I promise that every week won’t be about tariffs, but I wanted to provide a summary of this week. As part of the "liberation day" announcement on Wednesday, Donald Trump declared a 10% baseline tariff on all U.S. imports - plus much higher duties to be individually applied on roughly 60 nations (and apparently a few un-inhabitted islands).

It’s important to distinguish between the headlines, as it pertains to Canada and the reality. Much of the trade between Canada and the US is still under the USMCA agreement. Canada faces 25% tariffs on many non-USMCA compliant goods and a reduced 10% duty on non-USMCA compliant energy and potash, which will not face additional levies from the announcement.

The reciprocal tariffs do not apply to certain goods, including copper, pharmaceuticals, semiconductors, lumber, gold, energy, and certain minerals that are not available in the United States. Many of these products, Canada exports in abundance to the US. The tariffs will remain in effect until "such a time as President Trump determines that the threat posed by the trade deficit and underlying nonreciprocal treatment is satisfied, resolved, or mitigated." So, there is a lot to unpack, and we will react accordingly, and continue to have discussions.

What this all means long-term is yet to be determined, and what deals others will cut, and exemptions made have not been factored in. If there is one take-away it’s to expect some wild gyrations, news-driven market moves over the days and weeks ahead, that we cannot predict.

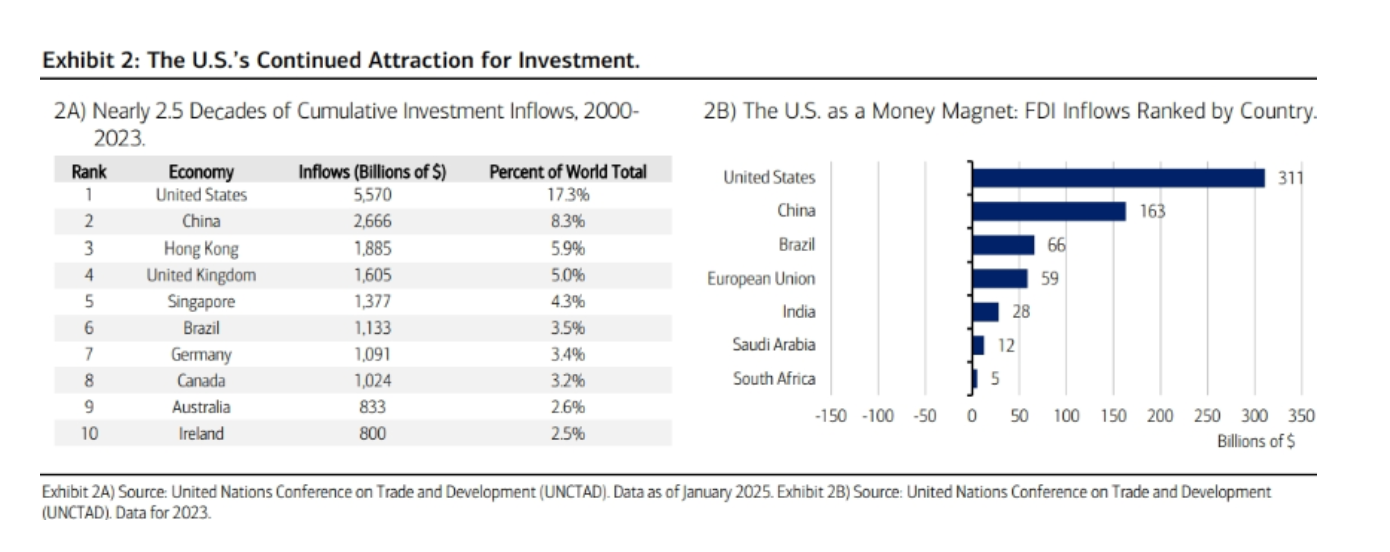

I do find this chart interesting: despite the declarations of “getting ripped off” , no other country in the world has been as successful in attracting other people’s money than the U.S., which, in turn, underpins the global competitiveness of America. If anything, the near-term pile-into-the-U.S. investment flows remains intact and coincident with a longer-term trend. It will be interesting to see if there are long-term negative effects on this investment trend.

No predictions this weekend. It’s the so-called Final 4 in the US, but I don’t follow, and no one in Canada likely cares…

Please, as we reach out to you, have calls and reviews, and look at our asset allocations: make sure that we have enough short-term funds for all our needs in the foreseeable horizon, and move the portfolios investments for the long-term in accordance with the trends that are occurring, without making knee-jerk reactions. Not to mention tax packages, and other custom tax-related requests.

Have a great weekend.