Key Takeaways

- Is Bitcoin a “fad” or a window into another technology wave that is developing, akin to the internet in the 1990’s

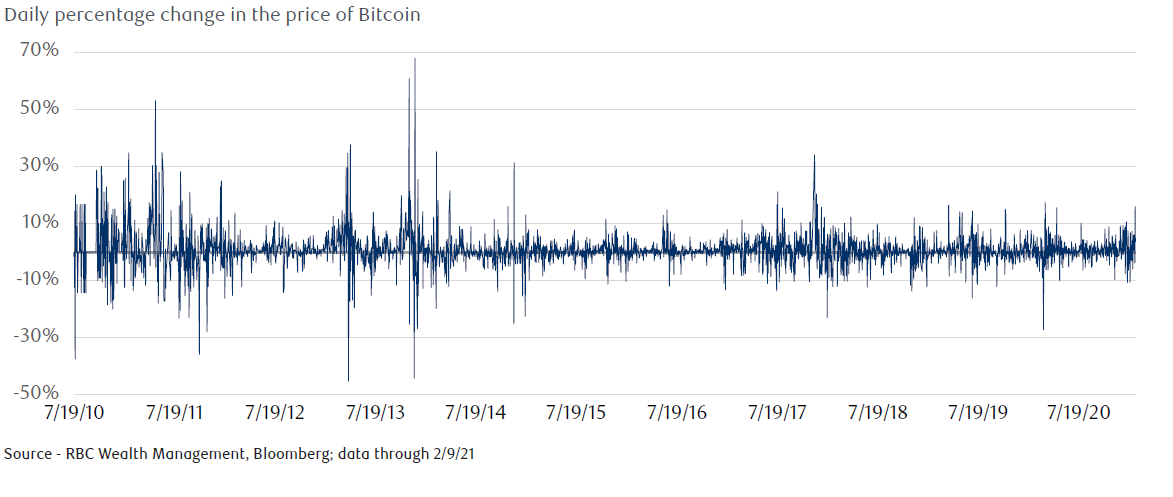

- The volatility of the price of Bitcoin, in terms of daily percentage change is considerable.

- It’s important to at least understand the investment rationale behind the interest in Bitcoin

By far for me at least, the “investment” which has garnered the most amount of queries in the last while: Bitcoin. I’ve spent a considerable amount of time in the last year learning and adapting my thinking on Bitcoin. What underpins Bitcoin is a potentially transformative technology whose impacts likely extend beyond its use as an investment.

For its most ardent advocates, a belief that Bitcoin will change society is close to an article of faith. Conversely, there are many decided nonbelievers who view the current enthusiasm for Bitcoin as a speculative phenomenon. The financial world is starkly divided on this issue.

Indeed, my firm, RBC, has the following disclaimer: “In our view, any investment in Bitcoin should be considered speculative and volatile, meaning that investors should be prepared to lose all of their investment.”One thing everyone can agree on though is that Bitcoin comes with a lot of “volatility”: The daily ups and downs of the asset class aren’t for the faint of heart:

I’ve included an attachment (Click Here) that gives an overview and I will go over briefly how it may be relevant to investors today. I’m hopeful to be able to invite participants to a call in the next month or so, so this is a summary.

I think the key takeaway is to understand that for many Bitcoin investors, they are focused on its potential to serve as a store of value. A key reason for this is that there will only ever be 21 million Bitcoins issued, making it a potential hedge against inflation and resistant to control by central banks. In order to manage the fallout of the pandemic, government expenditures as a percentage of GDP are approaching the all-time highs reached during World War II, and central banks are funding this by printing money at a rate unparalleled in modern history. In the near term, economic damage related to the pandemic may keep inflation low. But over a longer time frame, this kind of policy has been associated with inflation, and serves as a catalyst for investors to seek out assets which they expect will hold their value: Therefore hello Bitcoin!

So whether one invests in Bitcoin or not, I do think its important to at least have an opinion, and appreciate that what is driving the attention onto Bitcoin, beyond simply Fear of Missing Out, or concluding that its already had its run. With Bitcoin, and other “digital assets”, it’s not unreasonable to draw a parallel to the Internet as it started in the mid-1990s. We are in the early days of another stage in technological evolution. In addition to Bitcoin, there has been a wave of new efforts in another segments of this crypto space referred to as DeFi (Decentralized Finance) which aims to develop a financial infrastructure of lending, borrowing, and leveraging products and services that operate in a decentralized manner. The possibilities of cryptocurrency technology are wide-ranging. So stay-tuned for my invite in the weeks to come.

I will conclude this week, with a link to these incredible shots from Mars. As a kid, this was the stuff of science-fiction. (LINK). As preposterous as it might have been to predict the reality of exploring Mars, this is where we are: getting back high-resolution videos and photos, all controlled by a remote control robot. I predict that in the not too distant future, some crazy civilians will pay out of this world amounts of Bitcoin, to vacation on Mars!