Recognized as one of the leading investment teams in Saskatoon, The Keith Pavo Group provides a comprehensive range of wealth management services designed to your unique specifications. To provide a tailored plan, we follow a proven disciplined five-step process.

Your wealth management plan may include:

investment, financial, tax, insurance, and Will and estate planning.

Investment solutions

In order for your portfolio to grow, it is important find the most appropriate investments based on your unique values, comfort level to risk exposure and portfolio size. To do so, our team will create a personalized Investment Policy Statement (IPS) for every client.

The IPS spells out your risk tolerance, ideal portfolio make-up and investment strategies we will take to achieve your goals. It also defines your relationship with our team by providing examples of when you can expect our team to contact you, and outlining ways you can contact us to address your questions.

Find out how customized solutions can bring you closer to achieving your investment goals.

Contact us for a complimentary consultation.

Financial planning

We understand that investments are only a small part of your overall plan to:

-

Enjoy your wealth

-

Save for retirement

-

Help with a loved ones education

-

Create a legacy through charitable gifts

-

Build and transfer your estate

A comprehensive financial plan is built from a detailed analysis of your current situation and explores opportunities that will ensure you are on the right course. With the help of our accredited financial planning expert, our team will provide you with a plan that maps out tax-efficient strategies to achieve your goals.

Let us help clarify the big picture and get your investments working towards achieving all your goals.

Contact us for a complimentary consultation.

Tax-efficient strategies

For many of our clients, implementing tax-effective strategies to maximize their wealth is an important part of their wealth management plan. With the complimentary services of our dedicated financial planning expert, we help:

-

Preserve our clients current wealth

-

Maximize after-tax retirement income

-

Integrate business and personal tax strategies

-

Protect the value of their estate for the future

Contact us today to find out how we can help maximize your wealthy

Insurance solutions

Integrating insurance solutions into a wealth management plan is about more than a life insurance policy. Depending on each clients unique situation our insurance specialist can develop strategies that:

-

Protect your wealth from the unexpected financial burden of illness or accidents

-

Benefit from personal and corporate tax savings

-

Build wealth for your estate or a charitable contribution

-

Minimize the impact of taxes on your estate

Insurance solutions can play a big part in your overall plan.

Contact us today to learn more about our services.

Will and estate planning

Our legal Will and estate expert can help simplify the complex estate planning process so you dont have to make any compromises to your legacy. With a complimentary consultation, our team can help address your estate planning concerns and objectives, and recommend the steps you need to take to achieve your goals. Whether its updating your Will or creating one from scratch, establishing a trust for your loved ones, or setting up a charitable foundation, we can incorporate tax-efficient strategies to your plan.

Wed be happy to discuss how innovative Will and estate planning strategies can be a part of your wealth management plan.

Contact us today to learn more about our services.

The Keith Pavo Group recognizes that money is merely a means to an end. Its about having the financial security you need to live your life the way you want. Its about enjoying your success, spending time with your family, and creating memories that last for generations.

While money is just a means to an end, it still requires professional attention. Most importantly, it requires professional attention that acknowledges all your goals in life not just financial goals. In addition to helping you manage your investments and finances, we help you plan your retirement, save for a family members education, protect your lifestyle, fund a major purchase or create your legacy. Whatever your goals, we can help. This is the essence of our approach to wealth management.

Theres more to wealth than money

Wealth management goes beyond investment advice and money management to address a wide range of concerns related to both your financial and life goals.

A disciplined process is the key

To provide wealth management, we follow a disciplined five-step process to keep you on-track to achieving your goals. A disciplined process keeps us all focused on whats important helping you live life the way you want.

Five-step process

01. Introduction

We will introduce you to the wealth management services we provide, not just during our first meeting, but on an ongoing basis as your needs evolve and new services become available.

02. Discovery

Together, we will gain a deeper understanding of your individual needs, goals and circumstances to help you clarify your financial objectives. This includes gathering together all your important financial information.

03. Strategy

Next, we analyze your financial and personal information to match your objectives with smart, time-tested strategies.

04. Solutions

We develop thoughtful and creative solutions tailored to your objectives, drawing from a wide selection of world-class products and services.

05. Service

We regularly review your situation to ensure your financial objectives are being met in light of your changing needs.

Guiding you through each stage of your life

Wealth management is an ongoing process to help guide you and your family through each stage of your life.

