Every four years, as the presidential elections roll around, the media landscape is flooded with predictions about how the new administration will impact the stock market. These forecasts may provoke anxiety among investors. However, a deeper look into historical data reveals a different story: elections have negligible long-term effects on market growth. Let's delve into why this is the case.

The Market's Long-Term Resilience

It's crucial to understand that the stock market is remarkably resilient over long periods. While short-term fluctuations can occur due to political events, economic data, or other market forces, the overarching trend has consistently been upward. From the Great Depression to the Dot-Com Bubble, and the 2008 financial crisis to the COVID-19 pandemic, the market has always bounced back, often reaching new heights.

Historical data shows that regardless of whether a Democrat or a Republican is in office, the market tends to grow over the long term. This growth is driven by the fundamental principles of capitalism and innovation rather than the political party in power.

Short-Term Volatility vs. Long-Term Growth

It's natural for markets to experience volatility during election years. Investors often react to the uncertainty of new policies and potential regulatory changes. However, this volatility is usually short-lived. Once the election results are clear and policies begin to take shape, markets tend to stabilize.

One reason for this stabilization is that businesses and investors are incredibly adaptive. They adjust their strategies to align with new policies, mitigating potential negative impacts. Moreover, the checks and balances in the U.S. political system often mean that radical policy changes are either watered down or take time to implement, further reducing potential market disruptions.

The Media's Role in Market Perception

The media plays a significant role in shaping investor perception. Headlines predicting market doom or boom based on election outcomes can lead to emotional decision-making. However, as seasoned investors know, making decisions based on short-term news can be detrimental. Instead, it's essential to focus on long-term trends and fundamentals.

As highlighted in the original article Own Your Future – The Media: Not Your Investment Friend, the media's primary goal is to attract readership and viewership. Sensational headlines are more likely to achieve this than balanced, long-term perspectives. Investors must remember this bias when consuming financial news.

Historical Context

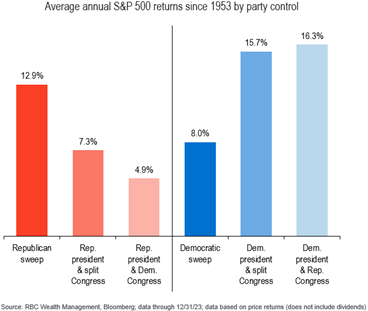

Looking back, the market has thrived under both Democratic and Republican administrations. Looking at different levels of party control we see that all combinations of government fostered significant growth. These periods of growth were not solely due to the presidents' policies but rather a combination of factors, including technological advancements, global economic trends, and corporate innovations.

The Bottom Line

The notion that elections significantly impact long-term market performance is largely a myth. While short-term volatility is inevitable, the market's long-term trajectory is driven by broader economic factors and the enduring spirit of innovation and entrepreneurship. Investors would do well to stay the course, focusing on their long-term goals rather than being swayed by the political noise.

By maintaining a well-diversified portfolio and sticking to a long-term investment strategy, investors can navigate the political cycles with confidence, knowing that the market's fundamental growth drivers remain intact.