Market Moves

U.S. stock indexes moved steadily higher this week with the S&P 500 trading at its highest level in three months as investors continued to view tariff threats as more bark than bite. The Information Technology sector led the charge on continued enthusiasm for Artificial Intelligence-related themes, while consumer-related stocks struggled.

The Toronto Stock Exchange’s rally since mid-April has already pushed the Canadian equity index above previous peaks.

Today, we remind ourselves that the tariff situation remains fluid and is likely to continue injecting uncertainty into global markets.

BoC holds rates amid tariff uncertainty

The Bank of Canada opted to hold rates steady again at 2.75% this week, their second straight pause after 225 bps of easing since last year. The BoC cited a Canadian economy that was “softer but not sharply weaker” and “unexpected firmness in recent inflation data” as drivers for the decision. In short, the BoC wants to see “more information on US trade policy and its impacts” before adjusting policy rates further. Much like the Fed, the BoC is in “wait and see” mode for the time being, and the decision to pause appears to have been fairly consensus among Governing Council members.

Markets were split heading into this decision, but were still leaning towards a pause. Looking ahead, the BoC prefers to be “less forward-looking than usual”, waiting for incoming economic data and tariff clarity before adjusting rates further. However, BoC Governor Tiff Macklem did indicate that the BoC would be willing to cut rates “if the economy weakens in the face of continued US tariffs and uncertainty, and the cost pressures on inflation are contained”.

Market pricing implies 1-2x more cuts through the end of this year, but we will need to wait for incoming economic data and tariff clarity before the BoC’s future policy path becomes any clearer.

The Canadian Economy

Canada’s economy grew at a 2.2% annualized pace in Q1 2025, exceeding consensus expectations and the BoC’s forecast. While the headline reading suggests the economy may be holding up better than expected in the face of U.S. trade policy uncertainty, the underlying components paint a more nuanced picture as Q1 output was largely influenced by a strong jump in tariff-driven exports that offset signs of weakness in other parts of the economy.

Exports and imports increased in Q1 by 6.7% and 4.4%, respectively, led by the Autos and Machinery & Equipment sectors, reflecting tariff-related front-loading that is unlikely to be sustained.

Meanwhile, worrying signs in the economy have emerged as household consumption growth slowed, residential investment fell, and business investment in non-residential structures also declined, indicating sluggish economic momentum.

Canadian Headwinds: Spotlight on Housing

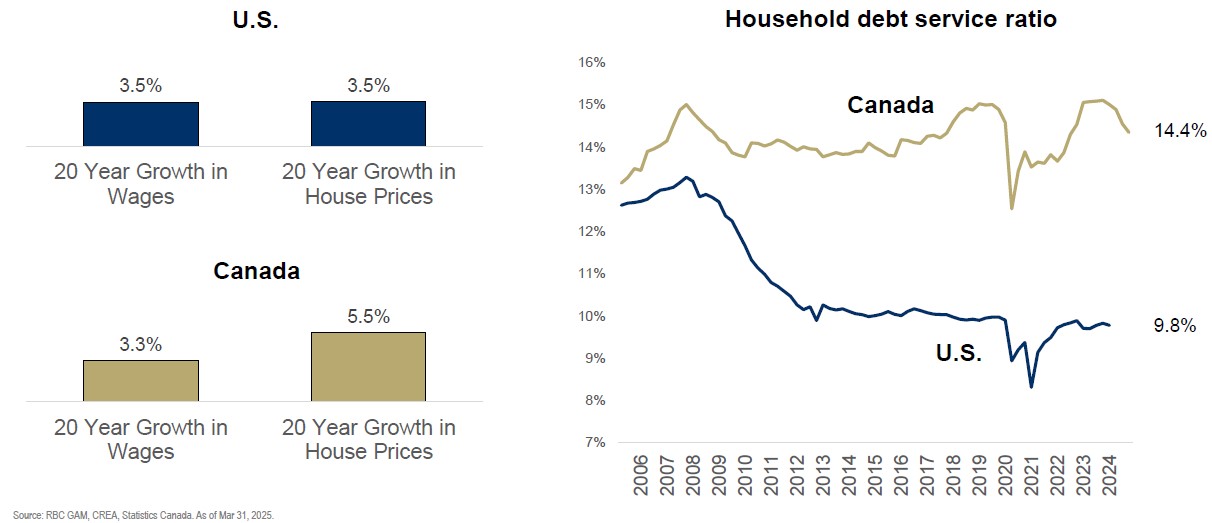

Throughout most of the developed world, housing costs have increased proportionately to wage increases. So while homes are more expensive everywhere, the alignment with income is reasonably consistent. Here in Canada, that just hasn’t been the case;

Ultimately this imbalance has resulted in a much higher debt service ratio than our U.S. neighbors, thus a much more interest rate sensitive economy.

Layer on top of that the headwinds from rising mortgage renewal rates over the next couple of years and there are very good reasons for the BoC to be on higher alert for signs that our housing market is putting too much pressure on the consumer. While we don’t worry about defaults in the mortgage space, we will be keeping an eye on how this evolves over the coming months as it will likely have an impact on consumer spending behavior.

As always, we will continue to keep a close watch on ongoing developments and share timely updates as new information becomes available. Our team is available to address any questions you may have, so please do not hesitate to contact us.

Thank you,

Kayte