While summer has been a relatively slow period in terms of client inquiries, we’ve been busy and also enjoyed some time away. Anyone that wants to reach out and ask about my Alaska trip, happy to oblige: HINT: it was amazing. Being completely remote with no email access for a few days was daunting at first but ultimately rewarding.

The markets have certainly been active this summer, and I thoroughly enjoyed watching what I thought was an exceptional Olympics. After a prolonged period of gains, the recent volatility has led the S&P/TSX Composite to fall about 4% from its all-time highs. Sharp retractions within short stints are generally uncomfortable, but long-term clients and readers know that these ups and downs are part of the process for achieving strong long-term returns — provided we don’t panic.

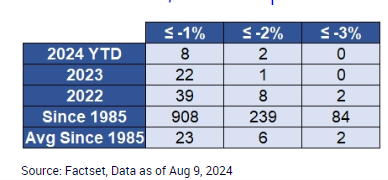

Again, market drawdowns are normal. On average, we experience a pullback of 1% or more about 23 times a year. Note that we haven’t had a one-day 3% pullback since 2022, despite historically having about two such occurrences per year. Remember this if we experience a sharp one-day drop. While I can’t predict the exact timing of sharp declines, we can expect them.

The good news is that after the market declines by at least 2% (as it did on August 2, 2024), the S&P/TSX Composite has historically returned an average of 3.2%, 6.3%, and 9.1% over the following 3-month, 6-month, and 12-month periods, respectively.

As summer continues, I hope everyone has more time to spend with friends and family. And speaking of changes, I predict we’ll soon be experiencing colder weather as the seasons shift!

Have a nice weekend,

Joshua Kingsmill