Key Takeaways:

- Empty airports an illustration of how things have changed

- The market has rallied significantly: in anticipation of things improving going forward.

- Consider best-practices as we start to reintegrate into day to day society again.

This weekend, I went to Pearson International Airport and took the photo below. It was startling to see one of the busiest airports in North America. This airport averages 50 million passengers a year (more than Newark, Mexico City and slightly less than JKF), virtually empty. Fun Fact: the busiest airport in North America, the Atlanta International Airport has over 107 million passengers a year:

This a strong visual reminder of how much our economies have slowed down and how much it has to move to come back. Recall that I talked about the historical reality that “the market goes up well in advance of the actual economy improving.”

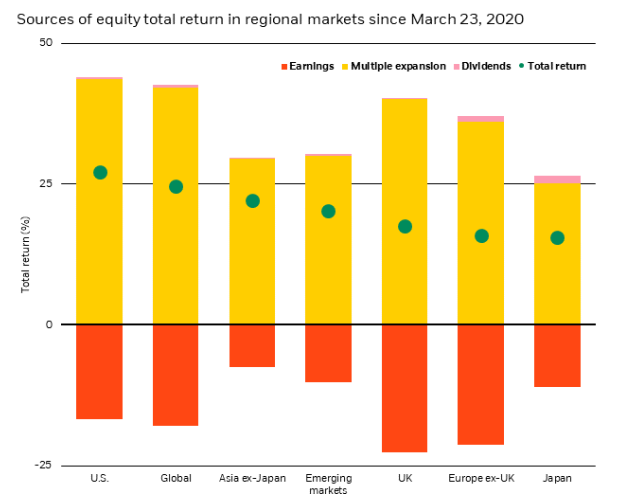

Indeed, the total world market has rallied 28.5% off its March 23 low on the back of massive fiscal and monetary stimulus and significant progress in containing COVID-19. It has allowed major economies to embark on a gradual reopening. The chart below does an excellent job of breaking down the “how” of the sharp recovery of stock markets. The takeaway is that the market has rallied, not based on earnings today (which, as you can see, is in the red). Rather, the market has rallied in anticipation of things getting better. The technical term for this is called “multiple expansion.”

If there is one thing that I hope you can have as a takeaway from this chart, is that investors are anticipating that earnings will stage a robust recovery in 2021 as economies emerge from painful lockdown restrictions and pent-up demand unleashes.

Whether this anticipation is well-founded or has the market rallied to much and is bound to fall back is now the focus going forward. There will no doubt be more volatility, and ups and downs. I don’t believe anyone should be confident in saying that we are out of the woods:

So we continue to be vigilant and make changes to the composition of investment portfolios while remaining focused on each of our overall objectives and ability to withstand the uncertainties that remain.

On a separate note, I had an illuminating conversation with one of my clients: this couple, both Doctors, front-line health workers, with young children. They reiterated to me the importance of the use of masks and washing our hands and faces constantly. Without wanting to pontificate, the science is clear that wearing masks when gathering in public is the most critical thing we can all do, especially as we enter the next phase, where our movements and interactions are less restricted. It is surprising that the wearing of masks hasn’t been mandated in the next stage while at stores, public transit, etc.

After that conversation, I was directed to this environmentally-friendly mask, and I placed an order.

Fine weather is anticipated across North America this weekend: hopefully, we can all enjoy some time outside: it's well deserved.