By late Monday night, September 20, we should have a better view of which political party will lead Canada for the next term. This blog is by no means a prediction on the election outcome, but to share our view that political events of this nature have little impact on the long-term trajectory of the TSX.

The odds of a majority government have come down significantly and a minority government seems increasingly probable. From a market perspective, this may be preferred as it can create a “political gridlock” environment as seen in the US, where compromises are made to dilute any potential extremes from the initially proposed policy change.

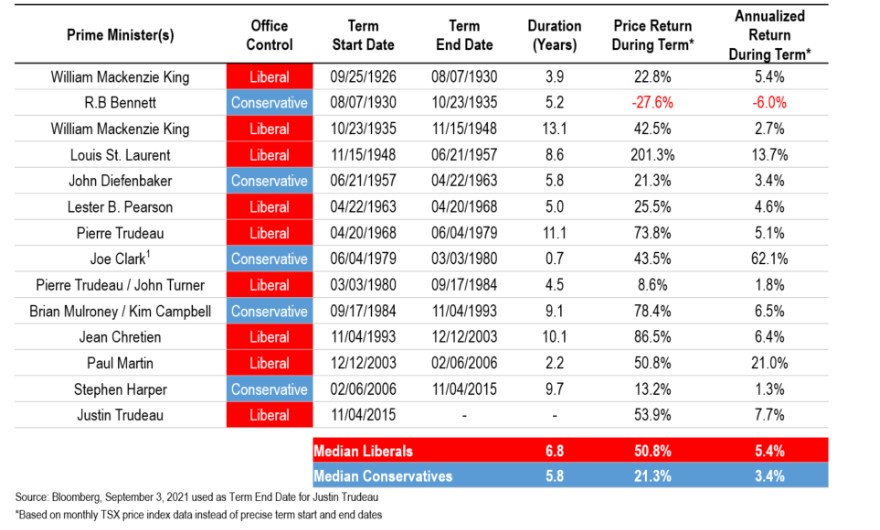

Even so, on a historical performance basis, a key question to answer is whether the market prefers a Liberal or Conservative government? Below is the TSX Composite performance under different Canadian Prime Ministers since 1926.

Since 1926, the Liberals have been in power for approximately 64 years with a median cycle of 7 years, while Conservatives have led 31 years with a median cycle of 6 years. During the Liberal tenures, the TSX had a median annualized return of 5.4% versus the 3.4% from the Conservative tenures. Based on these numbers you may have concluded that investors prefer a Liberal government. However one should dig deeper on why the TSX seemingly fared better with a Liberal government.

Between 2003 to 2006, the resource-heavy TSX was driven primarily by the powerful commodities bull market, courtesy of the rapid growth in Chinese infrastructure spending. Hence, this had little to do with our own domestic policy. Those resource sectors performed exceptionally well and provided outsized stock market returns. Taken further, the relatively weaker returns under the Conservative tenure between 2006 to 2015 overlapped the Global financial crisis (2007 to 2009). This resulted in one of the worse equity bear markets that required several years to recover.

Although the historical data seems to suggest that a Liberal Government has been “friendlier” to equity markets, we reiterate our view that investors should keep political distractions out of their long-term portfolio decisions. It seems like timing and global macro circumstances can be attributed as the cause of the lopsided returns witnessed above. Moreover, we feel economic and corporate fundamentals have a much greater explanatory power for stock market returns. Factors such as the US dollar, global growth conditions, commodity prices, and the outlook on domestic household spending are far more influential drivers than a Prime minister’s political affiliation. With that said, we recognize that major announcements of new policies can cause short-term shocks as the market does not like uncertainty or surprises. However, for long-term investors, we would encourage them to resist any impulse to make significant portfolio adjustments based on this evening’s election results.