With the Tax-Free Savings Account having been introduced over a decade ago, it has now become a cornerstone account within the financial plan of many Canadians. Many investors are familiar with the basic advantages of a TFSA, but may not be aware of the additional benefits that exist for estate planning or income splitting. Here are some things to consider.

Withdrawing for Big-Ticket Items

While the TFSA is often seen as an account for long-term investments and treated as a component of retirement planning, it can also be very practical for shorter-term goals such as a down payment or a major home renovation. When clients approach me for recommendations on how to fund upcoming big-ticket purchases, barring the availability of any excess cash, I generally recommend that they tap into their TFSA.

There is the obvious benefit of tax-free withdrawals, particularly in your peak-earning years or years where you have accumulated large unrealized capital gains in your non-registered investment accounts. However, one commonly overlooked fact is that any withdrawals get added back to your contribution room the next year. In other words, if you had maxed out your contribution room in 2020 ($69,500) and that amount grew to $90,000 which you then withdrew, your total contribution room in 2021 would be that $90,000 balance plus the $6,000 annual limit for a total of $96,000. Your contribution room grows with your investments, which should quell any hesitancies in withdrawing from a well-performing TFSA. Yet, this also means that withdrawing when your investments have lost money will cause your contribution room to shrink the next year.

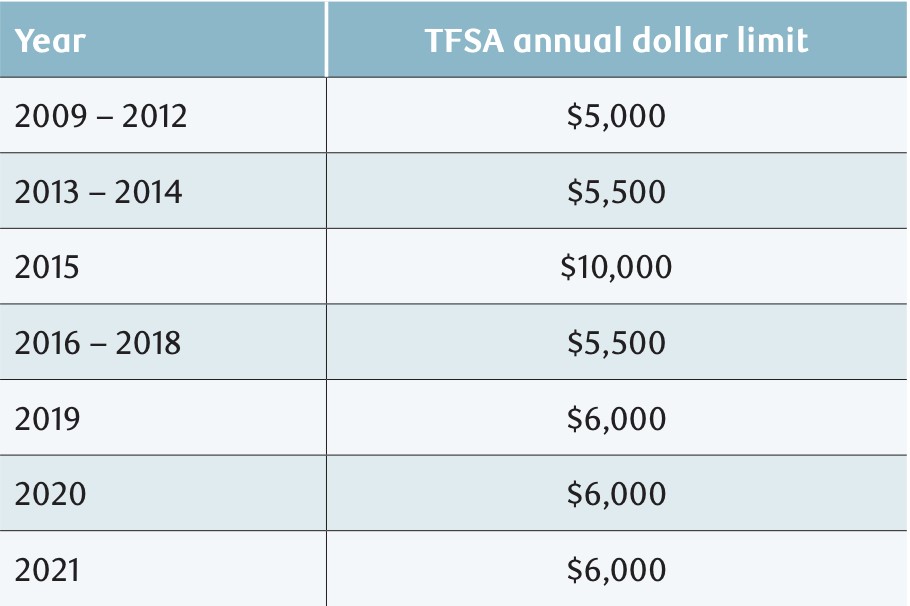

The total TFSA contribution room from 2009 to 2021 is C$75,500. The annual TFSA dollar limits from 2009 to 2021 are as follows:

Income Splitting

An additional benefit of a TFSA is that it can be utilized as a part of an income-splitting strategy. You can make a gift to your spouse or adult child to contribute to a TFSA in his or her own name. Although this is not tax-deductible such as with a spousal RRSP, this gift ensures that a lower-earning spouse or adult child is also able to benefit from tax-free investing. Particularly, getting your children investing as a young adult can pay dividends, literally and figuratively, as they improve their financial literacy and take advantage of compound growth.

Estate Planning

Although you are allowed to designate a beneficiary for your TFSA, some may not be aware of the concept of a “successor holder.” Similar to a beneficiary, naming a successor holder helps facilitate a smooth transfer of TFSA assets upon your passing. So what is the difference between a “successor holder” and a beneficiary? There are a of couple key differences. Only your spouse or common-law partner can be named as your successor holder, whereas you can designate your spouse, child, and/or a third party as a beneficiary. Successor holders automatically become the holder of your TFSA upon your death, and the account continues to exist as it is. Even if they already have their own TFSA, they will be able to consolidate the two accounts without affecting their own contribution room. In simple terms, a beneficiary receives the cash in the account of the deceased, whereas a successor holder gets the account and holdings.

Your TFSA can provide a lot of flexibility for your financial planning and its benefits are not just limited to tax-free compounding. Speak to your advisor on how to best utilize a TFSA to reach your financial goals.