Central banks largely stood their ground this week with the Bank of England delivering its third consecutive rate hike since last December to bring its policy rate to 0.75 percent, while the Federal Reserve began its own rate hike campaign with a 25 basis point move to a 0.25–0.50 percent fed funds rate target range at its March 15–16 meeting. Despite rising geopolitical concerns and economic uncertainty, central banks seemingly, at least thus far, continue to prioritize getting inflation under control over managing potential downside economic and market risks.

But it was the Fed’s meeting that garnered the bulk of the headlines, and sparked the most market volatility this week—if only briefly.

Slow out of the gate, but more to come

With all eyes on the Fed’s rate hike plans, it was the median estimates of the Fed’s updated Summary of Economic Projections that showed policymakers now expect seven rate hikes this year, in line with current market-based pricing, but well above what we expected the Fed to project. Following this week’s move, and with six meetings remaining, that would suggest a 25 basis point rate hike at every meeting, to a policy rate range of 1.75–2.00 percent.

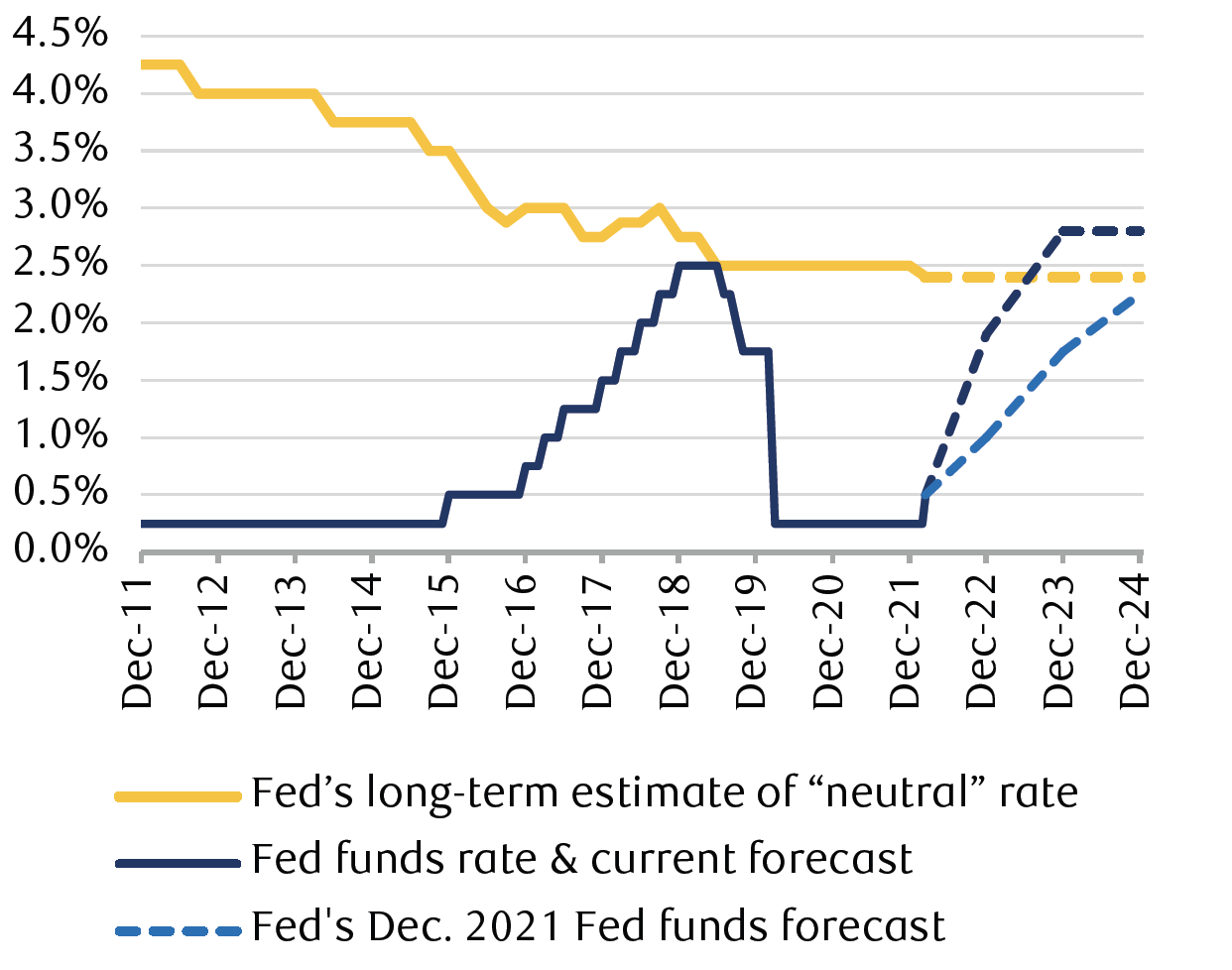

But even beyond that development, it was the extent to which the Fed now envisions rates needing to move in order to return to price stability, to 2.75 percent by the end of 2023, and above the Fed’s current estimate of the longer-run “neutral” rate for the U.S. economy of 2.40 percent, or the level below which monetary policy is seen supporting economic growth, and above which it is potentially restrictive. Where the Fed’s previous forecasts failed to reach that threshold over the entire forecast window, it could now be breached as early as next year. If the Fed maintains a 25 basis point-per-meeting pace into 2023, the policy rate would first exceed the Fed’s estimated 2.40 percent “neutral” rate for the economy as early as its March 2023 meeting.

As the first chart shows, the last time these two metrics converged was in 2019 when the fed funds rate of 2.50 percent matched the Fed’s “neutral” rate, which created sufficient market and economic stress to cause the Fed to begin a series of rate cuts, even before the onset of the global pandemic. So therein lies the next challenge for markets and investors to navigate as the Fed moves to tighten monetary policy, and perhaps aggressively so.

The Fed’s updated rate hike timeline shows monetary policy could restrict economic activity by end of 2023

Source - RBC Wealth Management, Bloomberg, Federal Reserve; dashed lines show Fed’s projections

Price stability, but at what cost?

