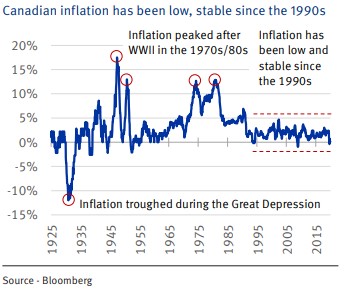

In periods of inflation, investment returns from most bonds will be adversely impacted as the purchasing power of the bond’s future cash flows are reduced. As shown below, during the last 30 years, Canadian inflation has been relatively muted. However, with the rise of government stimulus spending, investors are encouraged to consider the risks of higher inflation. For this reason, we endeavor to introduce our readers to the concept of real return bonds (RRB).

What are real return bonds?

As it pertains to fixed income, the “real return” is the return an investor earns net of inflation. It is calculated as the nominal return less inflation. This return is used by investors to gauge whether there has been a change to the purchasing power of their investment. As inflation rises, the real return decreases, and the purchasing power is lowered. Investors who buy and hold RRBs to maturity will receive a real return that is known and quoted at the time of the purchase. In order to ensure investors receive this real return, the return is adjusted for any further unexpected inflation that occurs during the life of the bond. In other words, investors receive a return equal to: The real yield (known at time of purchase) + realized inflation over the life of the bond. With this adjustment, the purchasing power of the investment is preserved.

What are the differences between RRB and other Government Bonds?

Real return bonds (RRB) are issued by the Government of Canada and carry the same credit rating as other Government of Canada bonds. In a traditional bond setting, the bond provides a known “nominal” return that is its yield to maturity. However, the real return will be unknown, up until the inflation rate is revealed at the end of the holding period. Real returns may even become negative if the level of inflation exceeds the yield of the bond.

On the other hand, real return bonds will provide a known real return that is guaranteed by the government, but the nominal return is unknown. The real return is known and locked in because future cash flows will be calculated by applying the RRB’s real return rate to the principal amount after it has been adjusted for inflation. Therefore, the purchasing power of the investment is preserved with RRBs.

As an example, with a traditional bond, the government borrows $10,000 from a bondholder at 3% each year. The bondholder receives $300 in annual cash flows and the government will pay back the principal and the final interest payment at maturity. However, because the level of inflation is not known at the time of purchase, the future purchasing power will only be revealed at maturity. If the level of inflation has been revealed to be 1.5% over the life of the bond, the real return of this bond can be calculated at the end of the period, to be 1.5% (3% - 1.5%).

For RRBs, the bondholder will receive income based on a real yield. If the government borrows $10,000 from a bondholder with a 1% real return, this return is locked-in regardless of the inflationary environment. If we assume the inflation rate is 1.5%, the $10,000 investment will adjust to $10,150 ($10,000 x 1.15) and the 1% coupon will be calculated based on the adjusted principal to be $101.50 ($10,150 x 1%). In this situation, the value of the coupon has also been adjusted higher and protected from inflation. Note that the higher the level of inflation, the greater principal adjustment, resulting in a greater coupon amount paid to the bondholder.

So, when should you consider a RRB versus a traditional government bond?

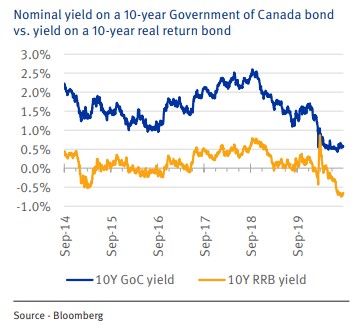

In the chart below, nominal yields (blue line) are showing a positive rate, however, the rates are so low that many investors do not expect it to keep pace with inflation. On the other hand, real yields are negative (orange line), however, if investors expect inflation rates to rise further, RRBs will increase in value because the bond’s principal will adjust higher with inflation. With RRBs appearing relatively cheap, they may have good upside potential and could provide higher returns compared to traditional bonds.

This blog is not intended to describe all the nuts and bolts of real return bonds but simply to show some of the tools fixed income portfolio managers can use through different parts of the economic cycles. There are other things investors may need to consider when considering RRB such as tax efficiencies, holding duration, and day to day relative pricing. RRB may not be the perfect solution for bond investors, though it can form part of a balanced bond portfolio that looks towards taking into account the concerns of inflation.