Key Takeaways:

- If we are in a "Bear Market," there will be many rallies

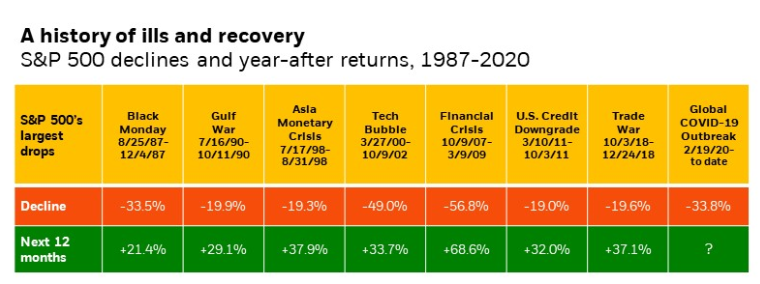

- Historically 20% + declines have been followed by strong 12 month gains

- Holding on all positions forever, indiscriminately, only to wait for it to "get back to even," costs us opportunities

How much would a crystal ball that worked be worth that could foresee the day to day ups and downs of the market?

In the U.S., the Dow achieved a gain of 20% from its low in three days this week. Surprisingly, that only ties another three-day record from October 8, 1931, for the quickest 20% gain ever. Recall my last blog post about the different kinds of Bear Markets. This week we went from a "bear market" to a "bull market" in a record 11 days.

I don't possess a crystal ball, and I am asked: "What is going to happen next?" No one can "guess" the market on a day to day basis. However, knowing what I don't know, for what it's worth these are the four things that I anticipate are required to "stabilize" this market:

- A sign that all these policy interventions, massive money injections, loans from governments to companies large and small, bail-outs, money sent to citizens, and actions of governments is sufficient to prevent even more significant economic shock soon after.

- A sign that the infection rate is reaching a peak.

- A sign that the economic downturn may be slowing.

- Cheap valuations.

So really, some of the things are subjective, some of them we will only know after they occur. But my best guess is it's a combination of all of them.

Indeed, this incredible rally does provide a glimpse of what will happen in the future when all of 1 through 4 points check off. This rally should give comfort that things will get better: the market will improve. While I don't believe we are out of the woods if we are great: none of my clients went to cash or did anything rash, and we are well on our way.

Some have asked me, "What do you think the market will do now?" I found this chart useful:

In the post-Coronavirus world, there are going to be changes in the way people and industries operate. Some of which have been underway for a while and this will be amplified. There are going to be companies and sectors that emerge from this more robust and better positioned than others. Some parts of the economy will recover very slowly, possibly vanish, or have weak long-term outlooks. Staying "invested" isn't the same as remaining the course. There will be some difficult decisions to sell some things at a loss to invest in strategies that we can anticipate will do better in the future.

On a personal note to everyone, this has been an incredibly uncertain and unsettling time. My admiration for the resiliency and fundamental optimism that my clients maintain, while we adjust and navigate this has provided me with great comfort as I work with you. I will continue to inform and monitor as we get through this, and have as many calls and personalized touchpoints as required.