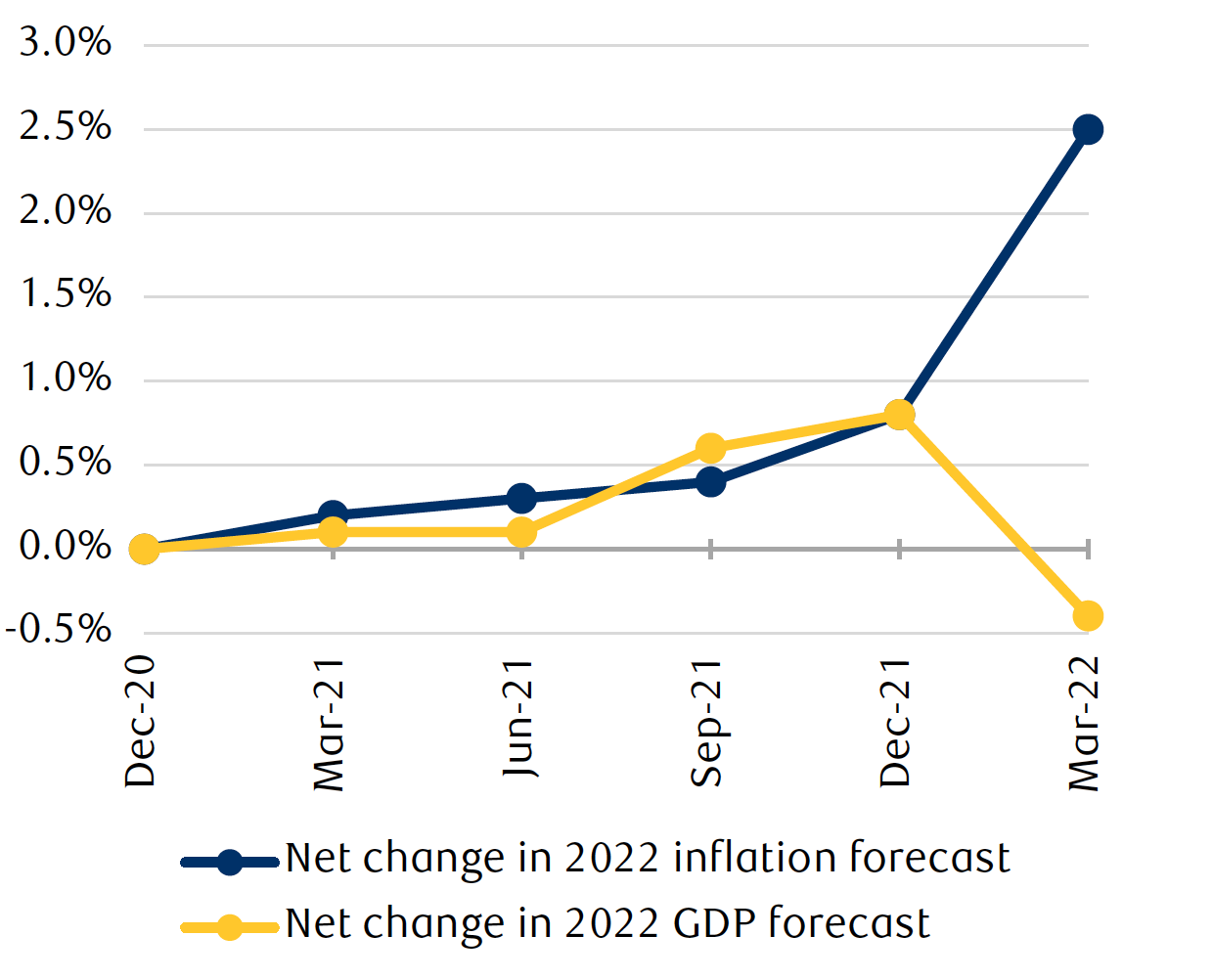

It wasn’t just the Fed’s upgraded rate hike projections that caught markets off guard, or the extent to which rates may rise this cycle, it was also the evolution of the economic outlook amid rising inflationary pressures, and waning economic growth prospects.

As the second chart shows, the Fed’s expectations for both economic growth and inflation have been moving steadily higher, and in tandem, since December 2020. But as inflation has proved more persistent in recent quarters, that has changed. The Fed’s updated numbers show headline inflation running at 4.3 percent this year, compared to a 2.6 percent estimate last December. Economic growth, on the other hand, received a sharp downgrade to 2.8 percent this year from 4.0 percent previously. Likely, and largely, it is a reflection of the Fed’s plans to raise rates more aggressively than thought before.

After rising in tandem, the Fed’s inflation and growth forecasts diverged sharply at the March meeting

Source - RBC Wealth Management, Federal Reserve; the Fed currently projects 2.8% GDP growth this year, with a headline personal consumption expenditures inflation rate of 4.3%

While this dynamic may further stoke the flames of “stagflation” fears, it’s important to note that GDP growth of 2.8 percent this year, and 2.2 percent next year, is still well above the 1.8 percent the Fed judges to be the long-term sustainable growth rate for the U.S. economy. But an aggressive rate hike timeline to above-neutral levels is one that could put monetary policy in a more precarious spot earlier than previously expected should the central bank battle against inflation come at the cost of the economic expansion.

Put in the work now to have options later

While no one wants to even utter the word “recession,” especially at a time when it still feels like the economy has barely left the last one behind, it’s the Fed’s outlook—paired with current market signals such as ever-flatter Treasury yield curves—that suggests to us that it may not be too early to begin exploring the likelihood, as well as the potential ramifications, of such an outcome of global central bank policy tightening.

Put simply, we continue to think the near-term recession risks are low, certainly in 2022, but not low enough to ignore into 2023. Analysts often look to the 1990s as an idyllic stretch where early Fed rate hikes in the decade succeeded in getting inflation under control, allowing the Fed to pause and to tweak policy as needed later on, which ultimately led to a sustained economic recovery. Given a strong labor market backdrop today, a scenario like this would be our base case.

As Fed Chair Jerome Powell noted during his press conference, “The goal, of course, is to restore price stability while also sustaining a strong labor market. In fact, it’s a precondition, really, for achieving the kind of labor market that we want, which is a strong and sustained labor market…”

It’s certainly too early to say whether the Fed can, in fact, engineer a soft landing for the economy. And while near-term market and economic risks may remain high as central banks seek to move early and aggressively, we think the longer-run backdrop remains on solid footing, and that central banks will ultimately retain flexibility in removing accommodation as appropriate down the road.