The year is off to a good start, with US markets seeing consecutive winning weeks on the back of slowing inflation and a relatively resilient economy. However, a challenging global macroeconomic climate driven by geopolitical risks and an ongoing (though easing) rate-hike cycle remains top of mind for markets. Many strategists and economists will not count out a recession to take hold sometime during this year. Despite this, China’s economic reopening and the expectation of moderation in global monetary policy has renewed the prospects for a market recovery. As such, to not miss a potential upturn, investors with a longer time horizon are increasingly encouraged to remain invested and hold steady.

Market corrections frequently serve as good buying opportunities. However, for many investors, this is only recognized in hindsight. Unfortunately, volatility can shake investors to forgo the benefits that come with a long time horizon in exchange for immediate psychological reprieve.

Although one’s intention is to re-enter the market after a market bottom has been confirmed, this is seldom achieved as the bottom is frequently achieved without a green light from the economy or corporate fundamentals. For example, corporate earnings growth is usually still in decline and does not bottom until 6-12 months after the bottom in stock prices. Furthermore, the unemployment rate has also been seen to march higher even after the market has troughed. This prevalent atmosphere of uncertainty makes market timing extremely difficult, and we recommend investors avoid the temptation to try.

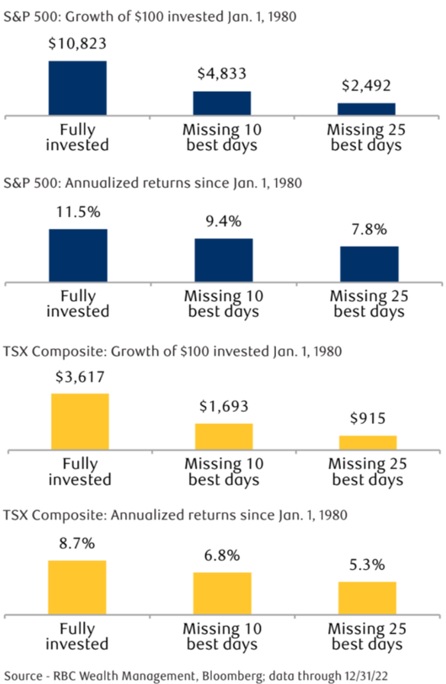

For those with a balanced investment plan, the need to be right in your outlook is reduced. Portfolios that are positioned to limit the downside when one’s projections do not unfold as planned will buy time and patience to stick to the long-term strategy. Historically, the best course of action has been to stay invested. As demonstrated by the charts above, since 1980, investor returns have been jarringly better by remaining fully invested compared to those who may have missed the best 10 or 25 days in the market. With that said, we are not suggesting that being ‘fully invested’ implies doing nothing. Indeed, there is a stark difference between staying invested through inaction versus retaining market exposure by rebalancing one’s portfolio. Adjusting one’s sector and geographic mix, reconsidering value & growth tilts, boosting dividend exposures, and adjusting fixed income duration and credit risks are part of staying invested. Moreover, reviewing whether one has the right balance of assets in your portfolio, based on your goals, investment horizon, and risk tolerance, is crucial in matching return expectations with your longer-term financial health.

With a recession potentially lurking ahead, the idea of doing nothing may sound crazy, and it probably is. Staying fully invested has never been harder and requires action. Work with an investment advisor that can provide you with guidance on creating a financial plan and portfolio rebalancing plan.