Chapter 44: Rotational Corrections: A Case Study in “Volatility does not Equal Risk”

Dear Clients,

In this installment, we wish to review the dynamics of a market in correction, defined as a shortlived pullback in asset prices. As we have pointed out in past installments, corrections are a natural part of investing in secular bull markets, as volatility-induced sell-offs are not the same thing as risk. We wish to highlight the case study of this summer’s rotational correction, in which one group of stocks went out of favour temporarily, while another group of stocks went into favour. As an investing practice, we are reticent to chase what has gone into favour, only to watch that go out of favour as well. Clients may be aware of this so-called “great rotation” in which Russell 2000 small cap companies outperformed their large cap S&P500 counterparts by 13% in the month of July. Yet, in the ensuing recovery, this rotation was not sustainable because it was not based on earnings growth, with small caps giving up 7% of this gain in the following month of August. That is why we believe that staying fully invested in long-lived, annuity-producing companies that are leading wealth creators is the best long-term strategy to prosper from the markets. The narrative of our case study follows:

Rotational correction triggered by an outside event. The rotational correction began in July, when the US Department of Commerce proposed export restrictions on US components used in semiconductor manufacturing equipment. Such a proposal, if it had gone into effect, would have significantly restricted purchases of semiconductor equipment in China, which is a major manufacturing hub for chips. In turn, our view is this proposal would have created significant shortages in any durable goods that use chips. Examples would include appliances, electrical and ventilation systems, consumer electronics, and the list goes on. This export proposal overshadowed otherwise excellent earnings results from our semicap and technology holdings, causing a 7% drawdown in the Philadelphia Semiconductor Index in a single session. We will take this opportunity to remind clients that our semiconductor holdings center on the highest quality, most durable business models that produce resilient, long-lived earnings growth – these are the select few earnings compounders that are leading profitable growth in their respective value streams of the semiconductor infrastructure industry.

Easing of event risk. Eventually, cool heads started to prevail in the export control saga, and exemptions were offered to semiconductor equipment manufacturers in Japan, South Korea and the Netherlands. This had the significant effect of de-risking the sector, contributing to a one-day semiconductor market rebound of 7%. Because of their resilient earnings characteristics, the semiconductor manufacturers we hold led the rebound: It appeared that companies were now being rewarded for their fundamental earnings characteristics.

The Unwinding of the Carry Trade: More volatility, however, was soon on the way. The week of July 29th, the Bank of Japan ended a decades long policy of zero interest rates. This had the effect of raising the borrowing cost on the Japanese Yen. Then, on Friday, August 2nd, the US Employment Report for July was released, heavily influenced by the unfortunate impact of Hurricane Beryl. Markets panicked, with recessionary fears emerging again. Here is where we differed with the market. Although we will acknowledge that employment growth for the month of July significantly cooled, the creation of 114,000 payrolls per month is nowhere near recession territory. This further buttressed our conviction in the soft-landing thesis, as inflation has abated significantly, job growth has normalized to pre-pandemic levels, and the US Federal Reserve is likely on the verge of cutting interest rates in September.

