It is interesting that only a few months ago, people were predicting interest rate hikes, but now everyone seems to be talking about interest rate cuts. The bond market is now worried that global factors, such as the trade war and Brexit, will drive the global economy into recession, thus forcing governments around the world to lower interest rates. As of May 31, the 10-year US Treasury note yield (the US government bond that gets the most attention), currently at 2.01%, has dropped to its lowest level in more than a year. The previous support levels of 2.8% and 2.4% have been broken, and now we are within the next area of technical support, in the 2.0% to 2.10% area. From the peak in last October, the 10-year yield is down approximately 30%, which seems quite significant. The US bond market has changed its expectation from one additional rate hike over the next two years (back in summer 2018), to three rate cuts!

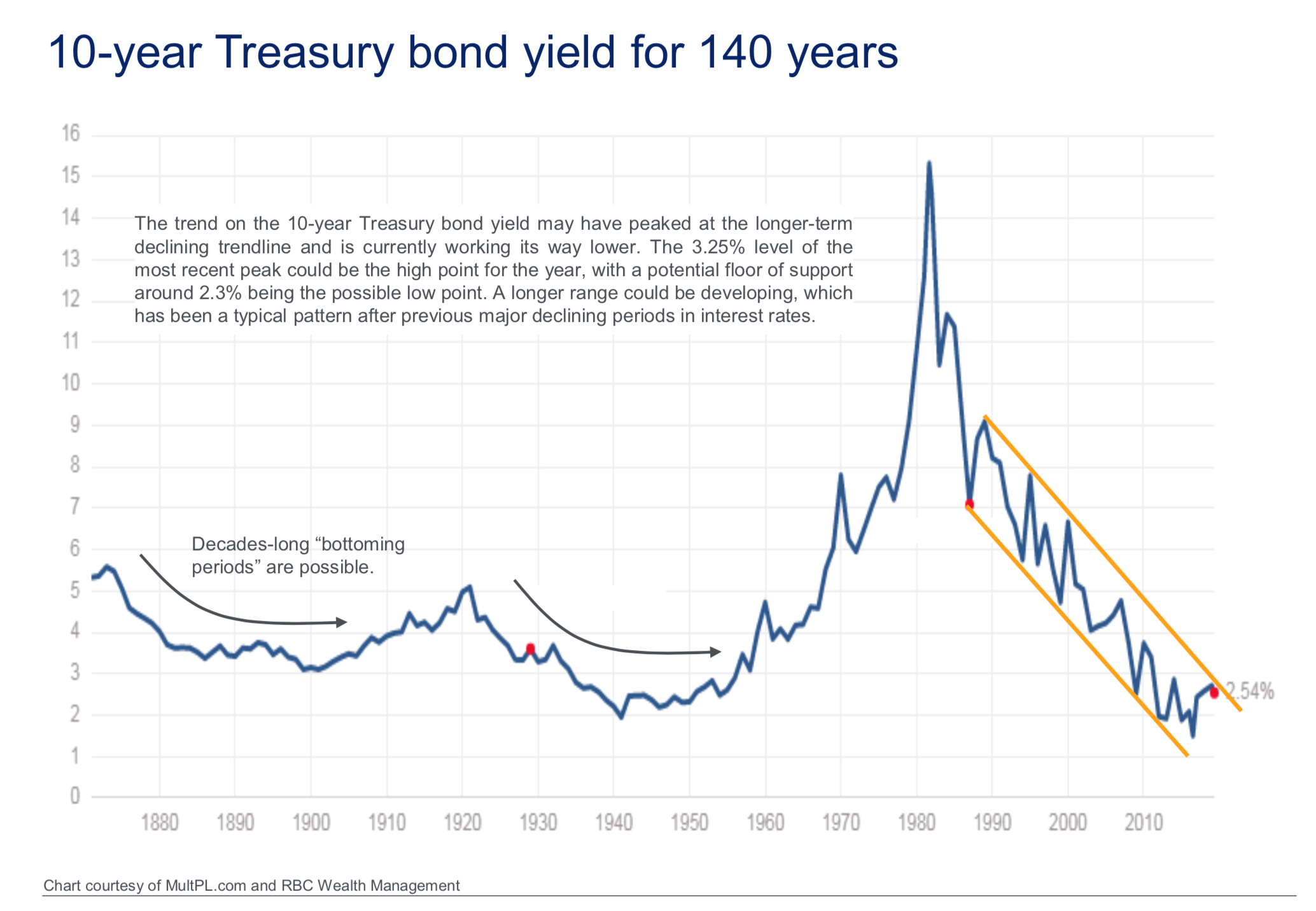

So, where are interest rates going? Short-term interest rates are more or less subject to government interest rate policies, however, long-term interest rates are mostly influenced by the markets. Take a look at the above chart, which shows a 140-year history of the 10-year Treasury bond yield. It looks like bond yields have to go through decades-long bottoming, or consolidation periods, before a change of trend is established. From the 1800s to the 1970s, 10-year Treasury yields have been range-bound between 2%+ and 5%+. Over this 140-year period, the 10-year yield only reached sky-high levels during the 1970s-1980s, after which it zig-zagged through a long downward trend, from the late 1980s to the current period. The 10-year yield is currently within these same downward trend lines, which seems to suggest that a higher rate environment may be delayed for quite some time. A downward trend in rates will help some industries, while pressuring others. However, lower interest rates, in general, should support better stock prices, and hence a long-term bull market.