Chapter 33: Quarter 2 of 2022 Earnings Recap and Federal Reserve Update

Dear Clients,

We hope you are having a pleasant summer. As this year has demonstrated, there is a distinction between volatility in the markets versus risk. As a reminder to clients from past investment journals, the entire movement in the S&P 500 this year can be explained by valuation multiple contraction, while corporate earnings growth for 2022 remains resilient and is in the positive, high single digits. As our investment process emphasizes cash generative companies with strong economic moats, these same companies possess the economic resiliency to weather through a rapidly shifting investment climate as we have seen this year. Their earnings power are buttressed by high barriers to entry, attractive industry fundamentals, and strong corporate governance. Despite temporary fluctuations, these companies tend to produce the vast majority of stock market wealth over a full market cycle.

We concur that the investment landscape has been challenging this year, with a wide spectrum of diverse viewpoints. The year began with a broadening of geopolitical risks that caused inflation to accelerate and the stock market to subsequently decline. The US Federal Reserve quickly reversed course on its initial views that inflation was transitory, and began to expeditiously raise borrowing costs to temper demand. Over the past two months, we have seen some signs of progress – the US landed into a mild “technical recession” characterized by two quarters of negative GDP growth, inflation appears to have peaked with the most recent July readings, and quarter 2 earnings were more resilient, with beat rates of 75.7% (above the long term average of 73.9%) and year-over-year earnings growth of 7.9% versus expectations of 4.1%. End markets were also healthy in Q2. We witnessed robust outlooks in travel & entertainment, industrial flight hours, high-end consumer spending, and innovator industries such as digital advertising and cloud computing. This broad-based strength was reflected in Q2 earnings results: 76% of overall S&P 500 companies reported positive earnings surprises versus analyst expectations, 2022 earnings growth is projected to be positive 7.6% by the end of the year, most 2022 outlooks were maintained, and among the 488 companies that have already reported, earnings were revised higher for 303 of them (62%). Within our portfolio holdings, companies catering to an affluent clientele have demonstrated strong pricing power characteristics: Profit guidance for all four of our luxury goods holdings was maintained, and after traveling to Europe, we observed the lengthy tourist flows attracted to these stores’ offerings in their respective home countries. Even among companies who are projecting a mild recession in Canada in 2023, they believe that this downturn will be less protracted than prior downturns, owing to more resilient labour markets and elevated consumer spending levels associated with the re-opening of economies from pandemic era restrictions. Therefore, we believe that corporate fundamentals are supportive of the valuation multiple re-rating we have witnessed on the S&P 500 this quarter.

There are also signs that inflation may have peaked. Gasoline prices are down 14% from their highs, so are industrial commodities, and container and freight rates have moved lower, a sign that supply chains are thawing. In conjunction with better earnings of the cash generative companies we hold, we believe that economic fundamentals will be recognized again soon. As Chair Powell of the US Federal Reserve re-emphasized in his Jackson Hole remarks, it is true that inflation will take time to recede, as it was caused by numerous sources spanning supply, demand, fiscal stimulus, and monetary policy; this said, Mr. Powell also repeated that it would be appropriate at some point to slow the pace of monetary tightening, should the “totality” of the data warrant it, with central bankers now emphasizing the importance of the upcoming August employment and inflation reports. Should these trends show a continued trend in inflation having peaked, it would be supportive of equity valuation levels.

Finally, we wish to remind clients that the stock markets tend to be a leading indicator of economic health, by about 6-9 months. If this projection holds, the markets may have already troughed in mid-June. While further re-tests cannot be ruled out, we believe they should be seen as opportunities to add high quality businesses at discounted valuations to the portfolio. Furthermore, bullish sentiment, as measured by the American Association of Individual Investors, is only 28% (below the long run average of 34%), which tends to be contrarian bullish signal. Throughout the summer, the frequency of insider transactions has also increased, signaling that corporate management, the individuals who know the most about their companies, are seeing value in their own stock. This is constructive from a sentiment standpoint.

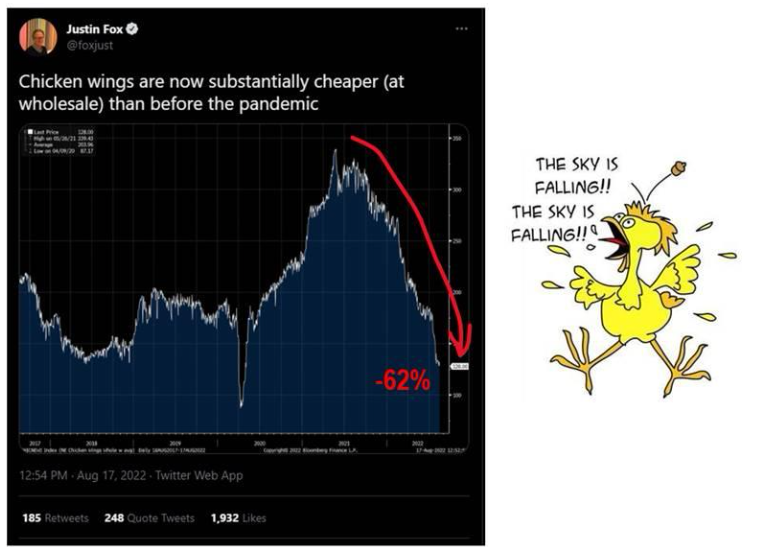

To end on a light note, the price of a delicious summer favourite – chicken wings – has declined 62% compared to before the pandemic, as pictured below.

We hope clients have found this update helpful, and please feel free to reach out with any queries.

Warmest regards,

Grace Wang, CIM, PFP | Senior Portfolio Manager

Samuel Jang, CFA | Investment Associate | samuel.jang@rbc.com

Leslie Mah | Associate Advisor | leslie.mah@rbc.com | 604-257-7059

Jennifer Hamilton | Associate | jennifer.hamilton@rbc.com | 604-257-2537

Kim Choi | Administrative Assistant | kim.choi@rbc.com | 604-257-3273

RBC Dominion Securities

Phone: (604) 678-5794

Fax: (604) 257-7391

745 Thurlow Street, 20th floor

Vancouver, BC V6E 0C5

https://ca.rbcwealthmanagement.com/Grace-Wang-Portfolio-Management/