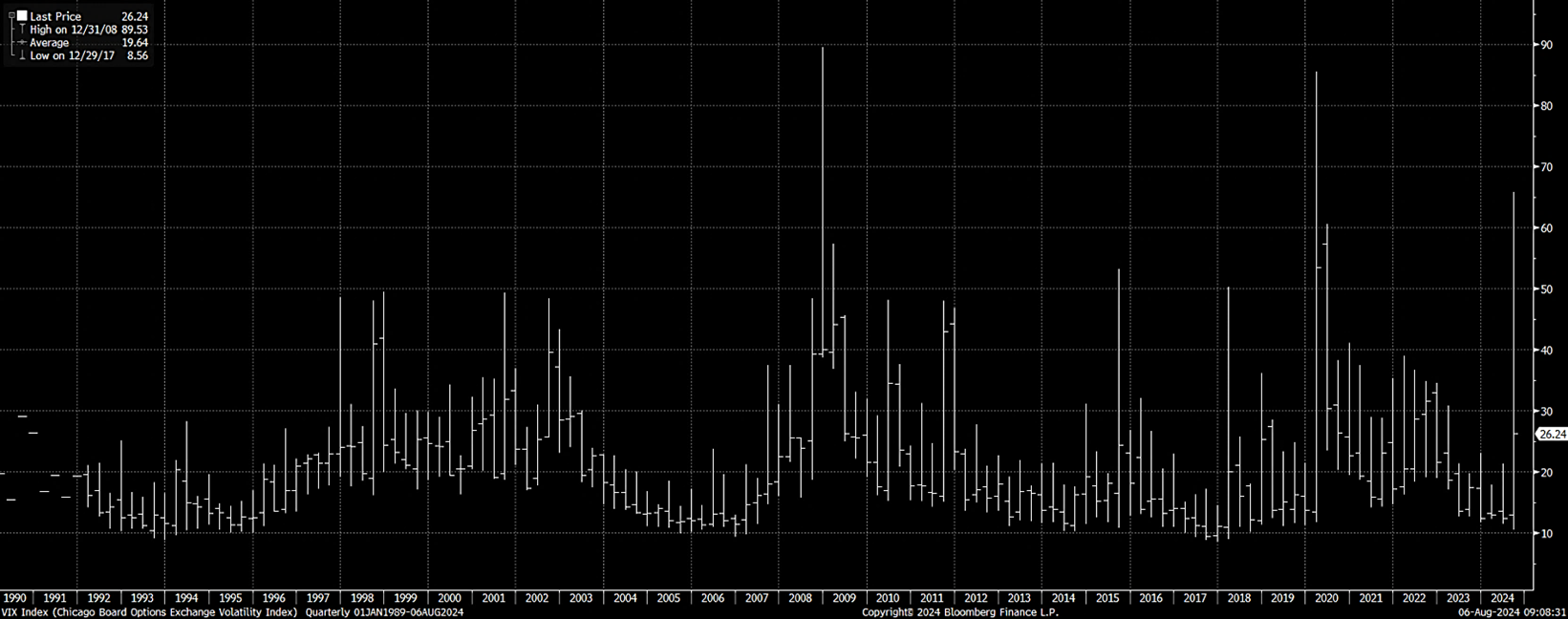

Because global financial markets are highly interconnected, investors often borrow in low-yielding currencies like the Japanese yen to invest in higher-yielding currencies like the US dollar, known in financial terminology as a “carry trade.” That the Japanese Yen now cost more to borrow in, augmented by compressed profits on US equities, led to heightened volatility (Exhibit 1). As witnessed in this exhibit, intraday volatility levels measured by the VIX nearly reached the levels of the last two systemic events, the 2008 Great Financial Crisis and the 2020 Pandemic, even though this event was of a significantly lesser scale and not systemic. Investors who had done less financial due diligence started panicking and rushed toward a disorderly unwind of this carry trade. But as we expressed to clients, the time horizon of a disorderly unwind often lasts days, if at most weeks, before patient, long-term capital allocators return to the market. We had seen such disorderly unwinds during the 1998 crisis of Long-Term Capital Management, the 1994 run on the Mexican Peso, and the 1997 Asian Financial Crisis. Each was considered serious at the time, but none derailed the global financial system or the secular bull market therein.

Exhibit 1: Volatility Index (VIX)

Source: Bloomberg Terminal

Resolution: Being a long-term patient capital allocator is a virtue in a market correction. We took the opportunity to capitalize on relative value within our holdings, shifting our positions to capitalize on the forthcoming resumption of the secular bull market. We also reminded clients that the real risk to investors is not corrections, but rather, missing out on the best 10 days of the market. Technical corrections involving deleveraging are not fundamentally led, and often result in swift resumptions of the secular bull market.

Conclusion: In the week of August 12th, markets staged a convincing recovery, rebounding by almost 4%. The catalyst sparking this was good inflation data, illustrating that we are in a soft landing. This episode illustrates how shortlived volatility can be, and the importance of remaining fully invested to capitalize on the long run earnings power of companies. Even at a target rate of 2% inflation, however, we would remind clients of the power of compounding: 2% inflation compounded over 10 years would mean an erosion of purchasing power of 20%+. This behooves clients to invest in long-run annuity producing earnings growers that can withstand environments of both high inflation and low inflation. Finally, while the market drawdown lasted half a month, the recovery was swift, a steep rebound of 7%+ over 10 trading days (August 5th to 16th), indicating intact fundamentals within a secular bull market that is experiencing a soft landing, comporting with our original investment thesis.

We hope clients are enjoying the late summer!

Warmest regards,

Grace Wang | Senior Portfolio Manager

Samuel Jang, CFA | Investment Associate

Leslie Mah | Associate Advisor

Katherine Yang | Associate