After a period of contraction, the word “reflation” is generally used to describe the first phase of the economic recovery driven by fiscal and monetary policy that stimulates spending and expands output. Reflation can also be understood as recovering inflation back to more normal levels. This blog will share RBC Capital Market’s views on inflation and the impact on specific sectors.

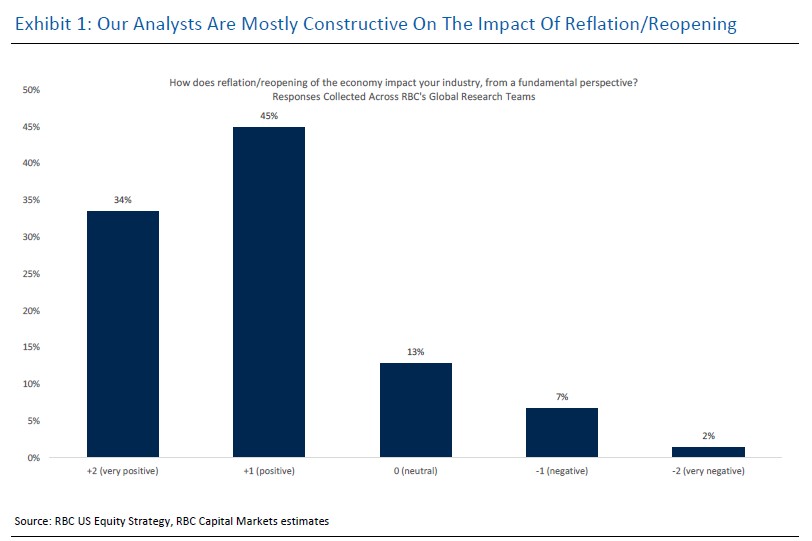

RBC CM equity research analysts generally agree that a post-covid world and re-opening will be positive for their industry. As the chart below shows, 78% of analysts have a positive or very positive view of its impact.

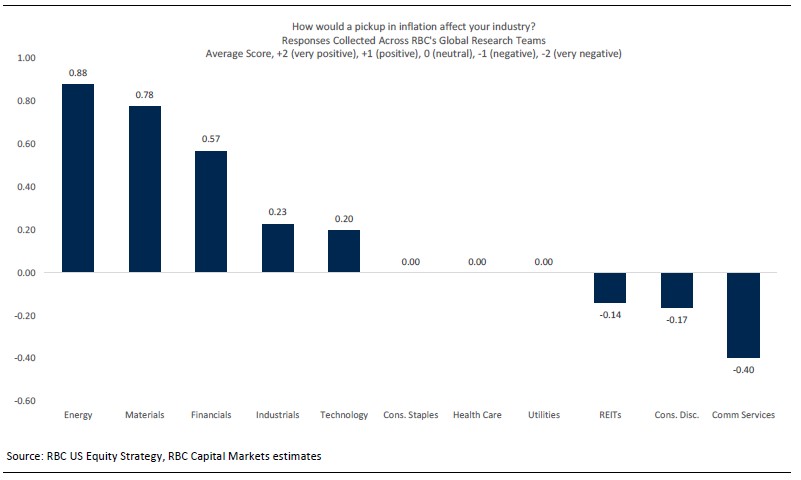

The following graph illustrates how RBC’S global research teams view the impact of inflation on their sectors.

The sectors that stand to benefit the most from a pickup in inflation are Energy, Materials, and Financials. However, REITs, Consumer Discretionary and Communication Services will be at greater risk of being negatively impacted.

Below we breakdown the potential impact from inflation on each sector.

From the table above, inflation is of less concern for those sectors and companies with pricing power. Some may find revenues and margins rise as they are able to increase prices and pass them onto customers. Higher margins can also arise due to effective cost-cutting and reduced Covid related expenses in a post-pandemic world. Ultimately, the impact of inflation is nuanced across a variety of sectors depending on how business processes and contracts are organized. The degree to which we see inflation overshoot or undershoot expectations can cause rapid sector rotations throughout the cycle; therefore, we recommend a careful review of one’s equity holdings and a balanced sector mix as we expect volatility to remain high