Inflation has been flat for most of the last decade but as the US economy gradually reopens, we are witnessing demand increase and prices rise. This demand is fueled by low-interest rates that incentivize borrowing and aggressive stimulus packages that the government has injected into the economy. The supply side of the equation is also leading to inflation as global supply chain issues have caused shipment delays and shortages to key commodities which have resulted in overall price increases.

In a previous blog, we discussed how inflation could be difficult or beneficial for certain sectors. In this blog, we will discuss how to navigate the fixed-income markets under an inflationary environment.

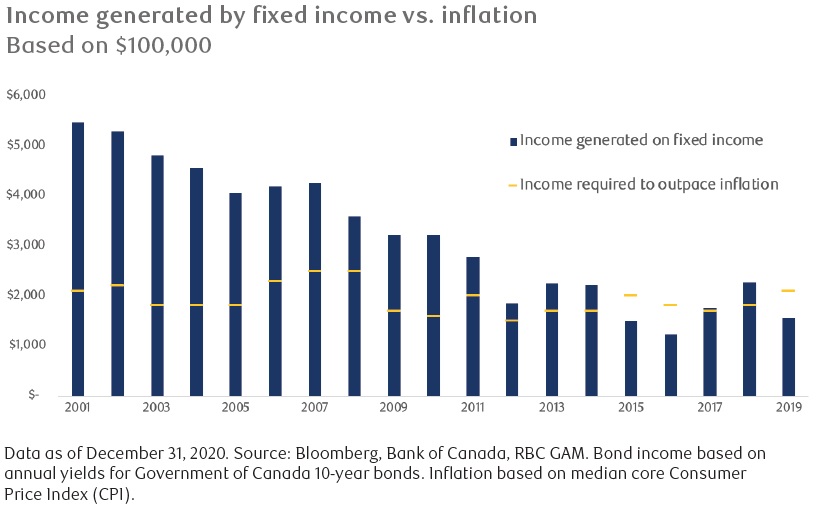

Historically, rising inflation usually leads to rising interest rates and bond yields. This translates to lower pricing in fixed income (bond yields and price are inversely related). At the core, rising inflation reduces the purchasing power for all investors and this is particularly evident for the coupons received from bonds. To earn a real return, a bond investor must look for income that is higher than the inflation rate or at least keeps up with inflation to maintain its purchasing power. As the chart below shows, this has become harder to achieve in recent years.

It is important to employ a disciplined and diversified approach when structuring a fixed income portfolio during times of rising rates and yields. Below are some areas that we consider:

Duration: Investing in longer term bonds can result in higher yields to beat inflation, however, it comes at the expense of more volatility should interest rates rise. Hence, we would prefer shorter term bonds that may not provide the highest coupon, but could be opportunistically sold at higher prices when equity market volatility rises and bonds face more demand.

Credit Risk: Taking more credit risk can provide higher yields to beat inflation. However, the spreads between High Yield Bonds (aka. Junk bonds) and government bonds are historically low. Hence, investors are not being compensated that well for taking credit risk. Maintaining exposure to investment grade or slightly below investment grade bonds are preferred.

Floating rates: Certain securities have floating rate terms where the yields of these instruments adjust higher with increased inflation or government yields. This helps eliminate the risk of rising interest rates and ensures one can keep up with inflation.

Currency: According to the Securities Industry & Financial Markets Association (SIFM), nearly 40% of the $119 Trillion global bond market is denominated in US dollars. With rates already so low and inflation making it even harder to break even, investors may look to hedge out the currency risk whose volatile movements could wipe out many years’ worth of coupon returns.

Ultimately, the fixed income space requires an investor to scrutinize a company’s cash flows and their adherence to particular debt covenants. It also requires one to monitor a cross current of macro-economic variables that are difficult to forecast. To reduce the impact of one particular variable (like inflation or rising yields), it is important to hold a diversified basket of fixed-income products. The ability to find a fixed income manager (Mutual Fund or ETF) that can rebalance duration and credit risk and opportunistically participate in international bonds, mortgage-backed securities, preferred shares, and convertible debt instruments can add value to a fixed income space that is increasingly difficult to generate returns. Speak to your advisor on how the fixed income sleeve of your portfolio is positioned.