also set in much the same way. This chart is sometimes difficult to find, so we decided to attach it here for your reference. I have highlighted the two columns that apply to most Ontario account holders. Follow this link to review the chart (press the back button to return to the newsletter): 2021 RRIF/LIF Percentages