All headlines of late have been dominated by the spread of the most recent global viral scare, Wuhan Coronavirus or 2019-nCov. Not quite declared global pandemic, but certainly on most folks' radar screen. The good news, is that mankind has expanded the tools available for its use when combating viruses such as this. Back in the SARS days, we did not have gene sequencing, powerful AI that could help defend against spread, and aid in containment. More good news is that it appears China is being more forthcoming in terms of providing information.

An interesting webpage tracking progression in real time can be found here

From an investment standpoint, I believe the following can be expected.

- crowd and momentum driven market behavior. As the headlines grow, and negative news spreads, the market will follow. This will be very difficult to time (like things always are)

- the overall effect to the markets will be completely transitory and while an impact to GDP will be felt, it too will be transitory.

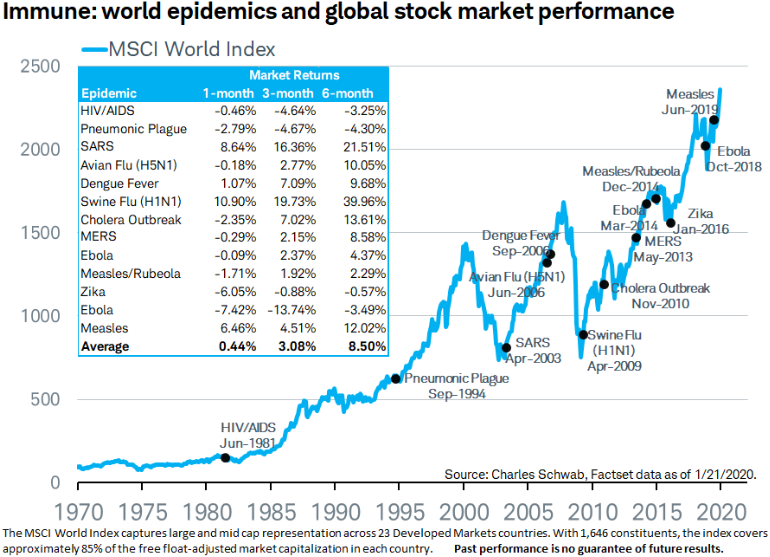

- Past epidemics have not typically lead to long term negative consequences for the markets.

What I will say is the following: If GDP, and overall economic activity is hovering around, what is referred to as, "stall speed", then an event like this can tip the scales out of balance. However (and that's a big however), there does need to be additional negative impact to give any one single event staying power.

Stay tuned as this continues to develop.