For individuals and business owners alike, finding the most suitable approach to saving for retirement is a key aspect in overall wealth planning, and, depending on your circumstances, there may be a range of options to consider in helping to build and maximize your retirement nest egg.

For business owners in particular, this area of planning may take on even more significance, as it’s fairly common for much of an owner’s net worth to be tied up in the business, which means they may not be as well-diversified, and many may not be a member of a registered pension plan.

Also, when the business and its growth or success is the priority (which is often the case, especially for owners who’ve poured a great deal of time and resources into their business over the years), looking ahead to retirement—and actively planning for it—is something that some entrepreneurs may find challenging, or that simply may not be top of mind.

In conceptualizing retirement and mapping out how that may take place, some owners may assume they’ll be able to sell their business and then use the sale proceeds to secure their finances in retirement. Others may envision transferring the business to the next generation or to management. In either case, there are a number of things that could happen to throw these intentions off course, and relying solely on the business for future retirement income may leave too much open to chance.

While it’s good to have the best intentions and hopes when it comes to your ultimate exit from your business and transitioning into retirement, it’s also crucial to have the safety net of a defined strategy with respect to your financial health at retirement, so you remain financially secure, no matter what ultimately happens with your business.

Retirement planning options for business owners

As a business owner, finding ways to reduce risk is important, and holding some of your savings outside the business may be effective in this regard.

In general, withdrawing profits and paying yourself a salary (in addition to or instead of taking dividends) may offer two key benefits:

- It may protect profits from future potential business losses.

- It generates Registered Retirement Savings Plan (RRSP) contribution room or Individual Pension Plan (IPP) pensionable service.

Specifically in relation to the second point, the next step then becomes determining which savings vehicle (RRSP or IPP) will most likely offer the greatest value and benefits for your particular situation.

Key features of IPPs

An IPP is a registered defined benefit pension plan established by a corporation that helps to enhance the retirement income of an incorporated business owner, incorporated professional or key employee (it can also be extended to the business owner’s spouse and/or children if they’re employed by the company too). While an IPP usually has only one individual member, it can include up to three members, and there’s no limit on the number of IPPs a corporation can sponsor.

In general, an IPP allows higher contributions than an RRSP, and it can be thought of as a replacement for your RRSP. The business makes annual contributions to the IPP over time and receives a tax deduction. And much like an RRSP, contribution room is earned if you earn employment income from your corporation, and funds in the IPP grow on a tax-deferred basis. This plan is also designed to pay out a steady stream of income at retirement that’s determined by a benefit formula.

When it comes to funding the IPP, the sponsoring corporation is responsible for funding it and maintaining sufficient assets in the plan to provide the required benefit. And the funding phase mainly happens when a member is working and accumulating service years.

Beyond annual contributions, your business may potentially be able to make a large contribution when the plan is initially set up, to cover your years of service before the IPP was established—this can go all the way back to 1991.

IPPs may also offer increased creditor protection, beyond what RRSPs offer, because they’re considered a pension, which is protected under federal or provincial legislation, whereas RRSP assets are generally only protected from creditors in the case of personal bankruptcy.

Note: It’s always crucial to consult with a qualified legal advisor about available asset protection options.

The concept of “wealth alpha” and applying it to IPPs

When thinking of “alpha” specifically in terms of your investments, it can generally be defined as the return on or outperformance of an investment. But “alpha” can also be more broadly applied to various aspects of overall wealth planning, and in this case it becomes the incremental benefit or value that’s added to your financial situation when certain strategies are implemented.

When considering different approaches for building retirement savings, further to consulting with your qualified advisors to ensure the options are appropriate for your particular circumstances, you should also look at how each one will pan out over time, as this may help to indicate the most effective long-term strategy.

With this in mind, let’s consider a sample scenario to see both an RRSP and an IPP strategy in action and to better understand which creates the most “wealth alpha” potential.

IPP vs. Dividends + RRSP – a case study

Tanya is a 55-year-old owner of an established business with a longstanding track record of success. She’s currently paying herself a salary of $200,000 to maximize her RRSP contribution room, as well as dividends as a means to cover her lifestyle expenses. Tanya is wondering whether her current approach is the most effective for maximizing her retirement savings or whether she’d stand to benefit from implementing an IPP.

With the help of her qualified advisor, Tanya explores the following options:

- Continue investing the surplus funds from her business in her holding company, while paying out a salary and dividends to maximize her RRSP contributions and to fund her personal lifestyle needs and costs.

- Create an IPP that will be funded by her incorporated business.

Calculation assumptions for this case study:

- A 7.5% rate of return (ROR) inside the registered plans.

- Tanya plans to retire at age 70.

- All amounts are in after-tax dollars (please refer to specific tax rate notes in each illustration).

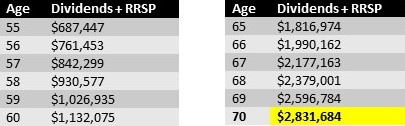

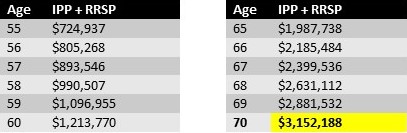

Here’s a look at how these two different options unfold over time:

Option 1

In Tanya’s situation, because she’s able to contribute more funds to an IPP than to an RRSP, she invests the additional funds (the difference between her contributions to the two plans) in her holding company. When she retires, she withdraws those investments as dividends to supplement her income.

Note: Tax assumptions include a small business tax rate of 26.50% and an average tax rate of 32.92% at the time of withdrawal.

Option 2

Here, Tanya instead focuses on maximizing the allowable contributions to her IPP. She still has a small amount of RRSP contribution room, so she continues to maximize that as well.

Note: Tax assumptions include an average tax rate of 39.24% at the time of withdrawal. The tax rate takes into account her retirement age, pension income and RRSP withdrawals. The actual tax rate may vary depending on individual circumstances at the time of withdrawal.

The “wealth alpha” difference

After tax, with Option 1, when she reaches age 70, Tanya will have slightly over $2.83 million accumulated for her retirement. With Option 2, she will have an after-tax accumulation of just over $3.15 million when she retires at age 70. That translates to more than $320,000 in additional funds—or the “wealth alpha”—for her retirement years.

It’s also worthwhile to note that for each year Tanya pursues the IPP + RRSP strategy, its advantage on a percentage basis increases incrementally. For example, at age 55, the advantage of Option 2 after taxes will be 5.5%, and by age 70, that advantage will have grown to 11.3%.

Note: The information in this article is a selection of potential options to consider as part of overall planning. In all situations, it’s crucial to consult with your qualified tax and legal advisors to determine whether these, or other, strategies may be suitable and to ensure your personal circumstances are properly accounted for.

Article by RBC Wealth Management Perspectives Volume 7, Issue 1, Spring 2019