Chapter 43: Spotlighting Alphabet: An Expansive Set of Value Creation Activities

Dear Clients,

In our prior investment journal, we referenced Alphabet, one of the highest weighted members of our investment portfolio. We have stated in past installments that compounding growth characteristics drive the vast majority of value-added in the equity markets. Alphabet, as a high-quality compounder, is a key example. We stated that even though its share price was making fresh 52-week highs, this was driven primarily by earnings compounding at 20% per year over the past 5 years. As a result, Alphabet’s valuation multiple still remains below its prior peak, buttressing our conviction in the company’s wealth creating qualities.

In this installment, we wish to dissect the anatomy of Alphabet’s wealth creating characteristics, going over its franchise value, networking advantages, and finally, the integration of generative AI into its tech stack. As readers can tell, this is an expansive set of value creation activities. In other words, Alphabet exhibits amplified reward- to-risk characteristics.

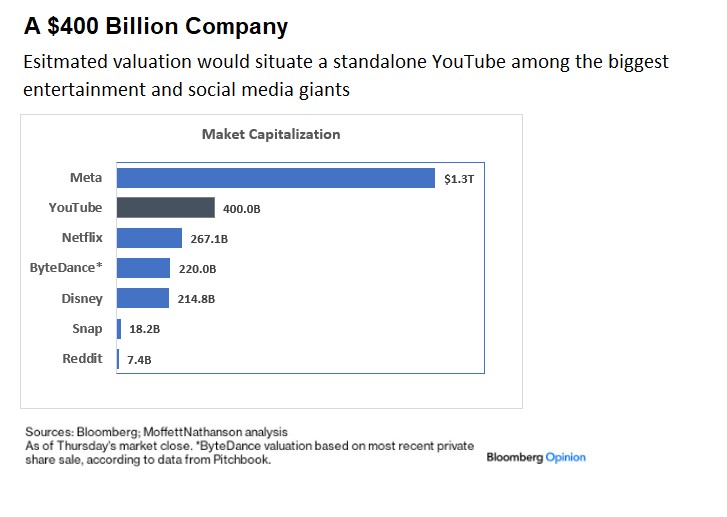

First, Alphabet’s business model is that of an integrated search engine and digital advertiser. The search engine collects data on users’ preferences through search queries, and positions advertisers to provide services to these users, such as completing a transaction. In this way, Alphabet’s search franchise, known as Google Search, generates network effects – the more users and advertisers who successfully interact on Alphabet’s platform, the more valuable the platform becomes, thereby creating a virtuous cycle. As CEO Sundar Pichai states, “The core of Google is bringing information to people....we try to work on things which billions of people will use everyday.” There is value in the scale, breadth, and depth of Alphabet’s network. In fact, this is reminiscent of iPhone usage – the more people who interact on an iPhone’s apps, and use its text and photo sharing features, the more valuable the phone becomes as a utilitarian device. Alphabet’s moat is formidable: As of 2024, StatCounter estimated that Google had a steady 90% share of the search market, virtually unchanged from Bloomberg’s past estimates from 2018. The same virtuous cycle goes for the YouTube platform, which is owned by Google, and which one analyst projection believes could command a market value of over $400B (~20% of the company, shown in Exhibit 1). According to this analyst, based on the recurring subscription/advertising revenue stream of over $65B in 2 years’ time, YouTube is on course to become the biggest cable provider by 2026, at only 19 years young of age. As clients can see, the network advantages of creating greater value for both users and advertisers has created a significant and wide economic moat around Alphabet’s core franchises. Scaled across billions of users, this network possesses formidable value.

Exhibit 1: YouTube’s estimated franchise value (Source: Bloomberg and MoffetNathanson)

These network advantages are becoming accelerated with the rapid adoption and monetization of Generative Artificial Intelligence (GenAI). To this end, Alphabet has consolidated its research leadership under Google Deepmind, the team of R&D scientists, engineers and ethicists responsible for building AI models, named Gemini and Gemma. Gemini is a complex, query-based chatbot that enables users to query and interact across a broad set of use cases. For example, Gems, an offshoot of Gemini, will enable the user to create a custom chatbot specialized in a certain recurring topic; for example, tutoring a user in calculus or developing a weight plan. The Gemini search experience is multimodal, meaning it can translate data from different formats into others; for instance, text to image, image to text, speech to image, etc. Gemini also comes in different versions – an ultra version for highly complex searches, a pro version for general purpose searches, a flash version for rapid searches, and a nano version for handheld devices. Finally, the search generative experience in the US will involve a distillation of web search results, known as “AI overviews” which will be integrated within Alphabet’s search function, pulling from a mosaic of funneled results. As readers can see, the search generative experience of consumer AI, developer AI and enterprise AI can be handled throughout the Alphabet ecosystem, creating even further enhanced switching costs and barriers to entry. The search generative experience will widen Alphabet’s already formidable moat.

Finally, clients will recall that one of the distinctive features of wealth creating companies is their capital allocation philosophy led by prudent stewardship of the management, balancing the requirements of organic investment, innovation and return of capital to shareholders. We would like to first touch on Sundar Pichai’s stewardship since his appointment to CEO in August 2015. From December 2015 to the present, Alphabet’s market capitalization has quadrupled under Mr. Pichai’s leadership, from $527B to $2.19T. Meanwhile, share repurchases have increased by 34x from $1.78B in 2015 to $62.2B in 2023, now representing ~3.5% of the total market capitalization. At the same time, Alphabet currently carries net cash of $80B, which has been replenished at a rate of $60-$70B in free cash flows per year over the last 3 years, and now expected to jump to

$80-$90B per year. Moreover, Mr. Pichai’s focus on profitable innovation is reflected in his career milestones - In 2004, Mr. Pichai led the product development efforts of Google’s client web products, including Google Chrome and Google Drive. He also oversaw the development of Gmail and Google Maps throughout his tenure with Google. With extensive durable advantages in global search networks, generative AI, and advertising, Alphabet is both an innovator and changemaker.

As clients can see, a focus on the longevity, profitability, and sustainability of a business’s economic moat is at the heart of our research process. Moreover, identifying quality businesses that still exhibit a valuation gap produces an even more favourable return profile that is buttressed by organic re-investment and return of capital characteristics. As legendary late investor Charlie Munger once stated, “The first rule of compounding: Never interrupt it unnecessarily.” Alphabet would be a case in point.

We hope clients have enjoyed this installment.

Warmest regards,

Grace Wang, CIM, PFP | Senior Portfolio Manager

Samuel Jang, CFA | Investment Associate | samuel.jang@rbc.com

Leslie Mah | Associate Advisor | leslie.mah@rbc.com | 604-257-7059

Katherine Jialing Yang | Associate | jialing.yang@rbc.com | 604-257-2537

Hazel Chen | Administrative Assistant | hazel.chen@rbc.com | 604-257-2483