All bear markets are painful, however, they all have different triggers and characteristics. To be able to set one’s expectations for a recovery, it is useful to recognize the type of bear market that we are faced with. Investors can split bear markets into three categories:

Structural Bear Market: This bear is triggered by structural imbalances and financial asset bubbles that burst and result in a price shock. Recent examples include the ‘tech bubble’ of the early 2000s and the Housing Crisis of 2008-09.

Cyclical Bear Markets: This bear is triggered by the end of the economic cycle that has traditionally faced rising interest rates and lower corporate profits. Recent examples include the recessions of the early 1980s and 1990s that can be attributed to the contractionary monetary policy from the Fed.

Event-Driven Bear Markets: This bear is triggered by a one-time exogenous shock that may or may not lead to a recession. Examples include the Bay of Pigs/Cuban Missile Crisis of 1961-62 and the infamous Black Monday of 1987.

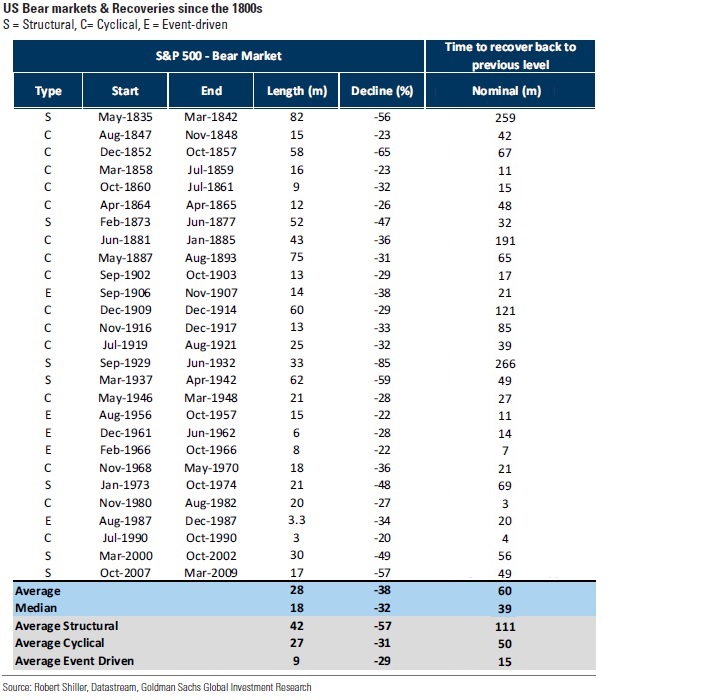

Goldman Sachs Research has published a useful chart of US Bear Markets since the 1800s. Below you can see that they categorize each type of bear market, detail the magnitude of the declines and provide the duration of each recovery.

To summarize, the above chart:

Structural Bear Markets on average fall by 57%, last about 3.5 years and take 9.25 years to recover.

Cyclical Bear Markets on average fall by 31%, last about 2.25 years and take 4.2 years to recover.

Event-Driven Bear Markets on average fall by 29%, last about 9 months and take 1.25 years to recover.

The current Covid19 induced bear market appears to be an Event-Driven Bear Market, which has the profile of experiencing faster declines but also benefitting from faster recoveries. With that said, we recognize that none of the previous event-driven bear markets were caused by a virus. Rather, they have traditionally come from a political event, a program trading collapse or a sovereign crisis. Furthermore, previous event-driven bear markets have never occurred in an environment where interest rates were already so low, which could limit the effectiveness of a monetary policy response. Needless to say, this is unchartered territory for investors and the duration of the crisis and recovery remain unclear. As should be expected, this unprecedented bear market has been met by an unprecedented response with global cooperation amongst governments, scientists and businesses to secure effective testing and medicines. This is combined with the Fed’s deep liquidity programs and “Unlimited QE” and the passage of the $2.2 Trillion Coronavirus Aid, Relief, and Economic Security Act (CARES Act). Altogether, investors should recognize and appreciate that this bear will not be left to roam unchecked.