As part of our effort to inform and educate our clients, our team will be providing periodic insights on the economy and concepts that we believe to be important in understanding behaviours in investment decisions. Our blog, Own Your Future, has been designed to serve two purposes:

1. It allows us to reinforce our long-term money management philosophies; and

2. It allows us to provide timely articles relating to the economy and wealth planning strategies that we think will be informative to our clients.

We believe that above all else, we are emotion managers, and we have found that behavioural economics drive many poor decisions for investors. Below are two behavioral economic issues that most investors can relate to.

Overconfidence:

People have a natural tendency to overestimate the likelihood of positive results on everything from the weather to investing. This largely explains why people are often disappointed by investment performance - they simply feel they would do better based on this bias – that a positive economic climate would have a disproportionate positive impact on their economic portfolio. Avoiding the feeling of disappointment is only one reason why one should consciously account for this optimism. If you base your financial goals on unrealistic expectations, you will certainly fall short and feel disappointed.

This can affect your retirement date, amount of retirement income, or estate value. Ensuring you achieve short and long-term goals first requires a clear and realistic time frame for achieving these goals. Next, it requires discipline and diligence to save and invest for the desired outcomes. Lastly, it requires monitoring and rebalancing to (1) confirm the goals remain realistic and achievable, and (2) make necessary adjustments as life changes occur.

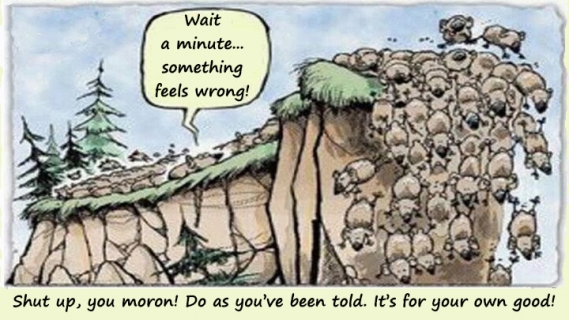

Herd Mentality:

When we see other people doing something, we have a tendency to think it must be a good thing and we should participate. This "herd instinct" is often behind sharp swings in the financial markets or rapid sell-offs. When a large number of people buy stocks, propelling the market upwards, the 'herd' buys too, sending the markets even higher. Similarly, when people sell, sending the market lower, the 'herd' sells too, fueling the decline. Unfortunately, that often results in buying at the height of market euphoria, or selling close to the depths which results in permanent loss. Instead of following the herd, we recommend following a disciplined strategy based on logic, reason, and goals – as the herd isn’t always right..

For further reading, click here to Own Your Future or click here to contact any member of of our team.