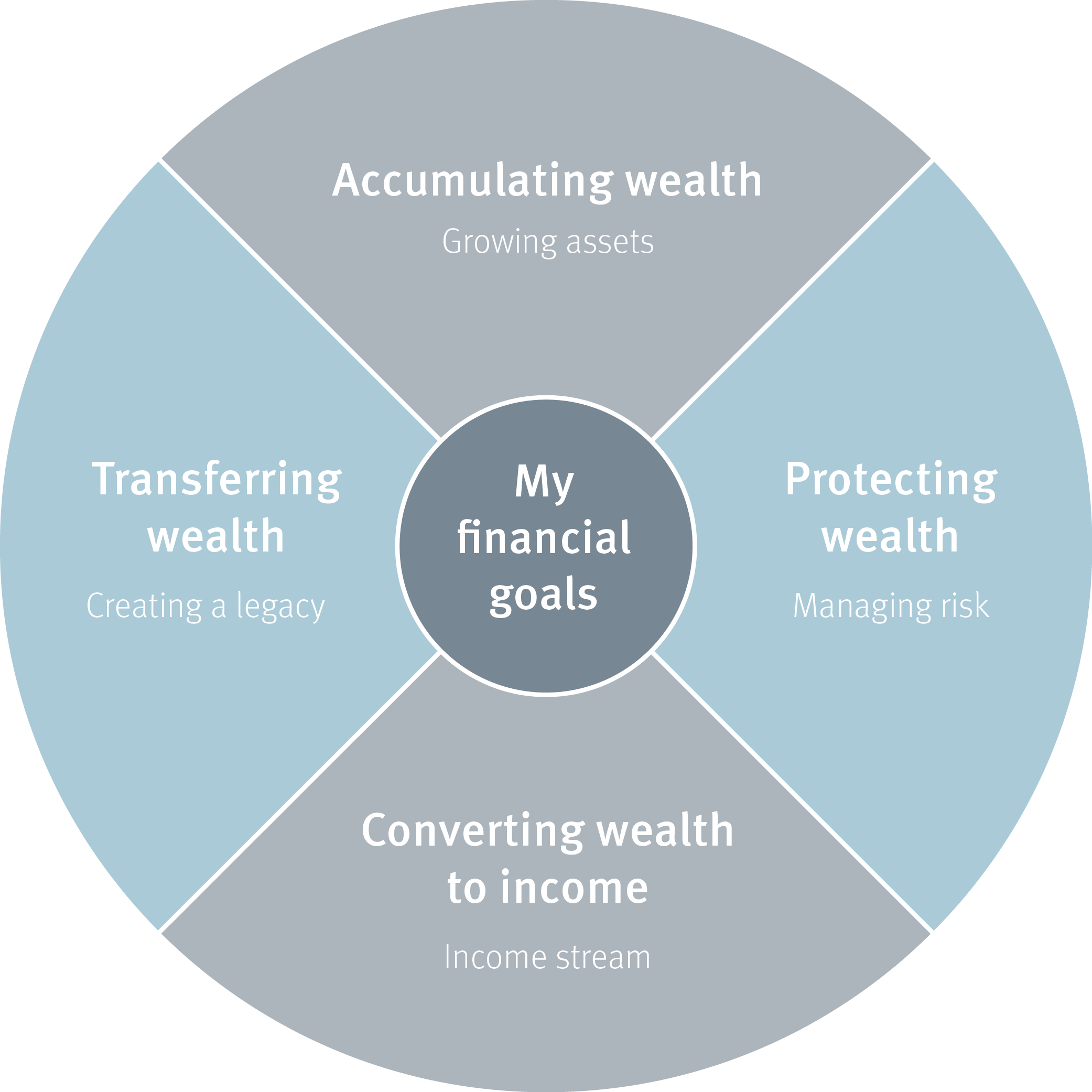

Accumulating wealth growing assets

Together we develop strategies to achieve your financial objectives, including planning for retirement, funding an education or preparing for a major purchase.

Converting wealth creating an income stream

We put strategies in place to help you maximize your after-tax retirement income. We will help you determine which types of income-producing investments are most appropriate for you.

Protecting wealth maintaining assets

To help protect your financial well-being, we will implement proven strategies to reduce risk. Our goal is to provide you with peace of mind, help maintain your independence and preserve family harmony or current lifestyle.

Transferring wealth creating a legacy

Working together with your other professional advisors, we will help create your legacy for family and charity, while addressing tax obligations and debts.