Below is a list of companies in Canada and the United States that have increased their dividends in the month of May.

The companies we list are not the complete list of companies that have increased their dividends in Canada and the United States or the rest of the world however, they are companies we follow or own.

Canadian Companies

| Company | Previous ($) | New ($) | Change (%) |

| Bank of Montreal | 1.33 | 1.39 | 4.51 |

| Bank of Nova Scotia | 1.00 | 1.03 | 3.00 |

| Canadian Tire | 1.1375 | 1.6250 | 42.86 |

| Hydro One | 0.2660 | 0.28 | 5.26 |

| Loblaw Companies | 0.3650 | 0.4050 | 10.96 |

| National Bank of Canada | 0.87 | 0.92 | 5.75 |

| Restaurant Brands International | 0.6740 | 0.6860 | 1.17 |

| Royal Bank of Canada | 1.20 | 1.28 | 6.67 |

| Suncor Energy | 0.42 | 0.47 | 11.90 |

| Sun Life Financial | 0.66 | 0.69 | 4.55 |

| TELUS | 0.3270 | 0.3390 | 3.67 |

US Companies

| Company | Previous ($) | New ($) | Change (%) |

| Deere & Company | 1.05 | 1.13 | 7.62 |

| Lowe’s Companies | 0.80 | 1.05 | 31.25 |

| PepsiCo | 1.0750 | 1.15 | 6.98 |

| Union Pacific Corp | 1.18 | 1.30 | 10.17 |

The dollar value listed per share represents a quarterly dividend payment.

Information was obtained from the companies directly.

History of Royal Bank of Canada

Royal Bank of Canada (RBC) recently increased their quarterly dividend by 6.67% from $1.20 to $1.28. With this dividend increase, RBC now pays an annual dividend of $5.12 per share to their shareholders. RBC has paid a dividend every year since 1870, which is a total of 152 consecutive years.

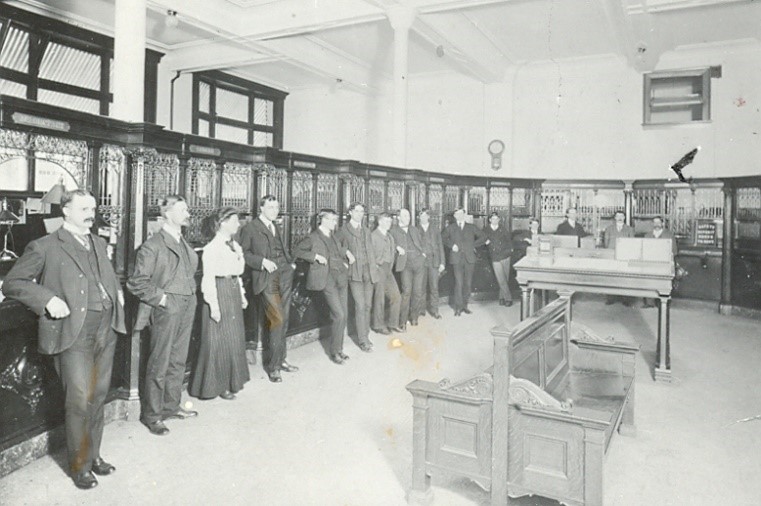

Royal Bank of Canada was originally named the Merchants Bank of Halifax and was formed in 1864. The bank was initially established as a private, unchartered commercial bank by a small group of Maritime trade merchants. The bank assisted them with their daily business activities. In 1869, the bank received its official federal charter and became a public company.

The bank then grew exponentially throughout the Maritime region, where they opened offices all throughout Nova Scotia, Prince Edward Island, and New Brunswick. Merchants Bank of Halifax fostered relationships alongside the Bank of Scotland in London, England as well as Chase National in New York. These relationships initiated the banks international exposure.

In 1893, the Merchants Bank of Halifax listed their stock for trading on the Montreal Stock Exchange. Shortly thereafter, the Bank opened its very first location on the West coast in Vancouver, British Columbia in 1897. The early coverage of operations enabled the bank to withstand the economic highs and lows of the maritime region, unlike its contenders.

The Bank’s very first international branches opened in Bermuda in 1882, and in Havana, Cuba, in 1899. These international expansions were provoked due to the close relations between the port of Halifax and the West Indies through trade in sugar and rum. These two locations were the beginning of 72 branches that were operating throughout Cuba and the West Indies by 1926. Since then, the West Indies has remained a prominent sector of the overall business of the bank.

In the early years of the bank, it stayed a relatively small company. It made up just 1.5 percent of the total assets of Canadian banks in 1880 and then grew up to 3.6 percent by 1900. In 1901, the bank altered its name to what we know it as today, The Royal Bank of Canada. This name change was initiated in anticipation of its growth and to provide a more modern look for itself. At this time, The Royal Bank of Canada had a total of 65 branches throughout the country.

RBC opened its very first branch in Toronto in 1903 although it wasn’t the first branch to open in Ontario. A branch was opened in 1899 in Ottawa. In 1907, shareholders approved the motion to relocate the banks head office from Halifax to Montreal, where its general manager was situated.

In 1988, RBC diversified their business operations outside of the traditional banking sector by acquiring 67 per cent of Dominion Securities Inc. and renamed it RBC Dominion Securities. Dominion Securities Inc. was the largest investment dealer in the country. They additionally acquired Richardson Greenshields in 1996 which lead to further growth and share in the investment industry.

Interestingly, The Bank of Montreal and RBC intended to merge in 1998. This was a huge shock to the government and the stock markets. The intention of both banks were to create a bigger bank that could complete internationally. The Minister of Finance was required to approve the change in bank ownership however, the merge was declared void since it would majorly reduce price competition and would not be in the best interests of Canadians. At this time, Toronto Dominion Bank and Canadian Imperial Bank of Commerce (CIBC) also proposed a merge however, it was declined due to the same reasoning.

RBC is currently the 8th biggest bank worldwide and the 5th in North America, as measured by market capitalization. In 2018, became Canada’s largest lender with $1.28 trillion in assets. RBC also employs over 89,000 full- and part-time employees who serve 17 million clients in Canada, the U.S. and in 27 other countries.

If you are interested in reading more about the history of companies we follow, please take a look at our previous blog posts: