A new year often brings with it a sense of renewal, a fresh page onto which we can set new goals or refresh existing ones. That newfound sense of promise can be an inspiration, lifting our energy and focusing our attention on a new pursuits, often centering on our own self-improvement or future success in life, health, business and finances.

The difference between a dream and a goal is a plan

Alas, there’s usually one problem with these New Year’s resolutions: we rarely see them through, with our initial enthusiasm fading when the reality of the effort required to achieve them hits us. According to research from the popular running app Strava*, 80% of resolutions are dropped by January 19, lasting only slightly longer than the champagne bubbles on New Year’s Eve that likely inspired them.

However, the same research showed that those who established a plan significantly boosted their chances of achieving their goals. Important to a plan’s success is ensuing that it has clear, measurable and achievable goals, and that it is periodically revisited to make sure it is still working for you.

C.A.R.E.: Goal-setting and planning

As stewards of your wealth, we care about you and your journey to achieving your new, existing or refreshed goals. An important first step in the process begins by engaging with your Investment Counsellor to establish or refresh your wealth plan, ensuring that your goals are clearly articulated, measurable and achievable.

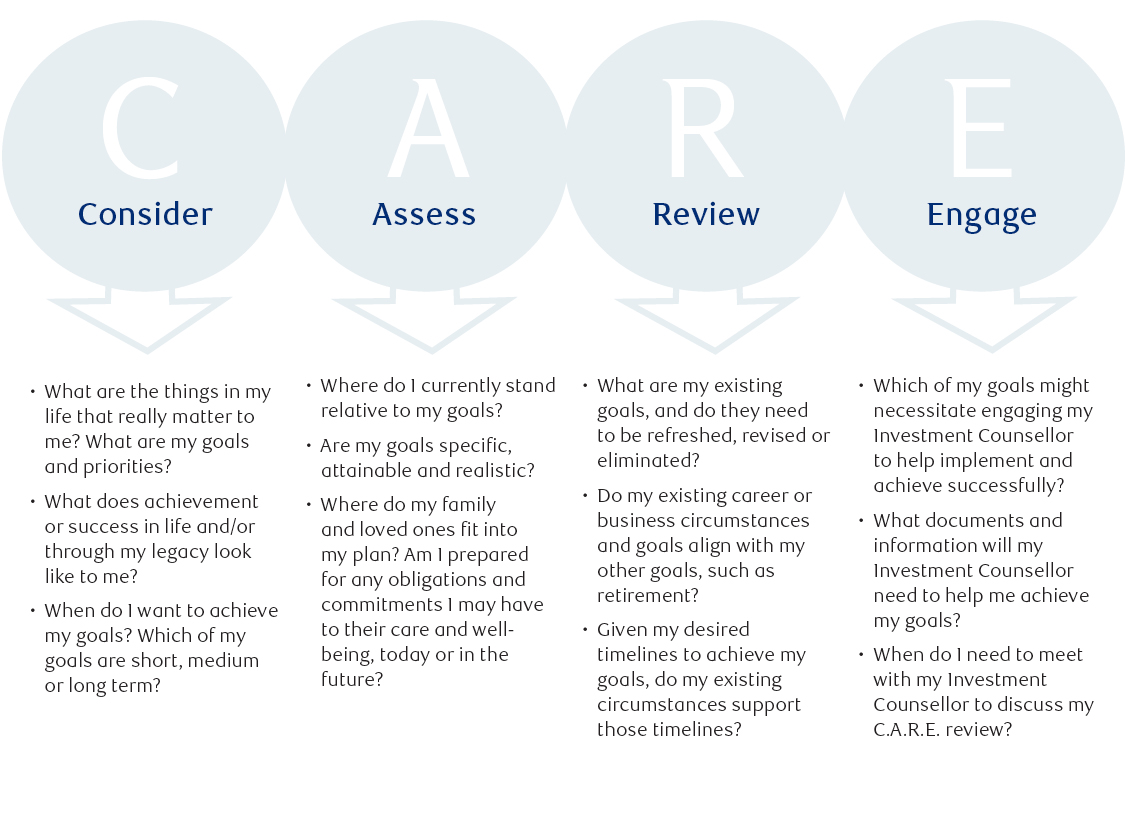

Using the structure of C.A.R.E. is an easy tool to guide you through the goal-setting and planning process (and may even inspire you to consider other goals and aspects to your planning):

While the list of questions above provides a broad guide to help you review your goals and priorities, you may choose instead to meet with your Investment Counsellor to start the process with them. Either way, taking time to establish what matters to you and reviewing how you might achieve those things is always an important investment in your success.

While the list of questions above provides a broad guide to help you review your goals and priorities, you may choose instead to meet with your Investment Counsellor to start the process with them. Either way, taking time to establish what matters to you and reviewing how you might achieve those things is always an important investment in your success.

We can help

Your Investment Counsellor has access to RBC Wealth Management’s Family Office Services team. With over 200 professionals to call upon in such areas as financial, tax, business succession and Will and estate planning, as well as life care planning, aging and caregiving guidance, your Investment Counsellor can help you achieve your life resolutions and goals with the care and consideration you deserve.

*Quitters’ Day: Why Strava thinks you’re about to give up your resolution, Madeleine Kelly, Canadian Running Magazine (January 2020).

Past performance is not indicative of future results. Counsellor Quarterly has been prepared for use by RBC Phillips, Hager & North Investment Counsel Inc. (RBC PH&N IC). The information in this document is based on data that we believe is accurate, but we do not represent that it is accurate or complete and it should not be relied upon as such. Persons or publications quoted do not necessarily represent the corporate opinion of RBC PH&N IC. This information is not investment advice and should only be used in conjunction with a discussion with your RBC PH&N IC Investment Counsellor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest information available. Neither RBC PH&N IC, nor any of its affiliates, nor any other person accepts any liability whatsoever for any direct or consequential loss arising from any use of this report or the information contained herein. This document is for information purposes only and should not be construed as offering tax or legal advice. Individuals should consult with qualified tax and legal advisors before taking any action based upon the information contained in this document. Some of the products or services mentioned may not be available from RBC PH&N IC; however, they may be offered through RBC partners. Contact your Investment Counsellor if you would like a referral to one of our RBC partners that offers the products or services discussed. RBC PH&N IC, RBC Global Asset Management Inc., RBC Private Counsel (USA) Inc., Royal Trust Corporation of Canada, The Royal Trust Company, RBC Dominion Securities Inc. and Royal Bank of Canada are all separate corporate entities that are affiliated. Members of the RBC Wealth Management Services Team are employees of RBC Dominion Securities Inc. RBC PH&N IC is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ® / TM Trademark(s) of Royal Bank of Canada. RBC, RBC Wealth Management and RBC Dominion Securities are registered trademarks of Royal Bank of Canada. Used under licence. © RBC Phillips, Hager & North Investment Counsel Inc. 2023. All rights reserved.