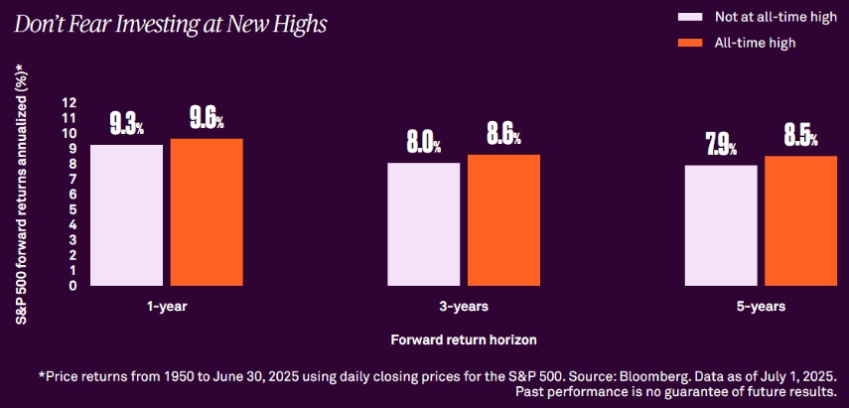

It’s an easy rationalization to say: “Well, the markets are at an all-time high, let’s just wait”. I’ve got a neat chart to help us all out.

History shows there is little difference between future returns following a new all-time high and future returns following any other day when the market has not registered a new high. The reason for this is that over time, the market always hits “all-time highs”. If you’re a long-term investor, with a long horizon, you’re going to experience hundreds or thousands of “all-time highs”. If your time horizon is a few days, weeks, or months – well, that’s just relying on a very short-term time frame and is more akin to gambling.

Since 1950, the S&P 500 has delivered strong returns in the forward 1-, 3-, and 5-year periods from a new all-time high. An all-time high is just like any other trading day, and investors are best served by viewing them all through the same lens. Don’t let fear of all-time highs keep you on the sidelines.

Rather, stay invested and diversified and maintain a long-term perspective. That’s why we keep a diversified basket of great companies in our portfolios, across a variety of sectors. Don’t panic – and make sure that we have the cash we need on hand to fund short and mid-term foreseeable expenses. Then we don’t have to worry about the highs and lows for this bucket of our money.

This is a useful visualization:

How ‘bout those Blue Jays! I’ve always enjoyed puttering around with the Blue Jays baseball radio in the background. I did predict they would win the World Series at the beginning of the season, let’s see next few months!