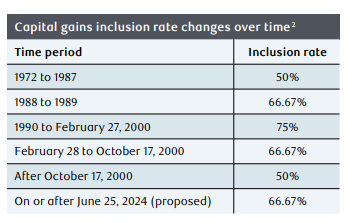

As we wrap up this tax season, the Canadian Government just announced a tax change requiring some discussions. Although it's not certain to pass, the recent federal budget proposes a capital gains inclusion rate increase to 66.6%, from 50%. It is anticipated that if this proposal goes through, any capital gains realized before June 25, 2024, will have an inclusion rate of 50%, and any capital gains after June 25th will have a 50% rate up to $250,000, and then 66.6% on amounts above this.

By way of background, I hadn’t appreciated that this rate had changed as often as it had historically: from 50 – 75% in the last 50 years.

For those with significant embedded capital gains, we will be reaching out to you in the coming weeks to discuss options, should this bill be passed. Like any tax-driven question, we consider many/all of the following:

- Are my goals still the same?

- Do I have a liquidity need for the sale proceeds in the short-term?

- Do I expect to have more than $250,000 in realized net capital gains personally in 2024?

- Would a sale take advantage of using lower marginal tax brackets?

- Do I plan to gift assets to my family members during my lifetime?

So, lots of considerations, and now that we get through this tax season, we will be talking to those who might be affected by these new rules…

Over the past few years, I’ve had the honor and privilege of being in an office adjacent to Mr. Tony Fell. Mr. Fell was the chairman of Dominion Securities, which was bought by Royal Bank. Mr. Fell then became the CEO of Royal Bank. While ostensibly “retired”, he is in the office every day before 7:30 am. When I come in sometimes on Saturday he is often there as well. The reason I mention this is that our floor is going through a reconfiguration, and Mr. Fell is moving to another office on the floor, and I am taking over his office space!

Saying that I work on the same floor as Mr. Fell at RBC DS, and now moving into his office, is like saying both Wayne Gretzky and I play hockey. It’s been amazing having Mr. Fell as my neighbor; he has been so kind and generous with us over the last few years.

This is Mr. Fell and his associate, Carole Fisher, in his current office. They have been working together for 22 years. I know for certain I won’t become the CEO of RBC: as for Avril and I for 22 years, who knows? But I’m delighted to be moving into his office: hopefully, some of Mr. Fell’s acumen and generosity will rub off on us…

Have a great weekend.