We are generating reports to see who might take this increased inclusion rate from 50% to 66% on Capital Gains, and be in touch with those who ought to consider it, or at least understand the implications.

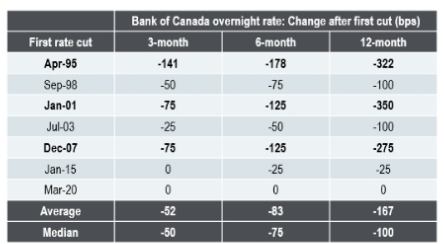

Going back to the interest rate cut last week. We are often asked: how many interest rate cuts will there be? Based on previous easing cycles, the Bank of Canada’s benchmark rate has declined by an average of just over 150 bps (median: 100 bps) in the 12 months following the first rates. Of course, there are significant variances in the magnitude of easing across cycles, with economic growth and the labour market being the key indicators to watch in assessing the magnitude of rate reductions. One of the key drivers is Canada’s unemployment rate: which rose to 6.2% in May from 5.3% a year ago and real GDP growth averaged just 0.5% over the past four quarters. Inflation, a relevant factor for this cycle, has improved substantially; core CPI registered 2.7% in April, down sharply from the 5.5% peak in July 2022.

While there is a lot to unpack, the key take-away is that its reasonable to assume rates will go down in Canada over the next 12 months. For anyone with mortgages up for renewal, we aren’t likely going to return to the sub 2% rates. But there should be some relief compared to the rates today.

We always have discussions with clients about their debts, and whether locking in short-term, vs. long-term, vs variable makes sense, and will continue to do so.

So of course, its Father’s Day this Sunday: whether we are Dad’s, or have a Dad, or miss our Dad, as well as the influence of Fathers on our society, I hope everyone gets some time to cheer and give praise to those Dads and Father Figures in our lives: I know I will. Is it too much to ask for Fathers Day that my Edmonton Oilers extend the Stanley Cup at least a few more days? And Rory is going to win the US Open Sunday, which I predict I won’t watch one moment of.

Have a great weekend.