We have talked about the upcoming reduction in rates that is starting to occur in Canada, as rate cuts will likely continue for awhile. On the one hand, it means that those 5% GIC’s are no longer available. On the other hand, these rate reductions will be welcomed by those carry debt, and/or have mortgages coming due.

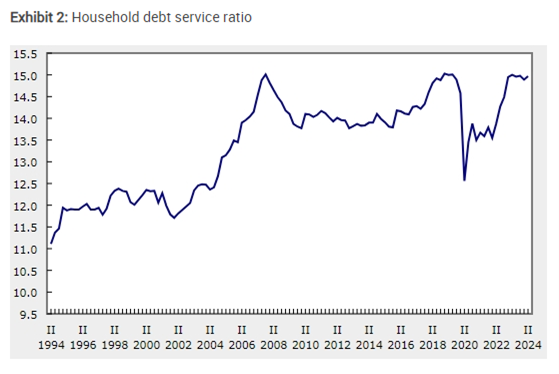

Despite this de-leveraging, the average household’s debt service ratio (principal and interest payments on mortgage and non-mortgage debt as a share of disposable income) continues to hover around 15%, similar to peaks seen in past BoC tightening cycles (see chart below). 3 times in the last 30 years, debt has been this high.

- with debt levels and interest rates coming down from earlier cycle highs, the average debt service ratio is likely to remain elevated as more homeowners renew their mortgages at higher interest rates. Back in May, the BoC noted that half of mortgage holders had still yet to refinance at higher rates, and based on market expectations for interest rates at the time (which have come down since), those that had yet to renew were likely to see a larger payment increase than those that had already refinanced. We really are entering a new cycle. Dedicating more income to servicing debt means households have less left over to spend on goods and services. Consumer spending has been sluggish as a result, declining by 3.8% on a per capita basis over the past two years.

If you want one take-away from this to impress your friends when they might ask :”why is the economy in Canada slowing down”? The answer is pretty simple: like in any cycle, as households take on more debt, there comes a time when this debt has to be paid down. This is where we are now: spending less and saving/paying down debt more. It happens every cycle…

I’m certainly not going to bet on the outcome of the US election, but just as I referenced, online-betting for sports events is growing massively in the US. I hadn’t realized that until a few days ago, that election betting was banned by the federal government. Now it is set to reach millions of Americans. A popular trading platform, Interactive Brokers, plans to launch a market where investors can bet on the outcome of the presidential election, taking advantage of a federal court ruling that has effectively legalized election betting in the U.S. Starting Monday, Interactive Brokers plans to allow its users to place wagers on whether Vice President Kamala Harris beats former President Donald Trump in November.