As the year is coming to a close and the holiday season is here, you might be thinking of making a charitable donation. With our approach of holding individual securities, I wanted to make you aware and discuss the potential tax benefits of making an in-kind securities donation versus a cash donation.

As many of you are aware, when you make a donation to a registered charity, you will receive a donation tax credit that can be used to reduce your taxes payable.

You may also receive an additional tax benefit when you donate securities in-kind. The benefit to making an in-kind donation is the capital gains triggered are eliminated.

Please be aware that the donation must be made to an organization that can issue donation receipts for gifts and are also willing to accept in-kind donations. To check whether the charity of your choice is able to issue donation receipts, you can refer to the list on the Canada Revenue Agency (CRA) website.

Donation Tax Credit

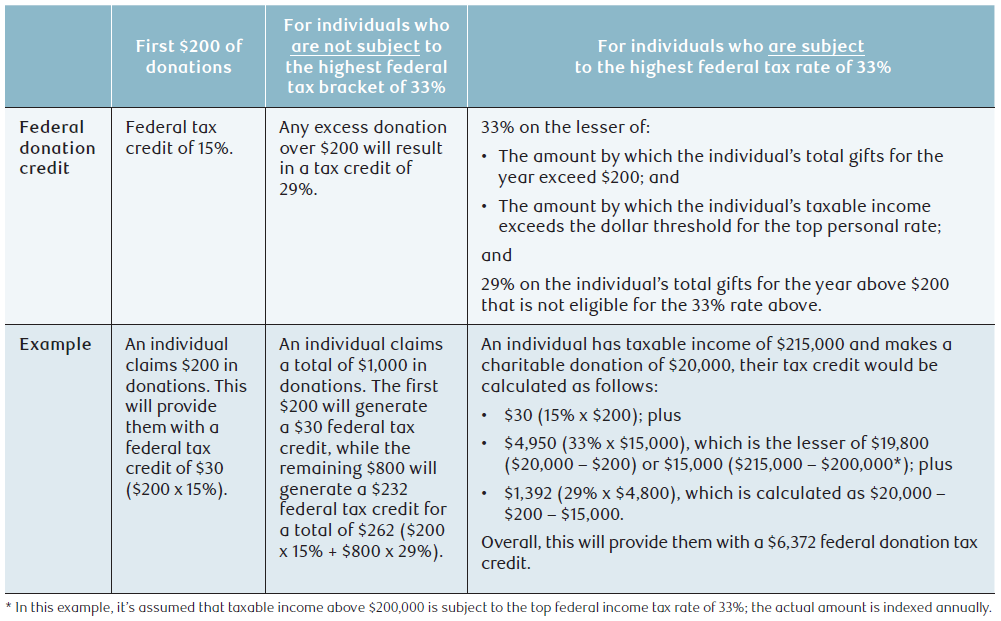

When you make a donation, you are given the opportunity to claim a tax credit on your personal tax return. The tax credit reduces your federal and provincial income taxes in the year you make a claim or you can carry forward the unclaimed amount for up to 5 tax years.

The chart below outlines the respective donation credit rates for the individual federal tax rates:

There is no limit to how much you can donate however, you can only claim a charitable donation of up to 75% of your income in one year.

Eliminating Tax on Capital Gain

If you were to sell securities to make a cash donation, you would incur tax on the capital gain. One way to eliminate the taxable capital gain is by donating securities in-kind.

Here is an example that illustrates how donating securities in-kind, assuming you are in the top tax bracket, can be beneficial:

|

| Sell Securities & Donate Cash | Donate Securities In-Kind |

| FMW of Donation | $50,000 | $50,000 |

| Adjusted Cost Base | $10,000 | $10,000 |

| Capital Gain | $40,000 | $40,000 |

| Taxable Capital Gain | $20,000 | 0 |

| Tax on Capital Gain | $9,200 | 0 |

| Tax Savings from Donation Tax Credit | $23,000 | $23,000 |

| Total Cost of Donation | $36,200 | $27,000 |

As you can see, donating securities in-kind has a lower cost because you are eliminating the tax on the capital gain and are still benefiting from the donation tax credit.

Conclusion

When you donate securities in-kind, in addition to getting a tax receipt for the market value of the securities donated, you can eliminate any capital gains accrued on the securities donated.

For more detailed information, please take a look at The Navigator Report: Charitable Donations of Securities that is listed on our Educational Articles page and consult with your accountant.

"How will you replace your current income in retirement?" - Jim Seyers