Chapter 46 - 2025: An Earnings-Driven Secular Bull Market

Dear Clients,

In October, we described the US economy as being in a gradual rate-easing cycle wherein interest rates are being reduced while the economy remains resilient, marking a soft landing into a new secular bull market. We concluded that US equities continue to demonstrate excellent risk-reward characteristics, as technologically driven earnings revisions, growth, and productivity gains continue to support valuations. We also cautioned clients against chasing tactical rotations as they tend to be short-lived and not rooted in durable fundamentals. In this installment, first, we would like to expand the client outlook into some of the areas that we have intentionally avoided, including long duration fixed income. Second, we would like to review our portfolio’s characteristics as we head into 2025, marking – we believe – the third year of the new secular bull market.

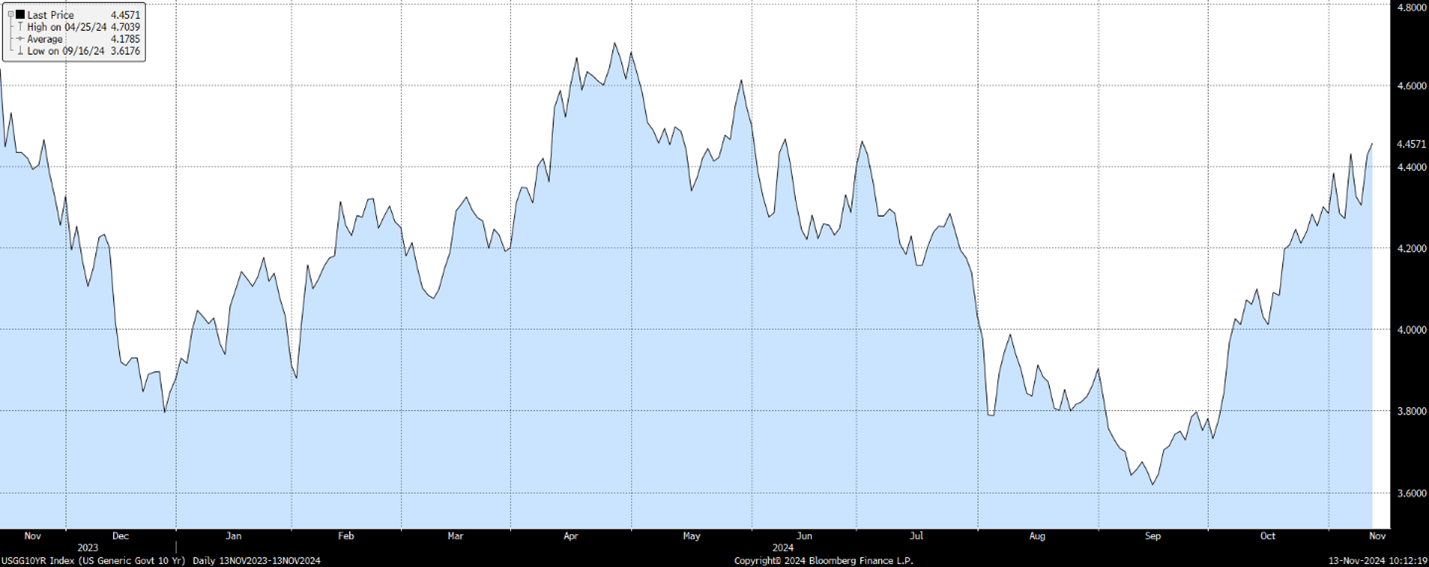

Within fixed income, some clients may be wondering why the rate easing cycle has not benefited long duration US government treasuries. After all, conventionally, treasury prices and bond yields tend to move in opposite directions. Yet, a look at the year-to-date performance of the 10-year US treasury yield (Exhibit 1) shows that it has climbed from 3.87% at the beginning of the year to 4.44% as of this writing, indicating that the average 10-year treasury has lost over -14% of value (which we completely avoided). This may be surprising to clients, as US 10-year yields rising in an environment where interest rates are falling appears to be an anomaly. Here, we would like to introduce the concept of a “Bond Vigilante,” first coined by Chief Investment Strategist Dr. Ed Yardeni in the 1980s. In simplified terms, a bond vigilante is an investor who imposes fiscal discipline on government deficits by driving up borrowing costs. This puts upward pressure on yields, depressing the value of the 10-year treasury. Furthermore, as we have expressed to clients through many market cycles, the 10-year treasury does not produce any earnings growth, while in the long-term, US equities do. Indeed, while long duration fixed income has failed to preserve value this year, the Nasdaq and S&P500 have each appreciated sizeably, not only preserving but growing capital – thanks to the compounding power of earnings-led growth.

Exhibit 1: YTD US 10-year treasury yields (Source: Bloomberg Terminal)

As process-oriented investors, we are always reflecting on shifts in our portfolio’s composition over time. 2022, the year of the downturn, was the year we significantly overweighted US technology and US financial shares, including a sizeable top-up in NVidia in May 2022. Clients who have invested with us since that period may ask about the forward-looking growth outlook of the portfolio. We continue to believe that earnings-led thematics will drive the market, and at the same time, that it is prudent to employ a barbell approach to our holdings: A combination of companies, such as US financials, that consistently return excess capital and trade at undemanding valuations, complemented by earnings and innovation growers, such as those found in US technology that can produce sustainably high returns on invested capital. At the same time, in an evolving consumer landscape, we believe in holding defensive safehavens with excellent brand desirability characteristics and secular growth opportunities.

Furthermore, geographically, we note a possible forthcoming divergence in performance characteristics between the US and Canadian economies as a result of trade policy differences between Canada and the incoming US Republican Administration; as a result, the majority of our portfolio continues to be fully invested in domestic US equities. We are prepared, as we have in the past, for elevated volatility; that said, we have used past instances of volatility to effectively position portfolios for future growth. The result of this strategy is that we have outperformed and added value above all market benchmarks over a long timeframe, while producing positive absolute net returns.

We would also like to keep clients focused on the market’s intrinsic, earnings-led growth. While we tend not to make long run market projections, strategist Dr. Ed Yardeni recently expressed his view that the S&P500 could hit 10,000 by 2029 (+69% gain from the current writing’s level of 5,916). Reconstructing his EPS growth figures, this would imply an EPS growth of 10% per year and a target earnings multiple of 22x, predicated on a pro-growth paradigm of lower regulation, lower taxation and productivity enhancements. We would remind clients that it is earnings growth, and not multiple expansion, that drives the long run compounding power of markets. Indeed, as portfolio thematics continue to drive an earnings-led return, we believe earnings growth will continue to accelerate, marking modest room for multiple expansion and most of all, productivity-led returns on invested capital. We will remind clients that productivity gains are both disinflationary and produce significant bottom-line expansion, in a world that is becoming increasingly de-globalized.

We wish clients a marvelous Christmas holiday and a cheerful time ringing in the New Year!

Warmest regards,

Grace Wang | Senior Portfolio Manager

Samuel Jang, CFA | Investment Associate

Leslie Mah | Associate Advisor

Katherine Yang | Associate

Grace Wang Portfolio Management Practice of RBC Dominion Securities

Email: gracewangpractice@rbc.com

Phone: 604-257-2483

745 Thurlow Street, 20th Floor

Vancouver BC, V6E 0C5

gracewangpractice.com