Greetings,

We thought that this might be an opportune time to quickly touch base with some lessons from history to help put the last two weeks’ events (and, for that matter, this year’s market action) in some perspective as it relates to your investment portfolios.

Remember it is “time in the market” and not “timing the market”

When market volatility increases, short-term dramatic movements in the market can lead to investor anxiety. This is entirely normal as the unknown consequences of the event currently unfolding may lead some to jump to some doomsday conclusions. However, this can lead to some individuals making hasty decisions in an attempt to time the market.

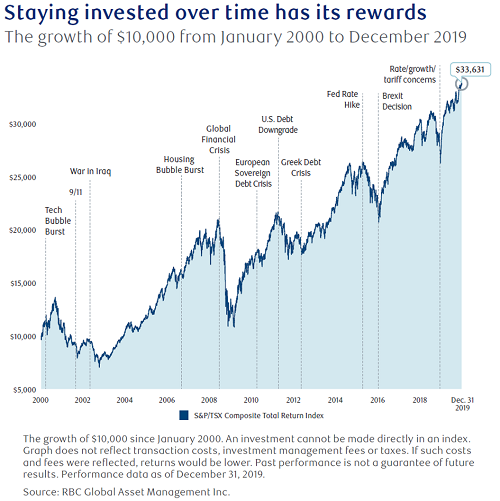

They may want to “get out” until things “calm down” but history has proven that timing that moment when to get back in is virtually impossible to get it absolutely right and the financial implications of missing just a few days of a market recovery can have a long term impact on your portfolio returns. It is important for everyone to understand that day-to-day market fluctuations will likely have little impact on your long-term investment objectives if you stay the course. Over the long-term, markets have always moved ahead. As you can see in this chart of the TSX total return index, prepared by RBC Global Asset Management, there are often events that cause dramatic fluctuations and extreme volatility, but the trend is always upwards when we review the long-term picture.

Individuals also have the temptation to move to “safer investments” or remove their funds from the market when there is market volatility in hopes of avoiding losses. However, this can result in locking in losses (or unnecessarily triggering taxable capital gains) in companies or investments that are likely going to recover in time. Selling at the wrong time and missing just a few days of a market recovery could hurt the portfolio significantly.

Can we prove why it’s best to stay invested?

Based on the annualized returns of the TSX for the past 10 years (up to December 2021), missing just the 10 best days in the market over the previous 10 years would have reduced returns significantly. See the following chart prepared by Bloomberg and RBC Global Asset Management:

If you had stayed invested during the 10-year period, your annual return would have been 9.1%, missing the 10 best trading days would have reduced your returns to 3.9%, missing the 30 best trading days to -0.7% and missing the 50 best trading days -4.0%. It is pretty easy to miss the 50 best days during 2600 trading days (10 years).

“Ok, fine, John, but now we are looking at the most significant military activity in Europe since the Second World War. How might the market react in this case” you might rightly ask?

While it certainly true that the current conflict is concerning on many different levels, we have had a history of surviving military events since the last World War to draw upon.

This table below shows the name of the military event and its start date; the number of trading days it took for the S&P 500 to hit its “trough” or lows (average number of days has been 13); the percent change (decline) to the trough (average has been -6.2%) and then the average number of trading days for the S&P 500 to get back to even to where it was before the start of the conflict (average 30). We are in Day 15 of the current conflict.

Taking a step back and reflecting on market history is always recommended during times like this. These may seem like the darkest days but, with time, the markets tend to prevail.

John Archer

P.S. If you have any friends or family who could also benefit from this message please feel free to share it with them. And if they are looking for a new portfolio manager we would be pleased to hear from them. All referrals are greatly appreciated at all times.