Chapter 45: The Macroeconomic Outlook for Q4 2024

Dear Clients,

In this investment journal, we would like to update you on the macro-level dynamics shaping the US equity markets, as we head into the final quarter of the year.

In August, we explained that the rotational correction was a short-lived phenomenon, influenced by unfounded fears of a US recession and the subsequent temporary unwinding of the Japanese yen carry trade. Clients will recall that we did not believe a recession was a likely outcome, given US’s resilient growth characteristics, and a recession’s strict official definition of two quarters of negative GDP growth (which we did not see as likely). Since that time in mid-August, the US S&P500 has returned an additional 5.73% on a better outlook for growth, validating our conclusions of a soft landing into a resilient economy. Here are the updates on the developments that continue to support our investment thesis:

- Outlook is for growth: On September 26th, the US Bureau of Economic Analysis revised their US Q224 Gross Domestic Income growth forecast to 3.4%, a sizeable revision of +2.1% from the prior August forecast. This profitable revision dispelled much of the negative idea generation around the economy heading into a hard landing thereby impacting earnings. Moreover, in terms of the global growth outlook, the International Monetary Fund (IMF) released their April 2024 report entitled “Steady but Slow: Resilience amid Divergence.” In this report, the USA received the largest positive growth revision in 2024, from 2.1% to 2.7%, citing stronger than expected growth and momentum carryover from 2023. A stronger than expected economy is typically a leading indicator of more prolonged earnings growth, supporting a growth orientated outlook.

- Considerable Progress on Inflation: Given the Federal Reserve’s 50 basis point interest rate cut on September 18th, we take this as confirmation from Federal Reserve Chair Powell that “significant progress” has been made toward returning inflation to its 2% target. At the same time, September’s US payrolls report beat by over 100,000 jobs, the unemployment rate fell, and hourly wage gains rose. Therefore, while inflation is cooling, the economy/labour markets still remain resilient as we enter a rate-easing cycle, typically representative of the early stages of a new bull market.

- Productivity is driving growth: The definition of productivity, in simple terms, is producing more output for every unit of input. With investments in technologically driven growth, much of the discussion focus has now turned to return on investment of that growth, a welcome discussion that puts the focus on companies’ profitability profiles in the coming years. In this regard, the large US technology companies see strong returns to their outlook, user engagement profiles, and revenue growth, buttressing durably higher returns on invested capital.

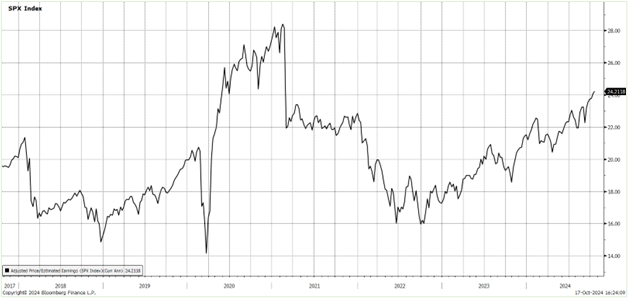

- Valuations are not extended: While some observers may point to valuation expansion, we would like to put this into historical context for clients. Below is a chart of the S&P500’s forward P/E multiple showing that US equities are still below their 2021 peak. Additionally, with rising earnings revisions (as mentioned above), the P/E multiple will compress, making equities even more relatively attractive.

Chart 1: Forward P/E multiple for the S&P500 Index

- Solvency is benign: In an election year, there have been many exchanges over the subject of the national debt, and how each side’s proposals would exacerbate deficit spending. We would like to draw clients’ attention to the overall debt profile of the United States, which still appears relatively benign. Total debt of $35 trillion can be measured against GDP of $29 trillion and US Household Net Worth of a sizeable $164 trillion, nearly 4.7x the US’s total debt. While deficits may present near-term cash flow concerns, solvency is far from being a problem. In addition, despite all the heated exchanges around election uncertainty in the US, it is the earnings power of companies in the US markets that is the most long-term wealth creating force, not the party in power. We hope this provides clients a “financial reality check.”

Realizing that the markets are prone to disruption by outside forces such as geopolitical unrest, we remain cognizant of the caveats that could cause near-term volatility in this bull market. However, we are reminded that short-term volatility is not the same thing as true market risk, and that from an economic stance, our base case remains the same: With a growth-oriented market narrative, and benign inflation readings supporting an accommodative Federal Reserve, US equities are positioned optimally to perform well. Rarely have we had instances of the Federal Reserve easing into a resilient economy wherein the growth outlook continues to be revised higher. This is the soft landing narrative we have presented to clients since 2022, and that narrative is now transitioning to one of growth, represented by the early stages of a new secular bull market.

We hope clients are enjoying the autumnal sunshine and the turning golden color of the leaves.

Warmest regards,

Grace Wang | Senior Portfolio Manager

Samuel Jang, CFA | Investment Associate

Leslie Mah | Associate Advisor

Katherine Yang | Associate

Grace Wang Portfolio Management Practice of RBC Dominion Securities

Email: gracewangpractice@rbc.com

Phone: 604-257-2483

745 Thurlow Street, 20th Floor

Vancouver BC, V6E 0C5

gracewangpractice.com