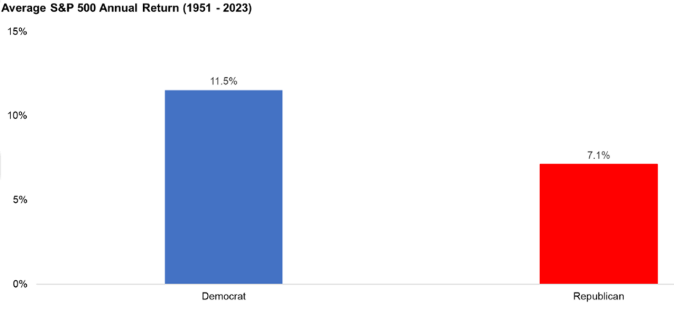

Do U.S. presidential elections “interfere” with market returns, and therefore with investors’ portfolios? What is the likely impact of a win by a Democrat versus a Republican? Historically, presidential election outcomes have delivered surprising results when it comes to equity market performance, defying the “common wisdom” that they perform better under Republicans due to policies such as lower corporate taxes and less regulation.

With the 2024 U.S. presidential election looming, it is understandable that investors may be wondering what impact, if any, the election of one party and/or presidential candidate might have on investment markets and their portfolios.

Source: Carson Investment Research, FactSet. S&P 500 Index (USD) from 1951 to 2023, inclusive. Returns of president term based on election dates.

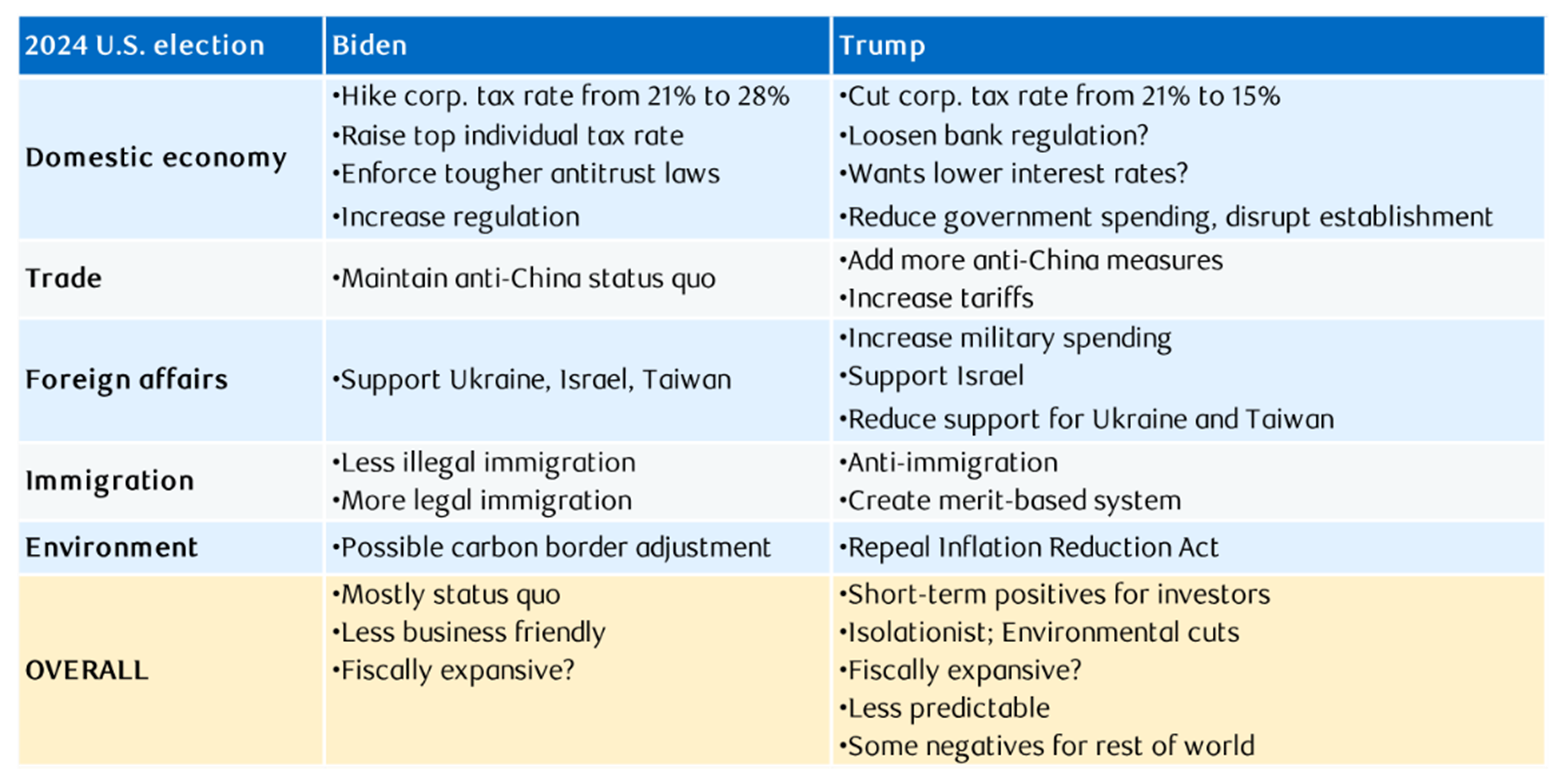

The 2024 candidates have positions on key policies that investors do, on the whole, care about, including taxes, jobs, trade and immigration.

Source: RBC Global Asset Management.

But beyond this, and recognizing that a president can’t really do much without control over or the support of Congress to pass legislation, the more important factor over the longer term is who controls the House and Senate.

Playing in the Congressional sandbox

There is a famous final scene in the 1972 Academy Award-winning film The Candidate, starring Robert Redford. After pulling off an upset against his incumbent and well-entrenched senatorial opponent, Redford’s character, stunned by the turn of events, turns to his campaign manager and says, “What do we do now?” While the question is left unanswered, it is the crux of the outcome of a presidential election and its impact on markets: what happens next.

Indeed, for markets and investors, the answer is often determined by the policy positions of the new president and the composition of the Congress they must work with. Importantly, does the president’s party hold power across Congress (a sweep), the House or Senate only (a split), or neither (opposing)? Looking at the following chart, it appears that, historically, a Democratic president who can “play well” with their political opponents in Congress has historically provided the best returns for investors.

Source: Carson Investment Research, FactSet. S&P 500 Index return (USD) 1951 to 2023. Returns attributed to governments immediately after election and accounts for changes in government control following mid-term elections. Sweep accounts for period where president’s party controls congress. Opposing Congress accounts for period where the opposing party of the president controls congress. Split congress accounts for periods where Democrats and Republicans each have control of one of the House of Representatives or the Senate.

A ballot for balance

Regardless of the outcome of this election, trying to anticipate how it will affect markets and your portfolio is next to impossible. Consequently, tuning out the election noise and “casting your vote” for a properly balanced portfolio designed to achieve your long-term goals remains the best strategy.

This information is not intended as nor does it constitute tax or legal advice. Readers should consult their own lawyer, accountant or other professional advisor when planning to implement a strategy. This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. Used under license.