Bond markets have had a difficult start to 2022, with expectations for tighter monetary policy driving yields higher and bond prices lower. For Treasury markets, there has been some offset to the selling pressure, as investors have sought the safety of U.S. government debt amid rising global tensions in Ukraine, a geopolitical concern that RBC Wealth Management’s Global Portfolio Advisory Committee recently examined and placed into historical context.

For monetary policy, we concur that the Fed will likely raise rates multiple times in 2022, but we believe current bond pricing reflects an overly aggressive tightening forecast, as indicated by futures markets showing a high probability of at least six rate hikes this year. In our view, it’s critical for investors to remember that the impetus for tightening comes from the success of the fiscal and monetary response to COVID-19; with significant fiscal tightening on the way in 2022 and the likely normalization of supply chains later this year, we believe the Fed will be able to move at a more measured pace, a view we discuss more fully in a recently published article.

The recent losses and likely shift in monetary policy may create concern regarding the prospects for fixed income this year; while we acknowledge the macroeconomic headwinds, we believe there are still pockets of value in the U.S. fixed income market for investors with a longer-term mindset.

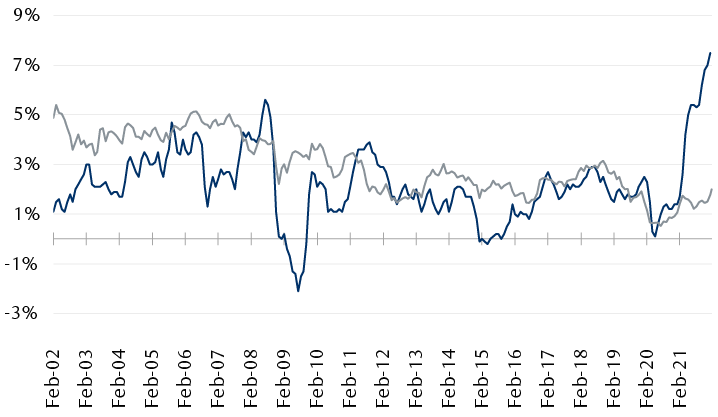

Rising inflation and potential policy response a potential headwind for bond prices

Source - RBC Wealth Management, Bloomberg; CPI data through 1/31/22, 10yr Treasury data through 2/17/22

Go long

One approach to dealing with policy uncertainty is to focus on longer-maturity Treasuries. Bonds that mature in 30 years, for example, tend to reflect longer-term economic trends and growth rates more than shorter-maturity bonds, which are influenced more directly by Fed policy. High-grade, longer-maturity bonds offer two additional advantages.

First, because longer-maturity bonds are more sensitive to changes in the yield curve, a relatively small position in 30-year Treasuries can create a return profile similar to that of a much larger stake in shorter maturities. A $100,000 position in 30-year government debt, for instance, will likely generate similar market gains and losses as a $450,000 stake in five-year bonds, if yields change by a similar amount for each maturity. By focusing on longer maturities for high-grade debt, investors can free up assets to invest in other, potentially more attractive asset classes, while keeping exposure to the hedging characteristics of bonds.

Second, if the Fed does act more aggressively to combat inflation, we believe yields will likely rise faster on short-maturity bonds than on long-maturity bonds, as the slower growth implications of tight policy could create demand for 30-year government debt. Investors could still see losses on longer-maturity bonds, even if those securities outperformed other Treasury bonds. Of course, if the Fed were able to combat inflation with fewer policy moves, yields could decline by more on shorter-maturities, potentially leading longer-maturity bonds to underperform.

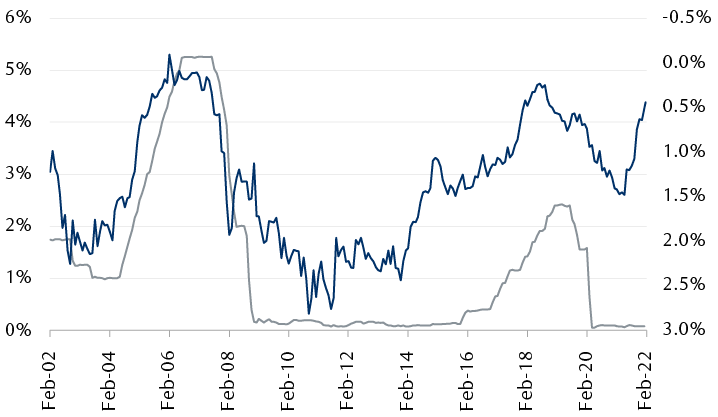

Longer-maturity bond yields historically rise more slowly as the federal funds rate increases

Source - RBC Wealth Management, Bloomberg; federal funds rate data through 1/31/22, yield data through 2/17/22

Credit where credit is due

For investors with greater risk tolerance, adding credit exposure can pair well with using longer-maturity Treasuries to free up assets.

The macroeconomic backdrop is not without risks—Fed tightening and fiscal contraction are headwinds. But recent data—including this week’s retail sales—have underscored the strength of private demand and consumer spending. Retail sales in January were up 3.8%, despite the ongoing omicron variant and without considering gas and auto prices, both of which have seen large supply-constrained price increases. Inflation also helps reduce debt burdens in real terms, and corporate borrowers in the aggregate used 2020 and 2021’s low rate environment to secure longer-term financing on attractive terms. In short, we view growth prospects and corporate balance sheets as supportive for credit markets, with default rates likely to remain low.

Shorter-term, higher-yielding debt also tends to be more heavily influenced by individual corporate factors than the general interest rate environment. Most importantly, because debt is governed by contractual obligations, market losses will eventually be recovered, unless there is a default or other credit event before maturity.

Rising coupons help hedge rising rates

Another fixed income instrument that can perform well with rising interest rates are floating-rate notes, known as “floaters.” The coupon on these instruments is calculated using a short-tenor reference rate—frequently an overnight or quarterly rate—plus a fixed spread. As policy rates rise, these reference rates tend to rise as well, providing investors with additional income.

One potentially interesting subset of floaters is hybrid preferreds with a fixed-to-float structure. These securities typically offer a multi-year period of fixed coupons before converting to a floating-rate structure. Hybrids are subordinated securities and usually include options for the issuer to call the security, but for investors with the appropriate background and risk tolerance we think they can offer an interesting blend of interest rate and credit exposure.

Volatility for longer-term potential gains

We expect continued volatility in U.S. fixed income markets. Fed policy expectations will change with incoming data, and while we anticipate inflationary pressures will recede in H2, the precise timing and magnitude of price stabilization is uncertain. In a similar vein, although we believe macroeconomic conditions are favorable for credit performance, the backdrop of a shrinking central bank balance sheet and reduced fiscal spending could put corporate bond prices under near-term pressure even if defaults remain low.

We believe investors with a longer-term perspective, and the appropriate risk tolerance and liquidity profile, can use this uncertainty to judiciously utilize longer-maturity government bonds and additional credit risk in their fixed income allocation. For investors with a greater risk tolerance, equity markets continue to look attractive to us as well.