I have talked about this before, and I know I will again before it happens, but I came across some “Swifteconomics” that are staggering. I wonder if there has ever been a more anticipated concert in Toronto. I suppose the Beatles’ visit would have been something at a different level, but that was before my time—before Ticketmaster scalping and, of course, the social media that drives everything these days.

Taylor Swift’s Eras Tour has set records across the globe by becoming the first-ever billion-dollar concert tour. When her Eras tour touches down in Toronto for a six-show stint in November, it will be the highest-grossing live music event in the city’s history—an impressive feat considering it wasn’t even in the original plan. But of course, money talks. When Swift first announced the final leg of her Eras Tour, it looked like Canada was going to be left out, as we weren’t on the list. Cue the desperate outcries from Canadian fans, a plea from Justin Trudeau on social media, and some behind-the-scenes wheeling and dealing that convinced Swift to change course.

In some articles I post, I refer to the exorbitant state of the Toronto real estate market. However, I’ve learned that this tour has an even more out-of-whack supply-and-demand dynamic than Toronto’s real estate and rental markets.

Thirty-one million people attempted to join the virtual waitlist for tickets—ten times the population of the entire city. And that’s just one of many indicators of the economic boom Swift is bringing to Toronto, with some estimates placing the impact as high as $700 million. I don’t know what the markup was for that Beatles concert at Maple Leaf Gardens in the 1960s, but tickets for the Rogers Centre’s luxury suites on the resale site SeatGeek are listed for as high as $121,000. For those who aren’t interested in high-class seats, the cheapest tickets currently available on secondary platforms are just over $2,000. Ticket sales for the six nights of performances are expected to generate around $120 million.

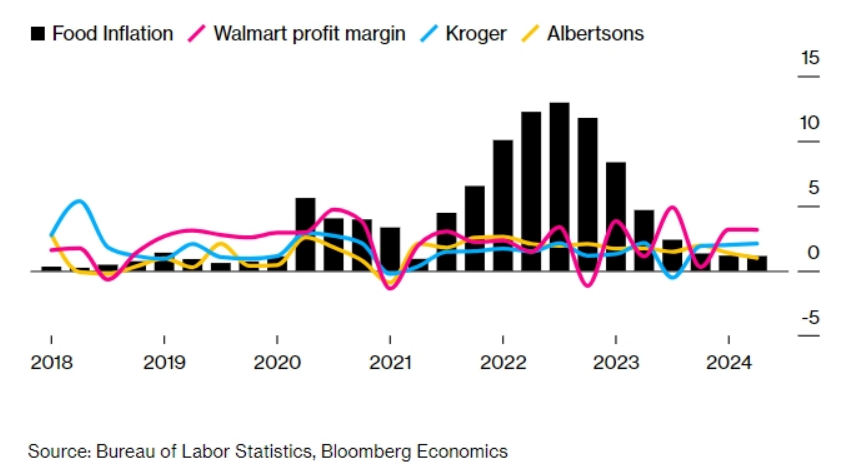

So, in an attempt to link this to something investment-focused, let’s look at “price gouging.” While the ticket resale price gouging is real, with resellers clearly making enormous profits, there has been much discussion about whether grocery stores have been “gouging” consumers. It’s true that prices in grocery stores have gone up since COVID, due to inflation, supply issues, and so on.

While stores were raising prices to preserve margins in the face of higher costs and supply-chain disruptions it’s clear from their margins that they were taking advantage of an inflationary episode to gouge consumers. If they could get into the Taylor Swift re-sale market, well that would be another story…

Next week is Canadian Thanksgiving, so there won’t be a post: but enjoy the time with friends and family, and we are always available by phone or email (just don’t ask me for Taylor Swift Tickets: I can only wish!)

Have a great weekend.